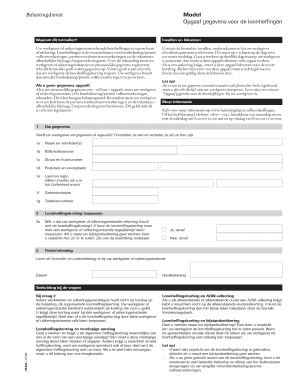

Model Opgaaf Gegevens Voor De Loonheffingen Form

What is the Model Opgaaf Gegevens Voor De Loonheffingen

The Model Opgaaf Gegevens Voor De Loonheffingen is a crucial document used for tax purposes in the Netherlands. It serves as a declaration form that provides essential information regarding wage tax and social security contributions. This form is typically filled out by employers to report the necessary data to the tax authorities. It includes details such as employee information, wages paid, and applicable deductions. Understanding this form is vital for ensuring compliance with tax regulations.

How to Use the Model Opgaaf Gegevens Voor De Loonheffingen

Using the Model Opgaaf Gegevens Voor De Loonheffingen involves several steps to ensure accurate completion. First, gather all necessary employee information, including names, addresses, and social security numbers. Next, compile wage data and any deductions applicable to each employee. Once all information is collected, fill out the form carefully, ensuring that all entries are accurate and complete. After completing the form, it should be submitted to the relevant tax authority by the specified deadline.

Steps to Complete the Model Opgaaf Gegevens Voor De Loonheffingen

Completing the Model Opgaaf Gegevens Voor De Loonheffingen requires attention to detail. Follow these steps:

- Collect employee details, including their full names and identification numbers.

- Document the total wages paid to each employee during the reporting period.

- Identify any deductions or tax credits applicable to the employees.

- Fill out the form accurately, ensuring all fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the completed form to the tax authorities by the deadline.

Legal Use of the Model Opgaaf Gegevens Voor De Loonheffingen

The legal use of the Model Opgaaf Gegevens Voor De Loonheffingen is essential for compliance with tax laws. This form must be completed accurately to avoid penalties and ensure that all tax obligations are met. It serves as an official record of wage payments and deductions, which can be audited by tax authorities. Employers must keep a copy of the submitted form for their records, as it may be required for future reference or audits.

Required Documents for the Model Opgaaf Gegevens Voor De Loonheffingen

To complete the Model Opgaaf Gegevens Voor De Loonheffingen, certain documents are necessary. These include:

- Employee identification documents, such as social security cards.

- Payroll records detailing wages and hours worked.

- Documentation of any deductions or credits applicable to employees.

- Previous tax filings, if applicable, for reference.

Form Submission Methods

The Model Opgaaf Gegevens Voor De Loonheffingen can be submitted through various methods. Employers may choose to file the form online, which is often the most efficient option. Alternatively, the form can be submitted by mail or in person at the local tax office. It is important to ensure that the submission method chosen complies with the requirements set by the tax authorities.

Quick guide on how to complete model opgaaf gegevens voor de loonheffingen

Complete Model Opgaaf Gegevens Voor De Loonheffingen effortlessly on any device

The management of documents online has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to easily locate the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to generate, edit, and electronically sign your documents quickly without delays. Manage Model Opgaaf Gegevens Voor De Loonheffingen on any device using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign Model Opgaaf Gegevens Voor De Loonheffingen without stress

- Find Model Opgaaf Gegevens Voor De Loonheffingen and click on Get Form to begin.

- Make use of the tools available to complete your document.

- Highlight important sections of your documents or obscure sensitive details with the tools that airSlate SignNow specifically offers for this purpose.

- Create your electronic signature using the Sign feature, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose your preferred method for sending your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Model Opgaaf Gegevens Voor De Loonheffingen and ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the model opgaaf gegevens voor de loonheffingen

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the formulier loonheffingskorting and how can airSlate SignNow help?

The formulier loonheffingskorting is a tax form in the Netherlands that allows employees to claim tax relief. With airSlate SignNow, you can easily send, eSign, and manage this form digitally, ensuring a streamlined process for your payroll department and employees.

-

How does airSlate SignNow ensure the security of my formulier loonheffingskorting?

Security is a top priority at airSlate SignNow. We implement robust encryption protocols to protect all your documents, including the formulier loonheffingskorting, ensuring that sensitive information stays safe during transmission and storage.

-

Can I customize the formulier loonheffingskorting with airSlate SignNow?

Yes, airSlate SignNow allows you to customize the formulier loonheffingskorting to fit your business needs. You can add your company branding, adjust the layout, and include any specific fields required for your employees' tax documentation.

-

What are the pricing plans for using airSlate SignNow?

airSlate SignNow offers flexible pricing plans suitable for businesses of all sizes. You can choose from various subscription levels that cater to your needs, making it an affordable solution for managing the formulier loonheffingskorting and other documents.

-

Does airSlate SignNow integrate with other software to manage the formulier loonheffingskorting?

Absolutely! airSlate SignNow integrates seamlessly with popular HR and payroll systems, allowing you to manage the formulier loonheffingskorting alongside your existing workflow. This integration saves time and reduces errors in document handling.

-

What are the benefits of using airSlate SignNow for the formulier loonheffingskorting?

Using airSlate SignNow to manage the formulier loonheffingskorting offers several benefits, including increased efficiency, reduced paperwork, and enhanced collaboration. The digital platform allows for quick signatures and immediate access to forms, streamlining your processes.

-

Is it easy to get started with airSlate SignNow for my formulier loonheffingskorting?

Getting started with airSlate SignNow is straightforward. Simply sign up for an account, and you can begin creating and managing your formulier loonheffingskorting immediately with our user-friendly interface and tutorials.

Get more for Model Opgaaf Gegevens Voor De Loonheffingen

Find out other Model Opgaaf Gegevens Voor De Loonheffingen

- eSignature New York Fundraising Registration Form Simple

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors