Nfp 105 10 Form

What is the Nfp 105 10?

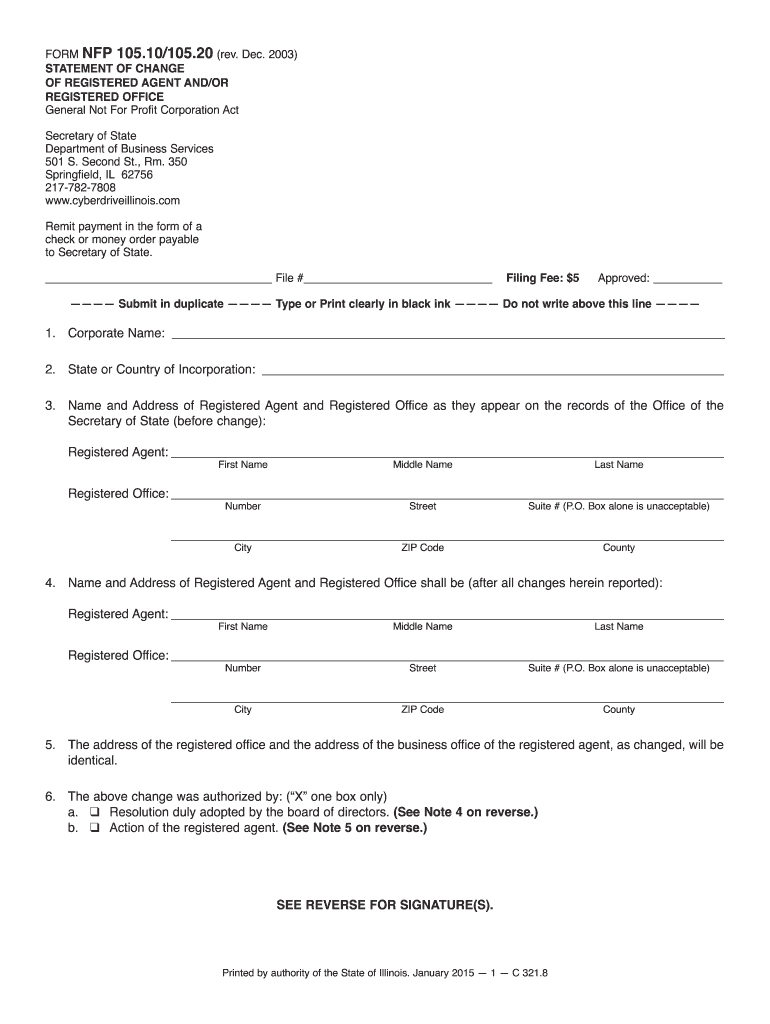

The Nfp 105 10 is a specific form used for documenting the registration of a nonprofit organization in the United States. This form is essential for entities seeking to establish themselves as recognized nonprofit organizations, allowing them to operate legally and access various benefits, such as tax exemptions. The Nfp 105 10 serves as a formal declaration of the organization's purpose, structure, and governance, ensuring compliance with state regulations and federal guidelines.

How to use the Nfp 105 10

Using the Nfp 105 10 involves several key steps. First, gather all necessary information about your organization, including its mission, structure, and the names of its board members. Next, complete the form accurately, ensuring that all sections are filled out according to the instructions provided. Once completed, the form must be submitted to the appropriate state agency, along with any required fees. It is advisable to keep copies of all documents for your records.

Steps to complete the Nfp 105 10

Completing the Nfp 105 10 requires careful attention to detail. Follow these steps:

- Gather Information: Collect details about your organization, including its name, purpose, and governing structure.

- Fill Out the Form: Complete each section of the Nfp 105 10, ensuring accuracy and clarity.

- Review the Form: Double-check all entries for completeness and correctness before submission.

- Submit the Form: Send the completed form to the designated state office, along with any applicable fees.

- Retain Copies: Keep copies of the submitted form and any correspondence for future reference.

Legal use of the Nfp 105 10

The legal use of the Nfp 105 10 is crucial for ensuring that your nonprofit organization operates within the law. This form must be filed in accordance with state regulations, and it serves as a legal document that establishes your organization's status. Proper completion and submission of the Nfp 105 10 can provide legal protections and benefits, including eligibility for grants and tax-exempt status. It is important to adhere to all legal requirements associated with this form to avoid penalties or complications.

Who Issues the Form

The Nfp 105 10 is typically issued by the Secretary of State or a similar agency in each state. This agency is responsible for overseeing the registration of nonprofit organizations and ensuring compliance with state laws. It is essential to check with your specific state’s agency for any additional requirements or variations related to the Nfp 105 10, as these can differ from state to state.

Required Documents

When completing the Nfp 105 10, several documents may be required to accompany the form. These can include:

- Articles of Incorporation: A document that outlines the organization’s purpose and structure.

- Bylaws: Internal rules governing the organization’s operations.

- Board Member Information: Details about the individuals serving on the board of directors.

