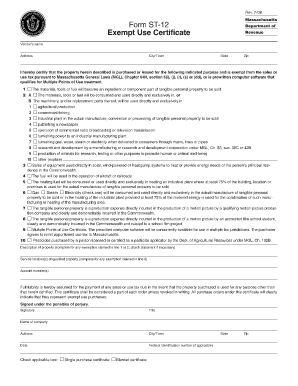

Irsgovformsst 12mass

What is the Irsgovformsst 12mass

The Irsgovformsst 12mass is a specific form utilized within the U.S. tax system, primarily designed for reporting purposes. This form is essential for individuals and businesses to accurately declare certain financial information to the Internal Revenue Service (IRS). It plays a significant role in ensuring compliance with federal tax regulations and helps facilitate the accurate processing of tax returns.

How to use the Irsgovformsst 12mass

Using the Irsgovformsst 12mass involves several key steps. First, gather all necessary financial documents, including income statements and any relevant deductions. Next, fill out the form with accurate information, ensuring that all entries are complete and correct. It is crucial to review the completed form for any errors before submission. Once finalized, the form can be submitted electronically or via mail, depending on your preference and the specific requirements set forth by the IRS.

Steps to complete the Irsgovformsst 12mass

Completing the Irsgovformsst 12mass requires a systematic approach:

- Collect all relevant financial documents, such as W-2s, 1099s, and receipts for deductions.

- Carefully read the instructions provided with the form to understand the requirements.

- Fill out the form, ensuring that all sections are completed accurately.

- Double-check for any mistakes or omissions.

- Submit the form either electronically through a secure platform or by mailing it to the appropriate IRS address.

Legal use of the Irsgovformsst 12mass

The legal use of the Irsgovformsst 12mass is governed by IRS regulations. To ensure that the form is legally binding, it must be filled out accurately and submitted within the designated deadlines. Compliance with federal guidelines is essential, as failure to adhere to these rules can result in penalties or legal repercussions. Utilizing a trusted eSignature solution can enhance the legitimacy of the form, ensuring that it meets all legal requirements.

Filing Deadlines / Important Dates

Filing deadlines for the Irsgovformsst 12mass are critical to avoid penalties. The specific due date typically aligns with the annual tax filing deadline, which is usually April fifteenth. However, it is important to verify any changes or extensions that may apply for a given tax year. Keeping track of these dates helps ensure timely submission and compliance with IRS regulations.

Form Submission Methods (Online / Mail / In-Person)

The Irsgovformsst 12mass can be submitted through various methods. Electronic submission is often the fastest and most efficient way to file, allowing for immediate processing. Alternatively, individuals may choose to mail the completed form to the designated IRS address. In-person submission is also an option at certain IRS offices, though it may require an appointment. Selecting the appropriate method depends on personal preference and the urgency of the filing.

Quick guide on how to complete irsgovformsst 12mass

Easily Set Up Irsgovformsst 12mass on Any Device

Digital document management has become increasingly popular with businesses and individuals alike. It offers a sustainable alternative to traditional printed and signed documents, allowing you to access the right format and securely store it online. airSlate SignNow provides all the necessary tools to create, edit, and eSign your documents quickly and without delay. Manage Irsgovformsst 12mass on any platform with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to Edit and eSign Irsgovformsst 12mass Effortlessly

- Obtain Irsgovformsst 12mass and click Get Form to begin.

- Utilize the tools available to complete your form.

- Emphasize important sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet signature.

- Verify all details and click on the Done button to save your changes.

- Select your preferred method for sharing your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device you choose. Edit and eSign Irsgovformsst 12mass to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the irsgovformsst 12mass

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the purpose of Irsgovformsst 12mass?

Irsgovformsst 12mass is designed to streamline the process of managing tax documents and forms electronically. With airSlate SignNow, users can efficiently eSign and send these documents, ensuring compliance and accuracy in financial reporting.

-

How can airSlate SignNow help with Irsgovformsst 12mass?

AirSlate SignNow provides a user-friendly platform that simplifies the signing and distribution of Irsgovformsst 12mass documents. By employing digital signatures, users can reduce processing times and enhance overall workflow efficiency.

-

What are the costs associated with using Irsgovformsst 12mass on airSlate SignNow?

airSlate SignNow offers competitive pricing plans suitable for various business sizes. By utilizing Irsgovformsst 12mass within our platform, you can access a cost-effective solution for all your eSignature needs while benefiting from additional features.

-

Can I integrate other software with Irsgovformsst 12mass in airSlate SignNow?

Yes, airSlate SignNow supports a wide range of integrations that can enhance your experience with Irsgovformsst 12mass. You can connect it effortlessly with your existing software to create a more cohesive workflow.

-

What features does airSlate SignNow offer for handling Irsgovformsst 12mass?

AirSlate SignNow provides several features for managing Irsgovformsst 12mass, including templates, automated reminders, and cloud storage. These functionalities help ensure that your documents are organized and easily accessible.

-

Is airSlate SignNow secure for processing Irsgovformsst 12mass?

Absolutely. AirSlate SignNow employs industry-leading security protocols to protect your documents, including Irsgovformsst 12mass. This ensures that your sensitive information remains confidential and secure throughout the signing process.

-

What are the benefits of using airSlate SignNow for Irsgovformsst 12mass?

Using airSlate SignNow for Irsgovformsst 12mass allows for faster document turnaround times and improved accuracy in your tax documentation. The platform also reduces paper usage and facilitates better collaboration among team members.

Get more for Irsgovformsst 12mass

- No wl 20 kjri dubai formulir pendaftaran wni di uae 3x4 indonesianconsulate

- Form 8911 instructions

- Apportioned registration form schedule c oregon department odot state or

- Georgia board of nursing georgia state capitol sos ga form

- Riderclaims trustmarkins com 448183596 form

- 4681 form

- Credit union wire transfer form

- Student lease agreement template form

Find out other Irsgovformsst 12mass

- Electronic signature Delaware Construction Business Letter Template Safe

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney