Dr 501sc Form

What is the DR 501SC?

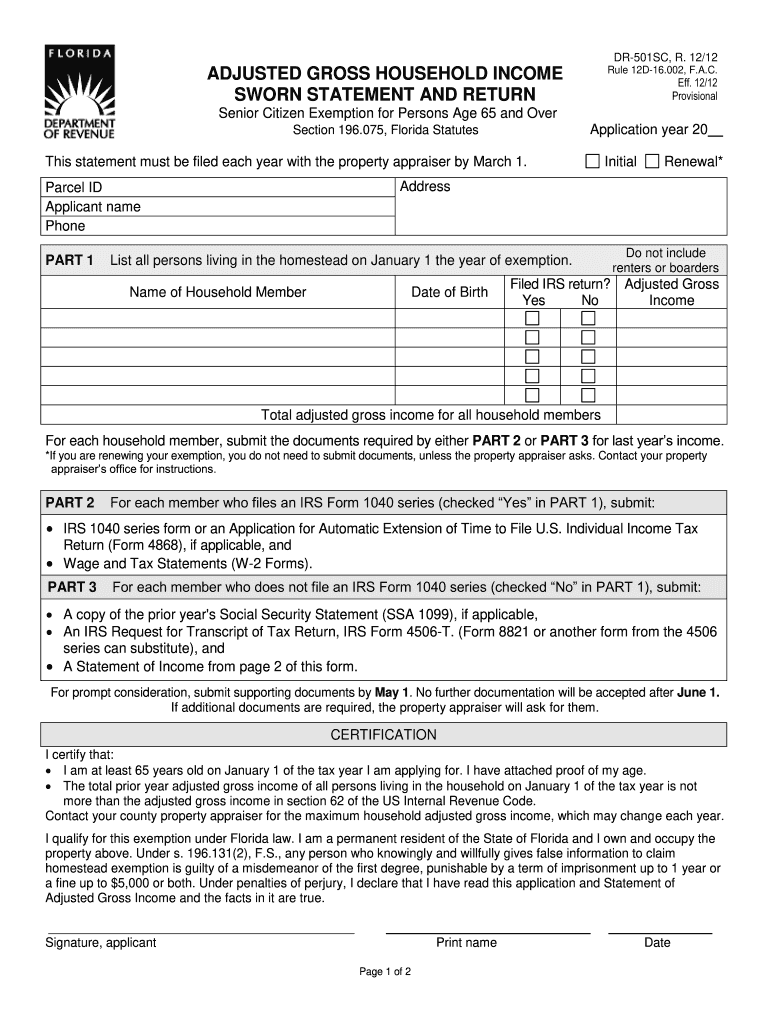

The DR 501SC is a Florida form known as the Adjusted Gross Household Income Sworn Statement and Return. It is primarily used to report household income for various state programs and benefits. This form is essential for individuals and families seeking assistance or eligibility for state-funded services. Completing the DR 501SC accurately is crucial, as it directly impacts the determination of benefits and eligibility for programs that support low-income households.

How to Use the DR 501SC

Using the DR 501SC involves several steps to ensure accurate reporting of your household income. First, gather all necessary financial documents, including pay stubs, tax returns, and any other income sources. Next, carefully fill out the form, providing detailed information about your household's income and expenses. It is important to review the completed form for accuracy before submission. Once completed, the form can be submitted to the appropriate state agency for processing.

Steps to Complete the DR 501SC

Completing the DR 501SC requires a systematic approach to ensure all information is accurately reported. Follow these steps:

- Collect all relevant financial documents, such as your most recent tax return and proof of income.

- Fill out the personal information section, including your name, address, and contact details.

- Report your household income, detailing all sources such as wages, benefits, and any other income streams.

- Provide information about household members, including their income if applicable.

- Review the form for completeness and accuracy before signing.

Legal Use of the DR 501SC

The DR 501SC is legally binding when completed and submitted correctly. To ensure its legal standing, it must comply with state regulations regarding income reporting. This includes providing truthful and accurate information about your household income. Misrepresentation or failure to disclose required information can lead to penalties or loss of benefits. It is advisable to keep a copy of the submitted form for your records.

Required Documents

When completing the DR 501SC, certain documents are necessary to support your income claims. These may include:

- Recent pay stubs or proof of income from employment.

- Tax returns from the previous year.

- Documentation of any additional income sources, such as Social Security or unemployment benefits.

- Bank statements, if required, to verify income.

Form Submission Methods

The DR 501SC can be submitted through various methods, depending on the requirements of the state agency. Common submission methods include:

- Online submission via the state's designated portal.

- Mailing the completed form to the appropriate office.

- In-person submission at local government offices.

Eligibility Criteria

Eligibility for programs requiring the DR 501SC typically depends on household income and size. To qualify, applicants must meet specific income thresholds set by the state. These thresholds can vary based on the number of household members and the type of assistance sought. It is essential to review the eligibility criteria carefully to determine if you qualify before submitting the form.

Quick guide on how to complete dr 501sc 100388052

Effortlessly Prepare Dr 501sc on Any Device

Managing documents online has become increasingly favored by both organizations and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed forms, allowing you to locate the correct document and securely store it in the cloud. airSlate SignNow equips you with all the functionalities needed to create, modify, and electronically sign your documents promptly and without delays. Manage Dr 501sc across any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

The Easiest Way to Modify and eSign Dr 501sc with Ease

- Locate Dr 501sc and click on Get Form to initiate the process.

- Utilize the tools available to complete your form.

- Emphasize important sections of your documents or redact sensitive information using the specialized tools provided by airSlate SignNow.

- Create your eSignature with the Sign feature, which takes mere seconds and carries the same legal validity as an ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method to send your form: email, SMS, invitation link, or download it to your computer.

Bid farewell to lost or misplaced documents, cumbersome form searching, or mistakes that necessitate printing additional copies. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Modify and eSign Dr 501sc and ensure excellent communication throughout your document preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the dr 501sc 100388052

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the dr 501sc and how does it benefit my business?

The dr 501sc is an innovative electronic signature solution offered by airSlate SignNow. It enhances your business processes by allowing you to easily send and eSign documents securely and efficiently, reducing time and errors in document workflows.

-

How much does the dr 501sc cost?

Pricing for the dr 501sc is competitive and designed to fit various budgets. You can choose from different plans based on your business needs, which include features like advanced workflows, team collaboration, and integrations with other tools.

-

What features does the dr 501sc offer?

The dr 501sc includes robust features such as customizable templates, audit trails, and real-time notifications. These functionalities enable users to manage their documents efficiently while ensuring compliance and security.

-

Can the dr 501sc be integrated with other applications?

Yes, the dr 501sc offers seamless integrations with popular applications like Google Drive, Salesforce, and Microsoft 365. This flexibility allows your team to continue using their preferred tools while benefiting from the electronic signature capabilities of airSlate SignNow.

-

Is the dr 501sc secure for sensitive documents?

Absolutely! The dr 501sc uses advanced security measures, including encryption and multi-factor authentication, to protect your sensitive documents. You can trust that your information remains confidential and secure throughout the signing process.

-

How does the dr 501sc improve workflow efficiency?

By utilizing the dr 501sc, businesses can streamline their document processes. The ability to send, sign, and store documents electronically saves time, reduces paper usage, and improves overall productivity for teams.

-

What customer support options are available for dr 501sc users?

airSlate SignNow provides excellent customer support for dr 501sc users, including live chat, email support, and a comprehensive knowledge base. Our team is dedicated to helping you resolve any issues and optimize your experience with our solutions.

Get more for Dr 501sc

- Protists graphic organizer form

- Drug court mcminnville tn form

- Ds 3032 14926083 form

- Cobell scholarship bfinancialb needs banalysisb cobellscholar form

- R2t4 worksheet pdf form

- Algebra 2 chapter 3 test answer key form

- Woolcock peak flow chart asthma australia form

- Investing in early educators stipend program appeals process form

Find out other Dr 501sc

- How Do I eSignature Nebraska Real Estate Lease Agreement

- eSignature Nebraska Real Estate Living Will Now

- Can I eSignature Michigan Police Credit Memo

- eSignature Kentucky Sports Lease Agreement Template Easy

- eSignature Minnesota Police Purchase Order Template Free

- eSignature Louisiana Sports Rental Application Free

- Help Me With eSignature Nevada Real Estate Business Associate Agreement

- How To eSignature Montana Police Last Will And Testament

- eSignature Maine Sports Contract Safe

- eSignature New York Police NDA Now

- eSignature North Carolina Police Claim Secure

- eSignature New York Police Notice To Quit Free

- eSignature North Dakota Real Estate Quitclaim Deed Later

- eSignature Minnesota Sports Rental Lease Agreement Free

- eSignature Minnesota Sports Promissory Note Template Fast

- eSignature Minnesota Sports Forbearance Agreement Online

- eSignature Oklahoma Real Estate Business Plan Template Free

- eSignature South Dakota Police Limited Power Of Attorney Online

- How To eSignature West Virginia Police POA

- eSignature Rhode Island Real Estate Letter Of Intent Free