- Financial Statements: Initial financial projections or statements may be requested.

Quick guide on how to complete form nfp 1051010520 rev dec 2003 cyberdrive illinois cyberdriveillinois

Complete Nfp 105 10 seamlessly on any device

Web-based document management has gained traction with companies and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the correct form and securely archive it online. airSlate SignNow provides you with all the resources necessary to create, modify, and electronically sign your files swiftly and without complications. Manage Nfp 105 10 across any platform using the airSlate SignNow Android or iOS applications and enhance any document-focused task today.

The easiest method to update and electronically sign Nfp 105 10 without any hassle

- Find Nfp 105 10 and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow offers explicitly for that purpose.

- Generate your signature using the Sign feature, which takes seconds and holds the same legal validity as a traditional handwritten signature.

- Verify all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate worries about lost or misfiled documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your needs in document management with just a few clicks from any device you prefer. Edit and electronically sign Nfp 105 10 and ensure outstanding communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

What is the time period to fill out form 10?

Well its a huge mission if you’re going to use a printer forget about it :)I’ve tried all the products and a lot of them you struggle with the mouse cursor to find the space to complete. So I think people can sometimes just get annoyed and use a printer.But the best is Paperjet. Go Paperless which uses field detection and makes the form fillable online immediately.No doubt the easiest and quickest way imho.

-

What is a W-10 tax form? Who has to fill one out?

Here is all the information regarding the W-10 tax form from the IRS. But, it is a request to get your Child’s Dependent Care Tax Information. If you are taking care of someone’s child for them you will need to fill it out. Again you are supposed to pay taxes on all Earned Income. But, a lot of people don’t and work under the table. I don’t know many drug dealers getting ready to report their earnings this year. I actually used that scenario in college. You can’t right off bribes as an expense.. Sorry off topic..About Form W10 | Internal Revenue Service

-

Can I fill out the NEET form since my DOB is 10/7/2001?

Yes of course you can fill the formAcc. To my knowledge the age criteria is that” the candidate have to be minimum 17 years of age by 31 December of that year in which neet is conducted “But for your satisfaction wait uptill the NEET 2018 brochure is out.

-

What is the IRS form W-10 and how is it correctly filled out?

While you may have never heard of IRS Form W-10, you will if you’re currently paying or planning to pay someone to care for a child, dependent, or spouse? If you are, then you may qualify to claim what’s called the Child and Dependent Care credit on your federal income tax return. To claim this credit, your care provider must fill out a W-10. You may also need to fill out the form if you receive benefits from an employer sponsored dependent care plan.It’s certainly worth it to see if you qualify (and for this we recommend that you consult with a tax professional). The child and dependent care credit can be up to 35 percent of qualifying expenses, depending on adjusted gross income. For 2011, filers may use up to $3,000 of expenses paid in a year for one qualifying individual or $6,000 for two or more qualifying individuals. (When it comes time to figure your qualifying expenses, remember that they must be reduced by the amount of any dependent care benefits provided by your employer, if those benefits were deducted or excluded from your income.)Do You Qualify for the Credit?To see if you need to have your care provider fill out a W-10, first determine if you qualify for the credit for child and dependent care expenses. To qualify, the care must have been provided for one or more qualifying persons, generally a dependent child age 12 or younger when the care was provided. Certain other individuals, spouses and those who are incapable of self-care, may also be considered qualifying persons. (Note: each qualifying individual must be listed on your tax return.)Remember also that the amount you can claim as a credit is reduced as your income rises. According to the Tax Policy Center, “Families with income below $15,000 qualify for the 35 percent credit. That rate falls by 1 percentage point for each additional $2,000 of income (or part thereof) until it signNowes 20 percent for families with income of $43,000 or more.”Next, consider why the care was provided. To qualify, the person (or couple, if married and filing jointly) claiming the credit must have sought care so they could work or search for employment. Further, the individual or couple filing must be considered earned income earners. Wages, salaries, tips, other taxable employee compensation, and net earnings from self-employment all qualify individuals as having earned income. For married filers, one spouse may be considered as having earned income if they were a full-time student, or if they were unable to care for themselves.Who did you pay for care? Qualifying funds spent for care cannot be paid to a filer’s spouse, a dependent of the filer, or to the filer’s child, unless that child will signNow age 19 or older by the end of the year. (The rule for payments to the filer’s child does not change, even if the child is not the filer’s dependent.) Filers must identify care providers on their tax return.There are just a few more qualifying details. To qualify, filing status must be single, married filing jointly, head of household or qualifying widow(er) with a dependent child. The qualifying person must have lived with the person filing for over one half of the year. There are exceptions, for the birth or death of a qualifying person, and for children of divorced or separated parents.IRS Form W-10So, if you meet those criteria, then its time to make sure your care provider fills out a W-10. The form is simple to fill out, requiring only the provider’s name, address, signature and taxpayer identification number (usually their social security number). The form is only for your records; details about the provider will come when you fill out form 2441 for Child and Dependent Care Expenses.Source: The Child and Dependent Care Credit and IRS W-10 Form

-

Is there any separate form to fill out for participating in the COMEDK counselling 2018? My COMEDK rank is 10,359.

No.There is no need of filling any form in order to participate in COMEDK counselling round. You just have to report to the counselling venue as per the day and time, on the basis of your Comedk rank. Just bring all the original documents along with two attested photocopies and DD of 55000/-

Create this form in 5 minutes!

How to create an eSignature for the form nfp 1051010520 rev dec 2003 cyberdrive illinois cyberdriveillinois

How to create an electronic signature for the Form Nfp 1051010520 Rev Dec 2003 Cyberdrive Illinois Cyberdriveillinois online

How to generate an eSignature for your Form Nfp 1051010520 Rev Dec 2003 Cyberdrive Illinois Cyberdriveillinois in Chrome

How to generate an eSignature for signing the Form Nfp 1051010520 Rev Dec 2003 Cyberdrive Illinois Cyberdriveillinois in Gmail

How to generate an eSignature for the Form Nfp 1051010520 Rev Dec 2003 Cyberdrive Illinois Cyberdriveillinois right from your smart phone

How to make an electronic signature for the Form Nfp 1051010520 Rev Dec 2003 Cyberdrive Illinois Cyberdriveillinois on iOS

How to make an eSignature for the Form Nfp 1051010520 Rev Dec 2003 Cyberdrive Illinois Cyberdriveillinois on Android OS

People also ask

-

What is the form nfp 105 10 105 20 used for?

The form nfp 105 10 105 20 is typically utilized for documenting specific business transactions and approvals. It helps streamline the process of collecting necessary signatures and establishing formal agreements within an organization.

-

How can airSlate SignNow help with form nfp 105 10 105 20?

airSlate SignNow enables you to seamlessly manage the form nfp 105 10 105 20 by providing digital signing capabilities. This makes it easier to send, sign, and store the document securely, reducing the time and effort required for traditional paper-based processes.

-

Is there a cost associated with using airSlate SignNow for form nfp 105 10 105 20?

Yes, airSlate SignNow offers various pricing plans designed to accommodate different business needs for handling the form nfp 105 10 105 20. You can choose a plan based on your volume of documents and features you require, ensuring a cost-effective solution.

-

What features does airSlate SignNow provide for the form nfp 105 10 105 20?

AirSlate SignNow offers features like customizable templates, secure cloud storage, and real-time tracking for the form nfp 105 10 105 20. These capabilities enhance efficiency and help maintain compliance during the document signing process.

-

Can I integrate airSlate SignNow with other applications for managing form nfp 105 10 105 20?

Absolutely! airSlate SignNow provides integration with various platforms, allowing you to manage the form nfp 105 10 105 20 alongside your existing tools. This ensures a seamless workflow and reduces the need for manual data entry.

-

What are the benefits of using airSlate SignNow for form nfp 105 10 105 20?

Using airSlate SignNow for the form nfp 105 10 105 20 offers numerous benefits, including faster turnaround times, improved security, and enhanced collaboration. These advantages help businesses save time and resources while maintaining the integrity of their documents.

-

Is there customer support available for airSlate SignNow users of form nfp 105 10 105 20?

Yes, airSlate SignNow provides comprehensive customer support for users handling the form nfp 105 10 105 20. You can access resources such as documentation, tutorials, and direct assistance to ensure you maximize the use of the platform.

Get more for Nfp 105 10

- Letter notice lease form

- Letter from tenant to landlord for 30 day notice to landlord that tenant will vacate premises on or prior to expiration of 497428123 form

- Letter from tenant to landlord about insufficient notice to terminate rental agreement virginia form

- Letter from tenant to landlord about insufficient notice of change in rental agreement for other than rent increase virginia form

- Letter from landlord to tenant as notice to remove unauthorized inhabitants virginia form

- Virginia utility shut off form

- Letter landlord about sample form

- Virginia notice form

Find out other Nfp 105 10

- Electronic signature Alabama High Tech Stock Certificate Fast

- Electronic signature Insurance Document California Computer

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer

- Electronic signature Indiana Insurance LLC Operating Agreement Computer

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will

- Electronic signature Insurance Document Kentucky Myself

- Electronic signature Delaware High Tech Quitclaim Deed Online

- Electronic signature Maine Insurance Quitclaim Deed Later

- Electronic signature Louisiana Insurance LLC Operating Agreement Easy

- Electronic signature West Virginia Education Contract Safe

- Help Me With Electronic signature West Virginia Education Business Letter Template

- Electronic signature West Virginia Education Cease And Desist Letter Easy

- Electronic signature Missouri Insurance Stock Certificate Free

- Electronic signature Idaho High Tech Profit And Loss Statement Computer

- How Do I Electronic signature Nevada Insurance Executive Summary Template