1295 Form

What is the 1295 Form

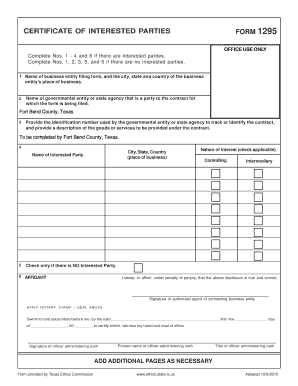

The 1295 form is a document used primarily for tax purposes in the United States. It is often associated with the reporting of certain financial transactions and is crucial for compliance with federal regulations. This form is typically utilized by businesses and individuals to disclose specific information to the Internal Revenue Service (IRS), ensuring transparency in financial dealings. Understanding the purpose and requirements of the 1295 form is essential for accurate reporting and avoiding potential penalties.

How to use the 1295 Form

Using the 1295 form involves several key steps to ensure proper completion and submission. First, gather all necessary information, including relevant financial data and identification details. Next, fill out the form accurately, paying close attention to each section to avoid errors. Once completed, review the information for accuracy before submitting it to the appropriate authority. Utilizing electronic signature solutions can streamline this process, making it easier to send and sign the form securely.

Steps to complete the 1295 Form

Completing the 1295 form requires careful attention to detail. Here are the essential steps:

- Gather required documents, including financial records and personal identification.

- Access the form from a reliable source, ensuring it is the most current version.

- Fill out each section of the form, ensuring all information is accurate and complete.

- Review the completed form for any errors or omissions.

- Submit the form electronically or via mail, depending on the submission guidelines provided.

Legal use of the 1295 Form

The legal use of the 1295 form is governed by specific regulations set forth by the IRS. To be considered legally binding, the form must be filled out correctly and submitted within the designated timeframes. Compliance with eSignature laws, such as the ESIGN Act and UETA, is also important when submitting the form electronically. Ensuring that the form is executed in accordance with these regulations protects both the submitter and the receiving entity from potential legal issues.

Filing Deadlines / Important Dates

Filing deadlines for the 1295 form can vary based on the specific circumstances and the type of transaction being reported. Generally, it is crucial to submit the form by the end of the tax year or as specified by the IRS guidelines. Missing these deadlines can result in penalties, so keeping track of important dates is essential for compliance. It is advisable to consult the IRS website or a tax professional for the most current information regarding filing deadlines.

Required Documents

To complete the 1295 form accurately, several documents may be required. These typically include:

- Financial statements relevant to the transactions being reported.

- Identification documents, such as Social Security numbers or taxpayer identification numbers.

- Any supporting documentation that substantiates the information provided on the form.

Having these documents ready can facilitate a smoother completion process and ensure compliance with reporting requirements.

Quick guide on how to complete 1295 form

Prepare 1295 Form easily on any device

Web-based document management has gained traction among companies and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to find the appropriate form and securely save it online. airSlate SignNow provides all the resources you need to create, modify, and eSign your documents quickly without delays. Handle 1295 Form on any platform with airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The simplest way to edit and eSign 1295 Form effortlessly

- Locate 1295 Form and click Get Form to begin.

- Use the tools we offer to complete your form.

- Highlight pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically provides for this purpose.

- Create your eSignature with the Sign tool, which takes seconds and carries the same legal validity as a traditional handwritten signature.

- Verify the information and click the Done button to save your modifications.

- Choose how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and eSign 1295 Form and guarantee exceptional communication at any point in your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 1295 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 1295?

Form 1295 is a document used in various business contexts, particularly for reporting and compliance. With airSlate SignNow, you can complete, send, and eSign form 1295 easily, ensuring all your business documentation is in order and compliant with regulations.

-

How can airSlate SignNow help with form 1295?

airSlate SignNow simplifies the process of managing form 1295 by providing an intuitive platform for document creation and eSigning. You can quickly create the form, send it for signatures, and store it securely—all in one place.

-

Is there a cost associated with using airSlate SignNow for form 1295?

Yes, there is a cost associated with using airSlate SignNow, but it is designed to be cost-effective for businesses of all sizes. Various pricing plans are available, ensuring that you can find a solution that best fits your needs for handling form 1295 and other documents.

-

What features does airSlate SignNow offer for form 1295?

airSlate SignNow provides several features for managing form 1295, including customizable templates, secure eSigning, and real-time tracking of document status. This enhances efficiency and ensures that all relevant stakeholders can easily access the document.

-

How does airSlate SignNow ensure the security of form 1295?

Security is a priority at airSlate SignNow. We use advanced encryption protocols and secure cloud storage to protect your form 1295 and other sensitive documents, ensuring only authorized users have access to them.

-

Can I integrate airSlate SignNow with other software for handling form 1295?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, allowing you to streamline your workflow around form 1295. Whether you’re using CRM, ERP, or other business tools, integration capabilities make it easy to manage your documents.

-

What are the benefits of using airSlate SignNow for form 1295?

Using airSlate SignNow for form 1295 can enhance efficiency, reduce processing time, and minimize errors. The ease of use and automation features mean you can focus more on your business rather than paperwork.

Get more for 1295 Form

- Study smart tutors act workbook form

- Uia 1920 522344005 form

- Modification agreement sample form

- New york commercial lease s3amazonawscom form

- Written agreement studentparent handbook agreement k12 form

- Physician certification statement form

- Ath fs 1 order form

- Waganakising arawak little traverse bay bands of d form

Find out other 1295 Form

- eSignature Oregon Amendment to an LLC Operating Agreement Free

- Can I eSign Hawaii Managed services contract template

- How Do I eSign Iowa Managed services contract template

- Can I eSignature Wyoming Amendment to an LLC Operating Agreement

- eSign Massachusetts Personal loan contract template Simple

- How Do I eSign Massachusetts Personal loan contract template

- How To eSign Mississippi Personal loan contract template

- How Do I eSign Oklahoma Personal loan contract template

- eSign Oklahoma Managed services contract template Easy

- Can I eSign South Carolina Real estate contracts

- eSign Texas Renter's contract Mobile

- How Do I eSign Texas Renter's contract

- eSign Hawaii Sales contract template Myself

- How Can I eSign Washington Real estate sales contract template

- How To eSignature California Stock Certificate

- How Can I eSignature Texas Stock Certificate

- Help Me With eSign Florida New employee checklist

- How To eSign Illinois Rental application

- How To eSignature Maryland Affidavit of Identity

- eSignature New York Affidavit of Service Easy