Form 433 F Mailing Address

What is the Form 433 F Mailing Address

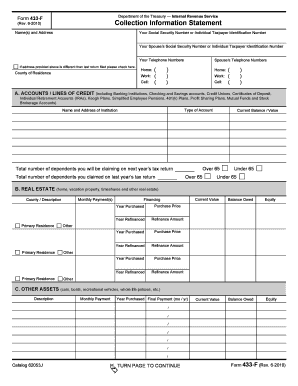

The Form 433 F is a financial statement used by the Internal Revenue Service (IRS) to collect information about a taxpayer’s financial situation. This form is essential for individuals seeking to negotiate payment plans or settle tax debts. The mailing address for submitting the Form 433 F varies based on the taxpayer's location and the type of tax being addressed. Understanding the correct mailing address is crucial to ensure that the form is processed efficiently.

How to use the Form 433 F Mailing Address

Using the Form 433 F mailing address involves filling out the form accurately and sending it to the appropriate IRS address. Taxpayers should first determine their specific mailing address based on their state and the nature of their tax issue. After completing the form, it is important to double-check all entries for accuracy before mailing it. Proper use of the mailing address ensures that the IRS receives the form and can process it without delays.

Steps to complete the Form 433 F Mailing Address

To complete the Form 433 F, follow these steps:

- Gather necessary financial documents, including income statements, bank statements, and expense records.

- Fill out the form, providing accurate information about assets, liabilities, and income.

- Review the completed form for any errors or omissions.

- Identify the correct mailing address based on your location and tax situation.

- Mail the form to the IRS using a secure method, such as certified mail, to confirm delivery.

IRS Guidelines

The IRS provides specific guidelines for submitting the Form 433 F. These guidelines include ensuring that the form is complete, accurate, and sent to the correct address. Taxpayers should also be aware of any additional documentation that may be required to support their financial claims. Following IRS guidelines helps avoid processing delays and potential penalties.

Filing Deadlines / Important Dates

Filing deadlines for the Form 433 F can vary based on individual circumstances, such as ongoing negotiations with the IRS. It is essential to be aware of any deadlines related to tax payments or settlements to ensure compliance. Missing a deadline may result in additional penalties or interest on owed taxes, making timely submission critical.

Required Documents

When submitting the Form 433 F, certain documents are typically required to support the information provided. These may include:

- Recent pay stubs or proof of income.

- Bank statements for the last few months.

- Documentation of monthly expenses.

- Tax returns for the previous years.

Having these documents ready can facilitate the review process and help the IRS make informed decisions regarding your financial situation.

Quick guide on how to complete form 433 f mailing address

Prepare Form 433 F Mailing Address effortlessly on any device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely save it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents swiftly without delays. Manage Form 433 F Mailing Address on any platform using the airSlate SignNow apps for Android or iOS and enhance any document-based workflow today.

How to alter and eSign Form 433 F Mailing Address effortlessly

- Obtain Form 433 F Mailing Address and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of your documents or redact sensitive information with the tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to share your form, whether by email, text message (SMS), or an invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign Form 433 F Mailing Address and ensure excellent communication at any point of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 433 f mailing address

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the IRS Form 433 F mailing address?

The IRS Form 433 F mailing address is the specific location where you send your completed Form 433 F when you need to disclose your financial information to the IRS. It’s important to ensure you have the correct mailing address to avoid delays in processing your form.

-

How can airSlate SignNow help with filing IRS Form 433 F?

airSlate SignNow streamlines the process of preparing and sending IRS Form 433 F by allowing you to eSign and securely send your documents electronically. This can save you time and make sure your forms are submitted correctly and on time.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow offers a variety of features that include customizable templates, electronic signatures, and collaboration tools. These tools enhance the document management process, especially when dealing with IRS forms like the 433 F, ensuring accuracy and efficiency.

-

Are there any costs associated with using airSlate SignNow?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. These plans are designed to be cost-effective, ensuring that you get excellent value while managing documents including IRS Form 433 F.

-

Can I integrate airSlate SignNow with other software?

Absolutely! airSlate SignNow integrates seamlessly with various commonly used applications, enhancing your workflow. This integration is particularly beneficial when preparing and sending IRS Form 433 F, as you can connect with your existing systems.

-

What are the benefits of using airSlate SignNow for IRS-related documents?

Using airSlate SignNow for IRS-related documents such as Form 433 F helps to simplify the submission process. You can ensure that your forms are signed and sent securely, which minimizes the risk of paperwork loss or errors.

-

Is it safe to use airSlate SignNow for sensitive documents like IRS Form 433 F?

Yes, airSlate SignNow employs advanced security measures to protect your sensitive documents like IRS Form 433 F. Features like encryption and secure access help ensure that your financial information remains confidential.

Get more for Form 433 F Mailing Address

- Tri state new patient form

- Editable iowa department of public health immunization form

- Contribution information request pd00000300

- Upf calibration baseline check sheet for total station form

- Your texas benefits people age 65 and older how to get help form

- Friends life is now part of the aviva group aviva form

- Critical illness claim form metlife

- Employee credit card agreement template form

Find out other Form 433 F Mailing Address

- Help Me With eSign New Hampshire Government Job Offer

- eSign Utah High Tech Warranty Deed Simple

- eSign Wisconsin High Tech Cease And Desist Letter Fast

- eSign New York Government Emergency Contact Form Online

- eSign North Carolina Government Notice To Quit Now

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online