Chase Profit and Loss Statement Form

What is the Chase Profit and Loss Statement

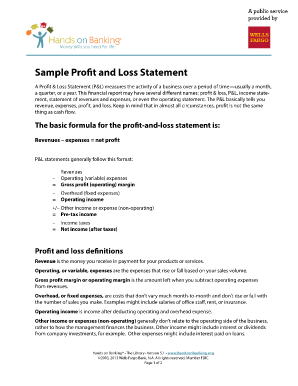

The Chase Profit and Loss Statement is a financial document that outlines a business's revenues, costs, and expenses over a specific period. This statement is essential for understanding the financial health of a business, particularly for mortgage applications and refinancing processes. It provides lenders with a clear view of the business's profitability, which can influence loan approval and terms. The statement typically includes details such as total income, operating expenses, and net profit or loss, helping to assess the business's ability to manage its finances effectively.

How to use the Chase Profit and Loss Statement

Using the Chase Profit and Loss Statement involves several key steps. First, gather all relevant financial data, including income sources and expenses. Next, accurately fill out the statement by categorizing income and expenses, ensuring that all figures are current and reflect the specified reporting period. This document can then be submitted to lenders as part of a mortgage application or refinancing process. It is crucial to maintain transparency and accuracy, as discrepancies can lead to delays or rejections in the loan approval process.

Steps to complete the Chase Profit and Loss Statement

Completing the Chase Profit and Loss Statement requires careful attention to detail. Follow these steps:

- Collect financial records, including invoices, receipts, and bank statements.

- Identify all revenue streams and list them under income.

- Document all expenses, categorizing them into fixed and variable costs.

- Calculate total income and total expenses to determine net profit or loss.

- Review the statement for accuracy and completeness before submission.

Key elements of the Chase Profit and Loss Statement

The Chase Profit and Loss Statement consists of several key elements that provide a comprehensive overview of a business's financial performance. These elements include:

- Total Revenue: The total income generated from all business activities.

- Cost of Goods Sold (COGS): Direct costs attributable to the production of goods sold.

- Operating Expenses: Regular expenses incurred in the course of running the business.

- Net Profit or Loss: The difference between total revenue and total expenses, indicating overall profitability.

Legal use of the Chase Profit and Loss Statement

The Chase Profit and Loss Statement is legally recognized as a valid financial document when prepared accurately and truthfully. It plays a crucial role in various legal and financial contexts, particularly when applying for loans or undergoing audits. To ensure legal compliance, businesses must adhere to relevant accounting standards and regulations. This includes maintaining proper records and ensuring that the information presented is consistent with other financial documents submitted to lenders or regulatory bodies.

Examples of using the Chase Profit and Loss Statement

There are various scenarios where the Chase Profit and Loss Statement is utilized. For instance, a small business seeking a loan for expansion may present this statement to demonstrate its financial viability. Additionally, when applying for a mortgage, self-employed individuals often use the statement to provide lenders with insight into their income stability. It can also serve as a tool for business owners to evaluate their performance over time, helping them make informed decisions about budgeting and investments.

Quick guide on how to complete chase profit and loss statement

Complete Chase Profit And Loss Statement effortlessly on any device

Digital document management has gained traction among organizations and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the necessary form and securely retain it online. airSlate SignNow equips you with all the tools needed to create, edit, and eSign your documents quickly without delays. Manage Chase Profit And Loss Statement on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to edit and eSign Chase Profit And Loss Statement without any hassle

- Find Chase Profit And Loss Statement and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you wish to send your form—via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from your preferred device. Edit and eSign Chase Profit And Loss Statement and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the chase profit and loss statement

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a profit and loss statement for a mortgage company?

A profit and loss statement for a mortgage company is a financial report that summarizes revenue, costs, and expenses over a specific period. This statement is crucial for understanding the company's financial performance and can assist in making informed business decisions. It typically includes income from mortgage origination fees and expenses related to running the business.

-

How can airSlate SignNow help with creating a profit and loss statement for my mortgage company?

airSlate SignNow streamlines the document management process, making it easy to create and send a profit and loss statement for your mortgage company. With our electronic signature capabilities, you can quickly gather necessary approvals and securely share financial reports. This not only saves time but also enhances accuracy and compliance.

-

What are the benefits of having an accurate profit and loss statement for a mortgage company?

An accurate profit and loss statement for a mortgage company provides valuable insights into financial health, helping business owners identify growth areas and control costs. It also serves as a crucial tool for communicating financial status to stakeholders and for meeting regulatory requirements. Overall, it fosters better decision-making and strategic planning.

-

Is there a cost associated with using airSlate SignNow for generating profit and loss statements?

Yes, airSlate SignNow offers affordable pricing plans tailored to different business needs, including those specifically for mortgage companies. These plans provide access to a range of features, including document templates and the ability to generate a profit and loss statement efficiently. By using our service, businesses can save on additional expenses related to traditional document management.

-

Does airSlate SignNow integrate with accounting software for creating profit and loss statements?

Yes, airSlate SignNow integrates seamlessly with popular accounting software, making it easy to generate accurate profit and loss statements for a mortgage company. This integration ensures that all financial data is synchronized and up-to-date, enabling more efficient reporting and decision-making. It streamlines processes by reducing manual data entry and enhancing accuracy.

-

How secure is the data when using airSlate SignNow for my mortgage company’s financial documents?

Security is a top priority at airSlate SignNow, especially when handling sensitive financial documents like a profit and loss statement for a mortgage company. Our platform uses advanced encryption methods and complies with industry standards to ensure that your data remains confidential and secure. You can trust us to protect your financial information while facilitating ease of access.

-

Can I customize the template for a profit and loss statement using airSlate SignNow?

Absolutely! airSlate SignNow allows users to customize templates for a profit and loss statement for a mortgage company according to specific needs. You can add relevant financial categories, adjust formatting, and personalize sections to align with your company’s brand. This flexibility ensures that the final document reflects your business accurately.

Get more for Chase Profit And Loss Statement

Find out other Chase Profit And Loss Statement

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Oregon Non-Profit Last Will And Testament

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed