Schwab Gift Stock Form

What is the Schwab Gift Stock Form

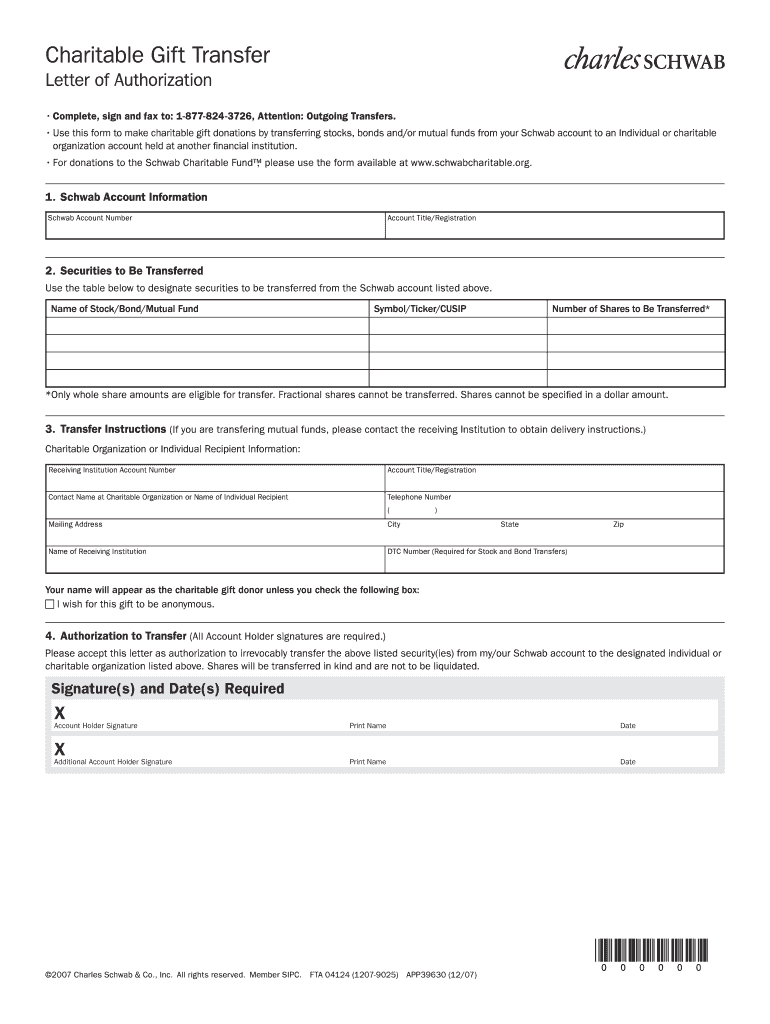

The Schwab Gift Stock Form is a document used to facilitate the transfer of stock as a gift from one individual to another. This form is essential for ensuring that the transfer is executed legally and in compliance with relevant regulations. By using this form, the donor can specify the details of the stock being gifted, including the number of shares and the recipient's information. It serves as a formal record of the transaction, which is important for both tax purposes and for maintaining accurate financial records.

How to use the Schwab Gift Stock Form

To effectively use the Schwab Gift Stock Form, begin by gathering all necessary information, including the stock details and recipient information. Fill out the form with accurate data, ensuring that the donor's and recipient's names, addresses, and the specifics of the stock are clearly indicated. After completing the form, both the donor and recipient should review it for accuracy. Once confirmed, the donor must sign the form to authorize the transfer. This completed form can then be submitted to Schwab for processing.

Steps to complete the Schwab Gift Stock Form

Completing the Schwab Gift Stock Form involves several key steps:

- Gather necessary information about the stock and the recipient.

- Fill out the form with accurate details, including the number of shares and stock type.

- Review the completed form for any errors or omissions.

- Sign the form to authorize the gift transfer.

- Submit the form to Schwab via the preferred submission method.

Legal use of the Schwab Gift Stock Form

The legal use of the Schwab Gift Stock Form is crucial for ensuring that the transfer of stock complies with federal and state regulations. This form acts as a binding agreement between the donor and recipient, outlining the terms of the gift. It is important to keep a copy of the signed form for personal records, as it may be required for tax reporting purposes. Additionally, the form should be filled out accurately to avoid any legal disputes or issues with the transfer.

Key elements of the Schwab Gift Stock Form

Key elements of the Schwab Gift Stock Form include:

- Donor Information: Details about the person giving the gift.

- Recipient Information: Information about the person receiving the stock.

- Stock Details: Information about the stock being gifted, including the number of shares and stock type.

- Signatures: Required signatures from both the donor and recipient to authorize the transfer.

- Date: The date when the form is completed and signed.

Form Submission Methods

The Schwab Gift Stock Form can be submitted through various methods, depending on the preferences of the donor. Common submission methods include:

- Online Submission: Using Schwab's secure online platform to upload the completed form.

- Mail: Sending the physical form via postal service to Schwab's designated address.

- In-Person: Delivering the form directly to a Schwab branch office for processing.

Quick guide on how to complete schwab gift stock form

Effortlessly Complete Schwab Gift Stock Form on Any Device

Digital document management has gained traction among companies and individuals. It serves as an excellent eco-friendly substitute for traditional printed and signed documents, as you can obtain the necessary form and securely keep it online. airSlate SignNow equips you with everything needed to create, modify, and electronically sign your documents quickly without delays. Manage Schwab Gift Stock Form on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to modify and electronically sign Schwab Gift Stock Form without hassle

- Obtain Schwab Gift Stock Form and click Get Form to begin.

- Utilize the tools we provide to fill in your form.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature utilizing the Sign tool, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose your preferred method to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, cumbersome form navigation, or mistakes that necessitate reprinting new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Schwab Gift Stock Form while ensuring excellent communication at all stages of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the schwab gift stock form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the schwab gift stock form?

The schwab gift stock form is a document used by investors to transfer ownership of stock from one individual to another as a gift. It simplifies the process of gifting stocks, enabling both the giver and recipient to manage tax implications effectively. Utilizing the schwab gift stock form ensures that the transaction is documented correctly.

-

How do I complete the schwab gift stock form?

To complete the schwab gift stock form, you will need to provide details such as the donor and recipient's information, stock details, and any necessary signatures. It's essential to follow the instructions provided by Charles Schwab closely. Once filled, the form can be submitted online or sent by mail to ensure the stock transfer is processed.

-

Are there any fees associated with the schwab gift stock form?

When using the schwab gift stock form, there may be minor fees related to transferring stocks, depending on Schwab's policies. Generally, there are no fees for the act of gifting stocks itself, but verifying with Schwab regarding possible transaction costs is advisable. Understanding these potential fees can help in planning your gifting strategy.

-

Can I use airSlate SignNow to handle the schwab gift stock form?

Yes, airSlate SignNow can streamline the process of completing and signing your schwab gift stock form electronically. With airSlate SignNow, you can easily send the form for electronic signatures, making the process quick and efficient. This integration ensures you have a compliant and secure method for handling sensitive stock transfer documents.

-

What are the benefits of using the schwab gift stock form?

The schwab gift stock form allows for a straightforward way to transfer stock gifts, benefiting both the giver and recipient. It can help reduce potential tax burdens associated with capital gains and makes record-keeping for tax purposes simpler. Additionally, gifting stocks can be a great way to introduce family members or friends to investing, fostering financial literacy.

-

Is there a limit to how much stock I can gift using the schwab gift stock form?

Yes, there are annual gift tax limits that apply when using the schwab gift stock form. As of recent regulations, individuals can gift amounts under a certain threshold without incurring gift taxes. It's essential to consult with a tax advisor to understand these limits and how they apply to your specific situation.

-

What are the key features of the schwab gift stock form?

Key features of the schwab gift stock form include a clear format for inputting donor and recipient information, instructions for submitting the form, and options for partial or full stock transfers. It also often includes guidelines on tax implications and necessary signatures. These features make the process efficient and compliant with financial regulations.

Get more for Schwab Gift Stock Form

Find out other Schwab Gift Stock Form

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT