Sfusd Senior Exemption Form

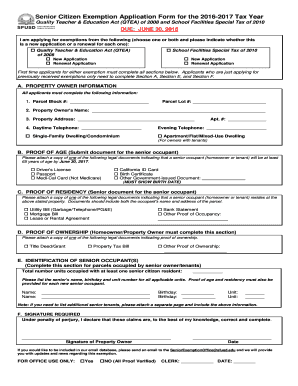

What is the SFUSD Senior Exemption

The SFUSD Senior Exemption is a program designed to provide property tax relief to qualified senior citizens within the San Francisco Unified School District. This exemption aims to ease the financial burden on seniors, allowing them to retain their homes while contributing to the community. To qualify, applicants must meet specific age and income criteria, ensuring that the benefits reach those who need them the most.

Eligibility Criteria

To be eligible for the SFUSD Senior Exemption, applicants must be at least sixty-five years old and must own and occupy the property for which they are seeking the exemption. Additionally, there are income limits that applicants must not exceed, which are determined annually. It is essential for potential applicants to review these criteria carefully to ensure they qualify before applying.

Steps to Complete the SFUSD Senior Exemption

Completing the SFUSD Senior Exemption involves several key steps:

- Gather necessary documents, including proof of age, income statements, and property ownership documentation.

- Obtain the SFUSD Senior Exemption application form, which can be accessed online or through the SFUSD exemption office.

- Fill out the application form accurately, ensuring all information is complete and correct.

- Submit the completed application along with the required documents to the SFUSD exemption office, either online, by mail, or in person.

Required Documents

When applying for the SFUSD Senior Exemption, applicants must provide several documents to verify their eligibility. These typically include:

- Proof of age, such as a birth certificate or government-issued ID.

- Income verification, which may include tax returns or pay stubs.

- Documentation of property ownership, such as a deed or property tax statement.

Form Submission Methods

Applicants have multiple options for submitting their SFUSD Senior Exemption application. They can choose to submit the form online through the SFUSD exemption office website, mail it to the designated office address, or deliver it in person. Each method has its advantages, such as convenience for online submissions or the ability to ask questions in person.

Legal Use of the SFUSD Senior Exemption

The SFUSD Senior Exemption is legally binding once approved, providing property tax relief to eligible seniors. It is important for applicants to understand that any misrepresentation or failure to meet the eligibility criteria can lead to penalties or the revocation of the exemption. Therefore, maintaining accurate records and ensuring compliance with the program's requirements is essential for continued eligibility.

Quick guide on how to complete sfusd senior exemption

Complete Sfusd Senior Exemption effortlessly on any device

Online document management has become increasingly popular among companies and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to easily locate the right form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and electronically sign your documents quickly without any delays. Manage Sfusd Senior Exemption across any platform using airSlate SignNow's Android or iOS applications and streamline your document-related processes today.

How to modify and eSign Sfusd Senior Exemption with ease

- Obtain Sfusd Senior Exemption and click Get Form to begin.

- Use the tools we offer to fill out your form.

- Highlight important sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign tool, which takes only seconds and holds the same legal significance as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose your preferred method for delivering your form, whether by email, SMS, invite link, or downloading it to your computer.

Forget about misplaced or lost files, tedious form searches, or mistakes that necessitate reprinting new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Modify and eSign Sfusd Senior Exemption while ensuring effective communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sfusd senior exemption

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the sfusd edu senior exemption for students?

The sfusd edu senior exemption allows qualifying senior students in the San Francisco Unified School District to waive certain fees. This exemption is designed to support students financially, ensuring that they can access education without added burdens. Students should consult their school administration for detailed requirements and application processes.

-

How can airSlate SignNow help with the sfusd edu senior exemption paperwork?

airSlate SignNow simplifies the process of submitting necessary documentation for the sfusd edu senior exemption. With our eSignature features, students and educators can easily sign and send forms securely. This not only speeds up the process but also ensures that all paperwork is correctly handled and stored.

-

Is there a cost associated with using airSlate SignNow for the sfusd edu senior exemption?

airSlate SignNow offers a cost-effective solution for managing documents, including those related to the sfusd edu senior exemption. Our pricing plans are designed to accommodate both individuals and educational institutions, making it affordable to access essential tools. Check our website for detailed pricing information and plans.

-

What features does airSlate SignNow provide for managing the sfusd edu senior exemption?

airSlate SignNow offers a range of features, including electronic signatures, document templates, and real-time tracking, specifically useful for managing the sfusd edu senior exemption process. These features streamline the workflow, making it easy to prepare, send, and receive signed documents. This enhances efficiency for students and administrators alike.

-

Can airSlate SignNow integrate with other educational tools for the sfusd edu senior exemption application?

Yes, airSlate SignNow can easily integrate with various educational tools and platforms, which can be beneficial for managing the sfusd edu senior exemption application. This means that schools can incorporate our eSigning capabilities into their existing systems for a more cohesive workflow. Integrations enhance collaboration and minimize administrative burdens.

-

What are the benefits of using airSlate SignNow for the sfusd edu senior exemption?

Using airSlate SignNow for the sfusd edu senior exemption provides numerous benefits, including enhanced security and compliance for sensitive student documents. Additionally, the platform's user-friendly interface ensures that both students and staff can efficiently navigate the eSigning process. Ultimately, it saves time and promotes organization within the school administration.

-

How does airSlate SignNow ensure the security of documents related to the sfusd edu senior exemption?

airSlate SignNow prioritizes document security, especially for sensitive applications like the sfusd edu senior exemption. All documents are encrypted, and our platform complies with industry standards to protect user data. This means users can confidently manage their exemption paperwork without worrying about unauthorized access.

Get more for Sfusd Senior Exemption

- Affidavit georgia department of agriculture form

- Supplement schedule for refund of louisiana citizens property revenue louisiana form

- Pelvic floor impact questionnaireshort form 7 pfiq 7

- Ashi instructor application home page ashinstitute org form

- 5 elevator pitch worksheet 1 westminster college westminstercollege form

- Bp s235 form

- Separate series agreement clint coons esq form

- Itemization of amount financed form

Find out other Sfusd Senior Exemption

- Sign Police PPT Alaska Online

- How To Sign Rhode Island Real Estate LLC Operating Agreement

- How Do I Sign Arizona Police Resignation Letter

- Sign Texas Orthodontists Business Plan Template Later

- How Do I Sign Tennessee Real Estate Warranty Deed

- Sign Tennessee Real Estate Last Will And Testament Free

- Sign Colorado Police Memorandum Of Understanding Online

- How To Sign Connecticut Police Arbitration Agreement

- Sign Utah Real Estate Quitclaim Deed Safe

- Sign Utah Real Estate Notice To Quit Now

- Sign Hawaii Police LLC Operating Agreement Online

- How Do I Sign Hawaii Police LLC Operating Agreement

- Sign Hawaii Police Purchase Order Template Computer

- Sign West Virginia Real Estate Living Will Online

- How Can I Sign West Virginia Real Estate Confidentiality Agreement

- Sign West Virginia Real Estate Quitclaim Deed Computer

- Can I Sign West Virginia Real Estate Affidavit Of Heirship

- Sign West Virginia Real Estate Lease Agreement Template Online

- How To Sign Louisiana Police Lease Agreement

- Sign West Virginia Orthodontists Business Associate Agreement Simple