Nyc 210 Form PDF

What is the NYC 210 Form?

The NYC 210 form, formally known as the New York City School Tax Credit Form, is a tax document used by eligible residents to claim a credit against their New York City personal income tax. This form is specifically designed for individuals who qualify for the school tax credit, which aims to provide financial relief to homeowners and renters in the city. The NYC 210 form is essential for ensuring that taxpayers receive the appropriate credits they are entitled to, thereby reducing their overall tax liability.

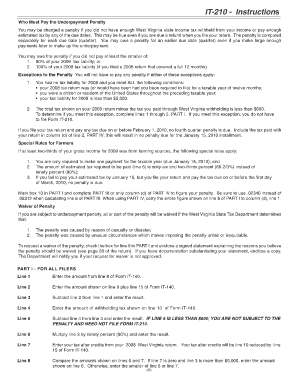

Steps to Complete the NYC 210 Form

Completing the NYC 210 form requires careful attention to detail to ensure accuracy and compliance with tax regulations. Here are the essential steps to follow:

- Gather necessary documents, including proof of residency and income statements.

- Fill out personal information accurately, including your name, address, and Social Security number.

- Indicate your eligibility for the school tax credit by checking the appropriate boxes.

- Calculate the amount of credit you are claiming based on your income and property status.

- Review the completed form for any errors or omissions.

- Sign and date the form to certify its accuracy.

How to Obtain the NYC 210 Form

The NYC 210 form can be obtained through various methods to ensure accessibility for all taxpayers. You can download the form directly from the New York City Department of Finance website or request a physical copy by contacting their office. Additionally, many tax preparation services and community organizations may provide copies of the form to assist residents in completing their tax filings.

Legal Use of the NYC 210 Form

The NYC 210 form is legally binding when filled out correctly and submitted in accordance with New York City tax laws. To ensure its legal validity, it is crucial to adhere to the guidelines set forth by the New York City Department of Finance. This includes providing accurate information, maintaining proper documentation, and submitting the form by the designated deadlines. Failure to comply with these regulations may result in penalties or denial of the claimed credits.

Filing Deadlines for the NYC 210 Form

Timely submission of the NYC 210 form is critical for taxpayers looking to claim their school tax credits. The filing deadline typically aligns with the annual income tax return deadlines. For most taxpayers, this means submitting the form by April fifteenth of the following year. However, it is advisable to check for any updates or changes to deadlines that may occur due to legislative changes or special circumstances.

Required Documents for the NYC 210 Form

When completing the NYC 210 form, certain documents are necessary to substantiate your claim for the school tax credit. These documents may include:

- Proof of residency, such as a utility bill or lease agreement.

- Income documentation, including W-2 forms or tax returns.

- Any additional paperwork that supports your eligibility for the credit.

Having these documents ready will facilitate a smoother completion process and help ensure that your claim is processed without delays.

Quick guide on how to complete nyc 210 form pdf 100097773

Easily Prepare Nyc 210 Form Pdf on Any Device

Online document management has become increasingly popular among organizations and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can access the appropriate form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Handle Nyc 210 Form Pdf on any device with the airSlate SignNow apps for Android or iOS and enhance any document-related procedure today.

Effortlessly Edit and eSign Nyc 210 Form Pdf

- Find Nyc 210 Form Pdf and click on Get Form to begin.

- Use the tools provided to fill out your document.

- Highlight important sections of your documents or redact sensitive information using features specifically designed for that purpose by airSlate SignNow.

- Create your eSignature with the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your modifications.

- Select your preferred method for sending your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Nyc 210 Form Pdf to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the nyc 210 form pdf 100097773

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the NYC tax form 210?

The NYC tax form 210 is a form used for various tax purposes in New York City, including reporting income and claiming necessary tax credits. Understanding how to correctly fill out this form is crucial for timely and accurate submissions to avoid penalties.

-

How can airSlate SignNow help with the NYC tax form 210?

AirSlate SignNow offers a seamless platform to complete and eSign the NYC tax form 210 online. With our user-friendly interface, users can easily populate, sign, and send the form, ensuring a smooth filing process.

-

Is there a cost associated with using airSlate SignNow for the NYC tax form 210?

AirSlate SignNow offers competitive pricing plans that provide access to features necessary for eSigning documents, including the NYC tax form 210. We also offer a free trial for new users, allowing you to explore our capabilities without commitment.

-

What features does airSlate SignNow offer for completing the NYC tax form 210?

AirSlate SignNow features advanced tools for filling out and eSigning the NYC tax form 210, such as document templates, real-time collaboration, and secure cloud storage. This ensures that your tax forms are handled efficiently and securely.

-

Can I integrate airSlate SignNow with my existing software for tax filing?

Yes, airSlate SignNow integrates smoothly with various accounting and tax software, making it easy to streamline your workflow for the NYC tax form 210 and other tax-related documents. Integration simplifies data transfer and enhances your tax preparation process.

-

How secure is the submission of the NYC tax form 210 using airSlate SignNow?

Security is a priority with airSlate SignNow; we employ bank-level encryption to protect your NYC tax form 210 and other sensitive documents. Our platform complies with various regulations, ensuring your information is safe during the eSigning process.

-

What are the benefits of using airSlate SignNow for the NYC tax form 210?

Using airSlate SignNow to complete the NYC tax form 210 offers numerous benefits, such as streamlined processes, quick eSigning, and reduced paper usage. This not only saves time but also helps to ensure accuracy and compliance with tax regulations.

Get more for Nyc 210 Form Pdf

- Wyoming corporation form

- Wy name change form

- Wyoming name change form

- Wyoming sale form agreement

- Wyoming poa form

- Wyoming lease purchase agreements package form

- Arizona legal last will and testament form for a single person with minor children

- Connecticut legal last will and testament form for a single person with minor children

Find out other Nyc 210 Form Pdf

- Electronic signature Texas Legal Lease Agreement Template Free

- Can I Electronic signature Texas Legal Lease Agreement Template

- How To Electronic signature Texas Legal Stock Certificate

- How Can I Electronic signature Texas Legal POA

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now

- Electronic signature Colorado Plumbing LLC Operating Agreement Simple

- Electronic signature Arizona Real Estate Business Plan Template Free

- Electronic signature Washington Legal Contract Safe

- How To Electronic signature Arkansas Real Estate Contract

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney