Arizona Inheritance Tax Waiver Form

What is the Arizona Inheritance Tax Waiver Form

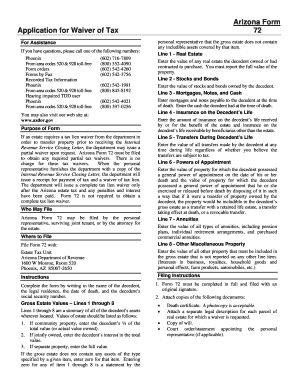

The Arizona inheritance tax waiver form is a legal document that allows individuals to waive their right to claim an inheritance tax on assets received from a deceased person's estate. This form is particularly relevant in situations where the estate's value falls below the threshold for taxation, thereby simplifying the transfer of assets. It is essential for heirs to understand that this waiver is a formal declaration that can affect their rights regarding the estate.

How to use the Arizona Inheritance Tax Waiver Form

Using the Arizona inheritance tax waiver form involves a few straightforward steps. First, heirs must ensure they are eligible to complete the form, typically requiring them to be beneficiaries of the estate. Next, they need to accurately fill out the form, providing necessary details such as the decedent's information and the specifics of the inheritance. Once completed, the form should be signed and dated before submission to the appropriate state authority to formalize the waiver.

Steps to complete the Arizona Inheritance Tax Waiver Form

Completing the Arizona inheritance tax waiver form requires careful attention to detail. Here are the steps to follow:

- Gather necessary information about the decedent and the estate.

- Obtain the correct version of the Arizona inheritance tax waiver form.

- Fill out the form completely, ensuring all required fields are addressed.

- Review the form for accuracy to avoid delays.

- Sign and date the form in the designated areas.

- Submit the completed form to the relevant state department, either online or by mail.

Legal use of the Arizona Inheritance Tax Waiver Form

The legal use of the Arizona inheritance tax waiver form is significant, as it serves to formally relinquish any claim to inheritance tax on the assets received. This waiver must be executed in accordance with Arizona state laws to ensure its validity. It is advisable for individuals to consult with a legal professional to understand the implications of signing this document, particularly in complex estate situations.

Required Documents

To complete the Arizona inheritance tax waiver form, certain documents may be required. These typically include:

- The death certificate of the decedent.

- Proof of identity for the heir or beneficiary.

- Documentation of the estate's value, if applicable.

- Any previous tax filings related to the estate.

Form Submission Methods (Online / Mail / In-Person)

The Arizona inheritance tax waiver form can be submitted through various methods, depending on the preferences and requirements of the state. Heirs may choose to submit the form online through the state’s official website, mail it to the designated office, or deliver it in person. Each method may have different processing times and requirements, so it is important to verify the preferred submission method before proceeding.

Quick guide on how to complete arizona inheritance tax waiver form 41648496

Complete Arizona Inheritance Tax Waiver Form effortlessly on any device

Online document management has become popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the tools you need to create, adjust, and eSign your documents swiftly without delays. Manage Arizona Inheritance Tax Waiver Form on any device with airSlate SignNow Android or iOS applications and simplify any document-centric process today.

How to adjust and eSign Arizona Inheritance Tax Waiver Form with ease

- Locate Arizona Inheritance Tax Waiver Form and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight relevant parts of your documents or conceal sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose your preferred method to send your form, by email, text message (SMS), invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form navigation, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Adjust and eSign Arizona Inheritance Tax Waiver Form and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the arizona inheritance tax waiver form 41648496

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an Arizona inheritance tax waiver form?

The Arizona inheritance tax waiver form is a document required to exempt an estate from inheritance taxes in Arizona. This form ensures that the estate is processed efficiently without incurring unnecessary tax liabilities. By completing this form, beneficiaries can secure their inheritance without complications.

-

How can I obtain an Arizona inheritance tax waiver form using airSlate SignNow?

You can easily obtain the Arizona inheritance tax waiver form by accessing airSlate SignNow's document template library. We offer a variety of pre-designed forms that you can customize and utilize. Simply log in, search for the form, and start the eSigning process in minutes.

-

Are there any fees associated with using the Arizona inheritance tax waiver form on airSlate SignNow?

Yes, airSlate SignNow offers a range of pricing plans that include access to the Arizona inheritance tax waiver form. Our cost-effective solutions are designed to meet the needs of various users, ensuring that you only pay for what you use. Check our pricing page for detailed information about each plan.

-

What features does airSlate SignNow offer for completing the Arizona inheritance tax waiver form?

airSlate SignNow provides various features for completing the Arizona inheritance tax waiver form, including easy document creation, customizable fields, and secure eSigning capabilities. Our platform also allows tracking of document status, ensuring all parties are on the same page during the signing process.

-

How does using the Arizona inheritance tax waiver form benefit my estate planning?

Utilizing the Arizona inheritance tax waiver form helps streamline the estate settlement process, allowing beneficiaries to receive their assets faster. By minimizing tax complications, you can ensure a smoother transition in your estate management. This efficient process ultimately saves both time and money for all involved parties.

-

Can I integrate airSlate SignNow with other software for managing the Arizona inheritance tax waiver form?

Yes, airSlate SignNow offers integrations with various software platforms, making it easier to manage the Arizona inheritance tax waiver form alongside your existing tools. These integrations facilitate better workflow management and ensure that your document processes remain cohesive and efficient.

-

Is it safe to use airSlate SignNow for my Arizona inheritance tax waiver form?

Absolutely! airSlate SignNow takes security seriously, utilizing advanced encryption methods to protect your Arizona inheritance tax waiver form and all sensitive information. Your documents will be safely stored, and your data privacy is our utmost priority, providing peace of mind during the signing process.

Get more for Arizona Inheritance Tax Waiver Form

- Complete the table with the correct form of be

- Dcarng 1315 form

- Custody child form

- Molina california service request form fill on pc

- How to fill out a quit claim deed form

- Msp group change form

- Usac medical examination form for usac and fia drivers license v2018 1 for pwc

- Scottish secure tenancy agreement template form

Find out other Arizona Inheritance Tax Waiver Form

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim