Air Standard Multi Tenant Office Lease Gross Form

What is the Air Standard Multi Tenant Office Lease Gross

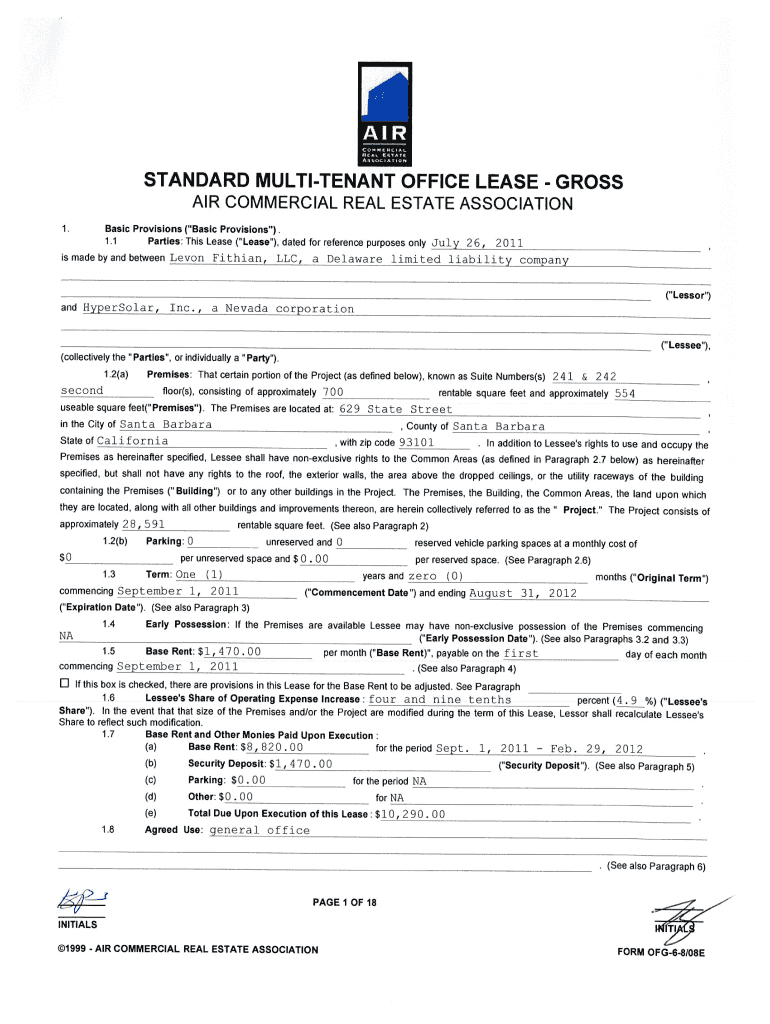

The air standard multi tenant office lease gross is a legal document that outlines the terms and conditions under which multiple tenants can occupy office space within a commercial building. This lease type typically includes provisions for rent, maintenance responsibilities, and shared expenses among tenants. Unlike a net lease, where tenants pay a portion of property expenses, a gross lease generally includes these costs in the rent amount, providing a simpler payment structure for tenants.

Key elements of the Air Standard Multi Tenant Office Lease Gross

Several key elements define the air standard multi tenant office lease gross, including:

- Rent Structure: The total rent amount, which covers all operating expenses, is clearly specified.

- Lease Duration: The length of the lease agreement, including start and end dates, is outlined.

- Maintenance Responsibilities: Details on which party is responsible for maintenance and repairs are included.

- Common Area Usage: Provisions for the use of shared spaces, such as lobbies and restrooms, are defined.

- Termination Clauses: Conditions under which the lease can be terminated by either party are specified.

Steps to complete the Air Standard Multi Tenant Office Lease Gross

Completing the air standard multi tenant office lease gross involves a series of steps to ensure that all parties are in agreement and that the document is legally binding:

- Gather necessary information, including tenant details and property specifications.

- Draft the lease, ensuring all key elements are included and clearly articulated.

- Review the lease with all involved parties to address any questions or concerns.

- Make necessary revisions based on feedback from tenants or property managers.

- Obtain signatures from all parties, ensuring compliance with legal requirements for electronic signatures if applicable.

Legal use of the Air Standard Multi Tenant Office Lease Gross

The air standard multi tenant office lease gross is legally binding when executed correctly. To ensure its legality, it must comply with relevant state laws and regulations regarding commercial leases. This includes adherence to the ESIGN Act and UETA, which govern electronic signatures and documents. Additionally, it is advisable to consult with a legal professional to confirm that the lease meets all necessary legal standards.

How to use the Air Standard Multi Tenant Office Lease Gross

Using the air standard multi tenant office lease gross effectively involves understanding its provisions and ensuring that all parties adhere to the terms set forth in the document. Tenants should familiarize themselves with their rights and responsibilities, including payment obligations and maintenance duties. Property managers or landlords should maintain clear communication with tenants to address any issues that may arise during the lease term.

Examples of using the Air Standard Multi Tenant Office Lease Gross

Examples of scenarios where the air standard multi tenant office lease gross might be used include:

- A shared office building where multiple businesses operate under one roof, each paying a gross rent.

- A co-working space that provides amenities and services included in the rental price.

- A commercial property with various tenants, where the landlord manages all common area maintenance and utilities.

Quick guide on how to complete air standard multi tenant office lease gross

Complete Air Standard Multi Tenant Office Lease Gross seamlessly on any device

Digital document management has become increasingly favored by businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, edit, and eSign your documents swiftly without delays. Manage Air Standard Multi Tenant Office Lease Gross on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest way to edit and eSign Air Standard Multi Tenant Office Lease Gross effortlessly

- Find Air Standard Multi Tenant Office Lease Gross and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Select important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose your preferred method to deliver your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign Air Standard Multi Tenant Office Lease Gross to ensure clear communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the air standard multi tenant office lease gross

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an air standard multi tenant office lease gross?

An air standard multi tenant office lease gross is a rental agreement where multiple tenants share a commercial space, typically with costs included in the lease. This type of lease covers all the standard operating expenses within the monthly rent, allowing businesses to optimize their budgeting. Understanding this lease type can help companies make informed decisions on their office space.

-

How can airSlate SignNow help with managing an air standard multi tenant office lease gross?

airSlate SignNow streamlines the document management process for air standard multi tenant office lease gross agreements by enabling users to send, sign, and store essential documents electronically. With its eSigning functionality, businesses can quickly finalize leases without the need for physical paperwork, speeding up the negotiation process. This ensures that all parties comply with lease terms efficiently.

-

What are the benefits of using airSlate SignNow for leasing documents?

Using airSlate SignNow for leasing documents offers signNow benefits, including enhanced security, speed, and accessibility. The platform allows businesses to store all lease agreements securely and access them anytime, which is crucial for managing an air standard multi tenant office lease gross. The ease of eSigning reduces turnaround times, which is beneficial for timely lease agreements.

-

Are there any integration options with airSlate SignNow for real estate management tools?

Yes, airSlate SignNow offers integration options with various real estate management tools that can streamline lease management, including those focused on air standard multi tenant office lease gross. These integrations facilitate better data sharing and help track lease obligations, making management more efficient. Integrating with tools ensures all stakeholders are updated on lease status.

-

What features does airSlate SignNow offer for managing leases?

airSlate SignNow provides features such as eSigning, document templates, workflow automation, and collaborative editing that are valuable for managing air standard multi tenant office lease gross. These tools help businesses create and modify lease agreements quickly, ensuring they comply with all legal requirements. Automation minimizes manual tasks, saving time for property managers and tenants.

-

How does airSlate SignNow ensure the security of lease documents?

airSlate SignNow employs advanced security measures to protect lease documents, including encryption and secure cloud storage. This ensures that sensitive information related to air standard multi tenant office lease gross agreements remains confidential and is accessible only to authorized users. Regular security audits and compliance with industry standards also enhance trust.

-

What is the pricing structure for airSlate SignNow?

airSlate SignNow offers flexible pricing plans tailored to businesses of different sizes, making it accessible for those managing air standard multi tenant office lease gross agreements. Users can choose from monthly or annual subscriptions, with features that align with their specific needs. This competitive pricing model ensures businesses can affordably manage their lease documents.

Get more for Air Standard Multi Tenant Office Lease Gross

- Postpartum doula contract template form

- Verification of employment form early learning coalition of the

- Nedgroupscriptpharmcoza form

- Dvla form diab1sg

- Tricare dental program claim form tricare

- Client intake form 06 16 cc doc

- Get the medical device recall reporting form final pdffiller

- Hockey nova scotia roster pos name eval form

Find out other Air Standard Multi Tenant Office Lease Gross

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself

- eSign Georgia Car Dealer POA Mobile

- Sign Nebraska Courts Warranty Deed Online

- Sign Nebraska Courts Limited Power Of Attorney Now

- eSign Car Dealer Form Idaho Online

- How To eSign Hawaii Car Dealer Contract

- How To eSign Hawaii Car Dealer Living Will

- How Do I eSign Hawaii Car Dealer Living Will

- eSign Hawaii Business Operations Contract Online