Icea Lion Pension Form

What is the Icea Lion Pension

The Icea Lion Pension is a retirement savings plan designed to help individuals accumulate funds for their retirement years. It offers various investment options and benefits that cater to different financial goals. Participants can make regular contributions, which are then invested to grow over time, providing a financial cushion during retirement. The scheme is managed by Icea Lion, a reputable organization known for its commitment to helping individuals secure their financial future.

How to use the Icea Lion Pension

Utilizing the Icea Lion Pension involves several straightforward steps. First, individuals must enroll in the scheme by completing the necessary application forms, which can typically be done online or in person at designated branches. After enrollment, participants can set up regular contributions, which can be adjusted based on their financial situation. It is essential to keep track of investment performance and make informed decisions regarding fund allocation to maximize retirement savings.

Steps to complete the Icea Lion Pension

Completing the Icea Lion Pension involves a series of steps to ensure proper enrollment and contribution management. The process includes:

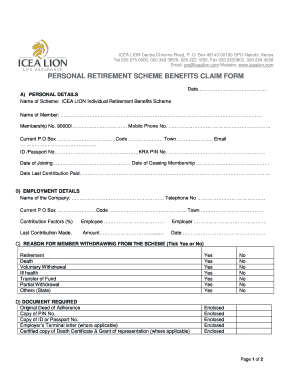

- Filling out the application form, which requires personal and financial information.

- Submitting the application form along with any required documents, such as identification and proof of income.

- Setting up a contribution schedule that aligns with financial goals.

- Regularly reviewing investment options and adjusting contributions as necessary.

Eligibility Criteria

To participate in the Icea Lion Pension, individuals must meet specific eligibility criteria. Generally, these criteria include being of a certain age, having a steady source of income, and being a resident or citizen of the country where the scheme operates. Some plans may also have minimum contribution requirements, which participants must adhere to for continued enrollment in the pension scheme.

Required Documents

When enrolling in the Icea Lion Pension, individuals need to prepare several documents to facilitate the application process. Commonly required documents include:

- A valid government-issued identification, such as a passport or driver's license.

- Proof of income, which may include recent pay stubs or tax returns.

- Completed application form, which can be obtained online or at Icea Lion branches.

Legal use of the Icea Lion Pension

The Icea Lion Pension operates within the legal frameworks established for retirement savings plans. This includes compliance with local regulations governing pension schemes, ensuring that all contributions and withdrawals adhere to legal standards. Participants should be aware of their rights and responsibilities under the scheme, including the implications of early withdrawals or changes in contribution levels.

Quick guide on how to complete icea lion pension

Complete Icea Lion Pension effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It serves as a perfect eco-friendly alternative to conventional printed and signed documents, allowing you to locate the appropriate form and securely save it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents quickly without delays. Handle Icea Lion Pension on any platform with airSlate SignNow's Android or iOS applications and simplify any document-based process today.

The easiest way to edit and electronically sign Icea Lion Pension with ease

- Obtain Icea Lion Pension and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant parts of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes only seconds and holds the same legal significance as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Decide how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misfiled documents, tedious form hunting, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and electronically sign Icea Lion Pension and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the icea lion pension

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the main benefits of the Kenya retirement scheme?

The Kenya retirement scheme benefits include a secure way to save for retirement, offering tax incentives and a structured plan for wealth accumulation. This ensures individuals can enjoy financial security in their later years, making it an essential consideration for long-term financial planning.

-

How does the Kenya retirement scheme impact my taxes?

The Kenya retirement scheme benefits from tax deductions on contributions, allowing individuals to reduce their taxable income while saving for retirement. This not only incentivizes saving but also helps maximize your retirement fund utilization as you grow your wealth in a tax-efficient manner.

-

Are there any fees associated with the Kenya retirement scheme?

While the Kenya retirement scheme benefits include low administrative costs, it’s essential to review the specific fee structures of providers. Generally, fees can include management fees, but many schemes aim to keep these costs low to maximize your retirement savings.

-

What features should I look for in a retirement scheme in Kenya?

When assessing retirement schemes, consider features such as flexible contribution rates, investment options, and withdrawal terms. Understanding these elements ensures that you can tailor your retirement savings strategy to suit your individual needs and maximize the kenya retirement scheme benefits.

-

Can I integrate my Kenya retirement scheme with other financial products?

Yes, several providers allow integration of the Kenya retirement scheme with other financial products, enhancing your investment portfolio. This integration can provide a holistic approach to managing your finances while maximizing the overall kenya retirement scheme benefits.

-

What are the eligibility requirements for enrolling in a Kenya retirement scheme?

Eligibility for the Kenya retirement scheme typically includes being of legal working age and having a stable source of income. However, specific criteria may vary by provider, so it's important to review the terms to ensure you can capitalize on the kenya retirement scheme benefits.

-

How will the Kenya retirement scheme affect my overall retirement planning?

Incorporating a Kenya retirement scheme is crucial for comprehensive retirement planning, as it provides a structured way to save and invest for the future. By understanding the kenya retirement scheme benefits, you can better secure your financial well-being and ensure a comfortable retirement.

Get more for Icea Lion Pension

- Fhlmc form 1149

- Dsar 29 form

- The state of texas witness subpoenasubpoena harris county form

- Form 4 9a ldss 5038 42014 nycourts

- Foca form 60 530 404365861

- Jan feb medicare b update fcso is first coast services form

- Personal loan between friends agreement template form

- Personal loan with collateral agreement template form

Find out other Icea Lion Pension

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy