Itr Acknowledgement Form

What is the ITR Acknowledgement?

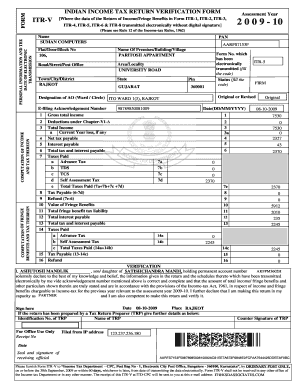

The ITR acknowledgement is an essential document that serves as proof of filing your Indian Income Tax Return (ITR). It confirms that your tax return has been successfully submitted to the tax authorities. This document includes key details such as your Permanent Account Number (PAN), the assessment year, and the acknowledgment number, which is unique to each submission. Understanding the ITR acknowledgement means recognizing its role in the tax filing process and its importance in maintaining compliance with tax regulations.

How to Obtain the ITR Acknowledgement

To obtain your ITR acknowledgement, you need to follow a few straightforward steps. After successfully filing your ITR online, the acknowledgment is generated automatically. You can download it directly from the tax filing portal. If you filed your return through a tax professional, they may also provide you with a copy. Ensure that you keep this document safe, as it may be required for future reference or in case of any queries from the tax department.

Steps to Complete the ITR Acknowledgement

Completing the ITR acknowledgement involves several steps to ensure accuracy and compliance. First, gather all necessary documents, including your income details and tax deductions. Next, access the online tax filing portal and fill out the required forms. Once you submit your ITR, the system will generate the acknowledgement. Review the details carefully for any discrepancies before downloading or printing it. This process ensures that you have a valid record of your tax filing.

Key Elements of the ITR Acknowledgement

The ITR acknowledgement contains several key elements that are crucial for tax compliance. These include:

- Acknowledgment Number: A unique identifier for your tax return submission.

- Permanent Account Number (PAN): Your unique identification number for tax purposes.

- Assessment Year: The year for which the tax return is filed.

- Date of Filing: The date on which your ITR was submitted.

- Details of Income: A summary of your reported income and deductions.

Legal Use of the ITR Acknowledgement

The ITR acknowledgement is legally binding and serves as proof of compliance with tax laws. It can be used in various legal contexts, such as applying for loans, verifying income for visa applications, or during audits by tax authorities. Retaining this document is vital for maintaining your financial records and ensuring you can substantiate your tax filings if required.

Filing Deadlines / Important Dates

Awareness of filing deadlines is crucial for timely submission of your ITR and obtaining your acknowledgement. Typically, the deadline for individual taxpayers to file their ITR is July 31 of the assessment year. However, extensions may be granted under specific circumstances. It is essential to stay updated on any changes to these deadlines to avoid penalties or complications with your tax filings.

Quick guide on how to complete itr acknowledgement

Effortlessly Prepare Itr Acknowledgement on Any Device

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed papers, allowing you to locate the right template and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage Itr Acknowledgement from any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to Edit and eSign Itr Acknowledgement with Ease

- Locate Itr Acknowledgement and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow.

- Generate your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and click the Done button to save your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate worries about lost or disorganized documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow caters to all your document management needs in just a few clicks from a device of your choice. Edit and eSign Itr Acknowledgement and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the itr acknowledgement

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Indian income tax return verification form?

The Indian income tax return verification form is a document that individuals use to confirm the authenticity of their income tax returns submitted to the government. This form is essential for ensuring proper compliance with tax regulations and facilitates a smooth process for processing returns. Using the airSlate SignNow solution can simplify the signing and submission of this critical document.

-

How can I complete the Indian income tax return verification form using airSlate SignNow?

To complete the Indian income tax return verification form with airSlate SignNow, simply upload your document, add the necessary fields for signatures and information, and send it for eSignature. Our platform allows you to complete the verification process digitally, ensuring a fast and accurate submission. With our user-friendly interface, you can manage your forms effortlessly.

-

Is airSlate SignNow cost-effective for managing the Indian income tax return verification form?

Yes, airSlate SignNow offers a cost-effective solution for managing the Indian income tax return verification form. With various pricing plans tailored to meet the needs of both individuals and businesses, you can efficiently handle your eSigning needs without breaking the bank. The increased efficiency and time savings also contribute to overall cost-effectiveness.

-

What features does airSlate SignNow offer for the Indian income tax return verification form?

airSlate SignNow provides a range of features for the Indian income tax return verification form, including customizable templates, real-time tracking, and advanced security measures. You can also integrate with other applications, ensuring a seamless workflow that enhances productivity. These features make it easy to manage and execute your verification tasks.

-

Can I integrate airSlate SignNow with other software for the Indian income tax return verification form?

Absolutely! airSlate SignNow supports integrations with various popular software platforms, allowing you to streamline your workflow when handling the Indian income tax return verification form. Whether you’re using accounting software or a customer relationship management system, our integrations help keep everything connected and efficient.

-

What are the benefits of using airSlate SignNow for the Indian income tax return verification form?

Using airSlate SignNow for the Indian income tax return verification form provides multiple benefits such as increased security, faster processing times, and improved accuracy. The electronic signature process eliminates the need for physical paperwork, helping you stay organized and compliant. Additionally, the ability to track document statuses elevates your overall document management experience.

-

Is airSlate SignNow compliant with Indian regulatory requirements for the income tax return verification form?

Yes, airSlate SignNow is designed to be compliant with Indian regulatory requirements for the income tax return verification form, including the legal validity of electronic signatures. Our platform adheres to the necessary standards to ensure that your document signing processes meet all local legal requirements. You can use our solution with confidence.

Get more for Itr Acknowledgement

- Redundancy worksheet form

- Occupational profile form

- Body mole map template form

- Child care verification housing authority of fulton county hafc form

- Short term lease agreement template form

- Short rental lease agreement template form

- Short term commercial lease agreement template form

- Six month lease agreement template form

Find out other Itr Acknowledgement

- How To Sign Arkansas Banking Forbearance Agreement

- Sign Arizona Banking Permission Slip Easy

- Can I Sign California Banking Lease Agreement Template

- How Do I Sign Colorado Banking Credit Memo

- Help Me With Sign Colorado Banking Credit Memo

- How Can I Sign Colorado Banking Credit Memo

- Sign Georgia Banking Affidavit Of Heirship Myself

- Sign Hawaii Banking NDA Now

- Sign Hawaii Banking Bill Of Lading Now

- Sign Illinois Banking Confidentiality Agreement Computer

- Sign Idaho Banking Rental Lease Agreement Online

- How Do I Sign Idaho Banking Limited Power Of Attorney

- Sign Iowa Banking Quitclaim Deed Safe

- How Do I Sign Iowa Banking Rental Lease Agreement

- Sign Iowa Banking Residential Lease Agreement Myself

- Sign Kansas Banking Living Will Now

- Sign Kansas Banking Last Will And Testament Mobile

- Sign Kentucky Banking Quitclaim Deed Online

- Sign Kentucky Banking Quitclaim Deed Later

- How Do I Sign Maine Banking Resignation Letter