Gst Pmt 03 Form Word Format

What is the GST PMT 03 Form Word Format

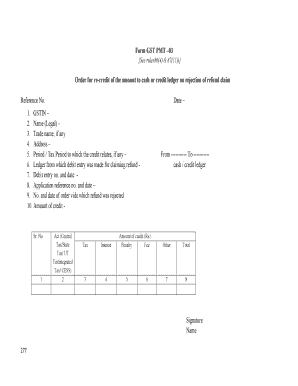

The GST PMT 03 form is a crucial document used in the Goods and Services Tax (GST) framework in the United States. It serves as a declaration for the payment of tax liabilities and is essential for businesses to ensure compliance with tax regulations. This form allows taxpayers to report their tax payments and adjust their liabilities accurately. The Word format of the GST PMT 03 form provides a user-friendly way to fill out the necessary information before submission. This format is particularly beneficial for those who prefer to work offline or need to maintain a record of their submissions for future reference.

Steps to Complete the GST PMT 03 Form Word Format

Completing the GST PMT 03 form in Word format involves several essential steps. First, download the form from a reliable source. Once you have the form, open it in Microsoft Word or a compatible word processor. Begin by filling in your business details, including your name, address, and GST registration number. Next, specify the tax period for which you are making the payment. It is important to accurately calculate the tax amount due based on your sales and purchases during that period. After entering all required information, review the form for accuracy before saving it. Finally, print the completed form if you need to submit it physically or save it as a PDF for electronic submission.

Legal Use of the GST PMT 03 Form Word Format

The GST PMT 03 form is legally recognized as a valid document for reporting tax payments under the GST regime. To ensure its legal standing, it must be filled out correctly and submitted within the stipulated deadlines. The electronic version of the form, when signed using a compliant eSignature solution, holds the same legal weight as a traditional paper form. Compliance with relevant laws, including the ESIGN Act and UETA, is essential when submitting the form electronically. This legal framework ensures that the digital signatures used are secure and verifiable, providing confidence in the authenticity of the submission.

How to Obtain the GST PMT 03 Form Word Format

Obtaining the GST PMT 03 form in Word format is straightforward. The form can typically be downloaded from official tax authority websites or other trusted sources that provide tax-related documentation. Ensure you are accessing the most current version of the form to comply with the latest regulations. If you prefer, you can also create a template in Word by formatting a blank document to match the layout of the GST PMT 03 form. This allows for easier customization and repeated use for future tax periods.

Key Elements of the GST PMT 03 Form Word Format

The GST PMT 03 form includes several key elements that must be accurately filled out to ensure compliance. These elements typically include:

- Taxpayer Information: Name, address, and GST registration number.

- Tax Period: The specific period for which the payment is being made.

- Payment Details: The amount of tax due, including any adjustments or credits.

- Signature: An authorized signature is required to validate the form.

Each of these components plays a critical role in ensuring that the form is complete and legally valid.

Form Submission Methods

The GST PMT 03 form can be submitted through various methods, depending on the requirements set by the tax authority. Common submission methods include:

- Online Submission: Many tax authorities allow electronic submission through their official portals, which is often the most efficient option.

- Mail: The completed form can be printed and mailed to the appropriate tax office.

- In-Person Submission: Some taxpayers may choose to submit the form in person at designated tax offices.

It is important to check the specific submission guidelines for your jurisdiction to ensure compliance.

Quick guide on how to complete gst pmt 03 form word format

Complete Gst Pmt 03 Form Word Format effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Gst Pmt 03 Form Word Format on any device using airSlate SignNow's Android or iOS applications and streamline any document-centric process today.

How to modify and eSign Gst Pmt 03 Form Word Format with ease

- Locate Gst Pmt 03 Form Word Format and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of your documents or redact sensitive information with tools provided by airSlate SignNow tailored for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and then click on the Done button to save your updates.

- Choose how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Purge yourself of lost or mislaid files, tiring form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Modify and eSign Gst Pmt 03 Form Word Format and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the gst pmt 03 form word format

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is PMT 03 in GST?

PMT 03 in GST refers to the application format used by taxpayers for claiming a refund of excess tax paid, or for adjusting the excess amount against future tax liabilities. Understanding PMT 03 in GST is crucial for businesses to manage their tax operations effectively and ensure compliance with GST regulations.

-

How can airSlate SignNow help with PMT 03 in GST?

airSlate SignNow simplifies the process of managing and submitting PMT 03 in GST by allowing businesses to electronically sign and send required documents efficiently. This streamlined approach reduces administrative burden and helps ensure timely submission to the tax authorities.

-

What features does airSlate SignNow offer for managing PMT 03 in GST?

airSlate SignNow offers features such as advanced eSigning, document templates, and collaboration tools that are particularly useful for managing PMT 03 in GST. These features facilitate seamless communication and documentation alignment between various stakeholders involved in the GST process.

-

Is airSlate SignNow cost-effective for businesses handling PMT 03 in GST?

Yes, airSlate SignNow is designed as a cost-effective solution for businesses looking to manage their PMT 03 in GST processes. By reducing paperwork and streamlining workflows, businesses can save both time and money while achieving compliance with GST requirements.

-

Can I integrate airSlate SignNow with my current accounting software for PMT 03 in GST?

Absolutely! airSlate SignNow offers integrations with various accounting software to help streamline the handling of PMT 03 in GST. This ensures that you can easily manage all aspects of your documentation and tax reporting from one platform.

-

What benefits do I gain from using airSlate SignNow for PMT 03 in GST submissions?

Using airSlate SignNow for PMT 03 in GST submissions provides several benefits, such as improved efficiency, enhanced security, and better organization of documents. These factors help ensure that your submissions are accurate and made on time, reducing the risk of penalties.

-

How secure is my data when using airSlate SignNow for PMT 03 in GST?

airSlate SignNow implements robust security measures, including encryption and secure cloud storage, to protect your data while dealing with PMT 03 in GST. This commitment to security ensures that your sensitive tax information remains confidential and safeguarded.

Get more for Gst Pmt 03 Form Word Format

- Raiseyouraq form

- Dma 5015pdf adult mail in application verificaiton checklist info dhhs state nc form

- Taekwondo ontario form

- Motion to dismiss traffic ticket pdf form

- Employees statement of nonresidence in pennsylvania fillable form

- Academic planner form

- Property maintenance agreement template form

- Property lock out agreement template form

Find out other Gst Pmt 03 Form Word Format

- Electronic signature Utah Mobile App Design Proposal Template Fast

- Electronic signature Nevada Software Development Agreement Template Free

- Electronic signature New York Operating Agreement Safe

- How To eSignature Indiana Reseller Agreement

- Electronic signature Delaware Joint Venture Agreement Template Free

- Electronic signature Hawaii Joint Venture Agreement Template Simple

- Electronic signature Idaho Web Hosting Agreement Easy

- Electronic signature Illinois Web Hosting Agreement Secure

- Electronic signature Texas Joint Venture Agreement Template Easy

- How To Electronic signature Maryland Web Hosting Agreement

- Can I Electronic signature Maryland Web Hosting Agreement

- Electronic signature Michigan Web Hosting Agreement Simple

- Electronic signature Missouri Web Hosting Agreement Simple

- Can I eSignature New York Bulk Sale Agreement

- How Do I Electronic signature Tennessee Web Hosting Agreement

- Help Me With Electronic signature Hawaii Debt Settlement Agreement Template

- Electronic signature Oregon Stock Purchase Agreement Template Later

- Electronic signature Mississippi Debt Settlement Agreement Template Later

- Electronic signature Vermont Stock Purchase Agreement Template Safe

- Electronic signature California Stock Transfer Form Template Mobile