Form No 16

What is the Form No 16

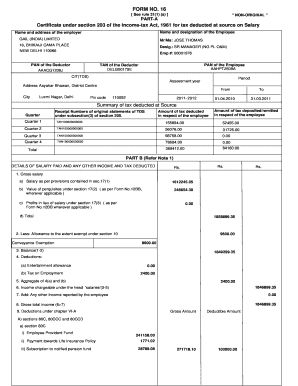

The Form No 16 is a crucial document in the United States tax system, primarily used for income tax certification under section 203. It serves as a certificate of tax withheld from an employee's salary or other income sources. Employers issue this form to their employees, detailing the amount of tax deducted during the financial year. This document is essential for individuals when filing their income tax returns, as it provides a clear record of income and taxes paid. Understanding the purpose and details of Form No 16 is vital for accurate tax reporting and compliance.

How to Obtain the Form No 16

Obtaining the Form No 16 is a straightforward process. Typically, employers provide this form to their employees at the end of the financial year. Employees should ensure they receive it from their employer, as it contains essential information for tax filing. In cases where the form is not received, individuals can request it directly from their HR or payroll department. Additionally, in some instances, individuals may access a digital version of the form through their employer's online portal, ensuring a quick and efficient retrieval process.

Steps to Complete the Form No 16

Completing the Form No 16 involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including salary slips and previous tax returns. Next, fill in personal information such as name, address, and Social Security number. Then, accurately report the total income earned during the financial year, along with the tax deducted at source. It is crucial to double-check all entries for correctness to avoid discrepancies. Finally, sign and date the form, ensuring it is submitted to the appropriate tax authority or retained for personal records.

Legal Use of the Form No 16

The legal use of the Form No 16 is governed by various tax laws and regulations in the United States. This form is recognized as a valid document for tax purposes, provided it is filled out correctly and submitted on time. It serves as proof of income and tax deductions, which can be critical during audits or tax assessments. Compliance with IRS guidelines regarding the use of Form No 16 is essential to avoid penalties. Understanding the legal implications of this form ensures that individuals can confidently use it in their tax filings.

Key Elements of the Form No 16

Several key elements must be included when completing the Form No 16. These elements typically comprise the taxpayer's personal information, including name, address, and taxpayer identification number. Additionally, it must detail the total income earned, the amount of tax deducted, and any exemptions or deductions applicable. The form should also include the employer's information, such as name and address. Ensuring all key elements are accurately filled out is crucial for the form's validity and for meeting tax obligations.

Penalties for Non-Compliance

Failure to comply with the requirements associated with the Form No 16 can result in significant penalties. Individuals who do not file their tax returns accurately or on time may face fines imposed by the IRS. Additionally, discrepancies in reported income or tax deductions can lead to audits, further complicating tax situations. Understanding the potential penalties for non-compliance emphasizes the importance of accurately completing and submitting Form No 16 in accordance with U.S. tax laws.

Quick guide on how to complete form no 16 47697834

Effortlessly prepare Form No 16 on any device

Online document management has become increasingly favored by businesses and individuals. It presents an ideal environmentally friendly substitute for conventional printed and signed documents, as you can acquire the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly and without delays. Manage Form No 16 on any platform using the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The simplest method to modify and eSign Form No 16 with ease

- Find Form No 16 and click on Get Form to commence.

- Utilize the tools we offer to complete your document.

- Highlight relevant portions of your documents or obscure sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign feature, which only takes a few seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Select how you would like to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that require reprinting new document copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you prefer. Modify and eSign Form No 16 to ensure effective communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form no 16 47697834

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the r16 form and how is it used?

The r16 form is a specific document used for various business and legal purposes, particularly in transactions involving electronic signatures. With airSlate SignNow, you can easily create, send, and eSign r16 forms, ensuring compliance and efficiency in your documentation process.

-

Is there a cost associated with using the r16 form on airSlate SignNow?

Using the r16 form through airSlate SignNow comes with no hidden costs. Our pricing plans are transparent and designed to cater to businesses of all sizes, providing an affordable and effective solution for handling r16 forms and other documents.

-

What features does airSlate SignNow offer for managing the r16 form?

airSlate SignNow provides a range of features for managing the r16 form, including customizable templates, advanced signing options, and real-time tracking. This ensures that you have complete control over your documents and can streamline your signing process efficiently.

-

How does airSlate SignNow ensure the security of the r16 form?

Security is a top priority at airSlate SignNow. We utilize advanced encryption methods and strict authentication protocols to protect your r16 forms and sensitive information, ensuring that your documents are secure throughout the signing process.

-

Can r16 forms be integrated with other software on airSlate SignNow?

Yes, airSlate SignNow supports seamless integration with various platforms, enabling you to incorporate r16 forms into your existing workflows. This is particularly beneficial for businesses looking to enhance productivity and automate their document management processes.

-

What are the benefits of using airSlate SignNow for r16 forms?

Using airSlate SignNow for r16 forms offers numerous benefits, including time savings, improved accuracy, and enhanced collaboration. The user-friendly interface allows teams to manage and sign documents quickly, making it an ideal solution for modern businesses.

-

How can I get started with airSlate SignNow for my r16 forms?

Getting started with airSlate SignNow for your r16 forms is simple. Sign up for an account, explore our templates, and begin creating and sending your documents for eSignature. Our intuitive platform makes the onboarding process quick and easy.

Get more for Form No 16

- Dc joint 497301858 form

- Warranty deed to separate property of one spouse to both as joint tenants district of columbia form

- Dc deed online form

- District columbia llc form

- Dc deed form

- Dc quitclaim deed form

- Quitclaim deed from three individuals to two individuals district of columbia form

- Legal last will and testament form for single person with no children district of columbia

Find out other Form No 16

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself

- Electronic signature Alaska Car Dealer NDA Mobile

- How Can I Electronic signature Arizona Car Dealer Agreement

- Electronic signature California Business Operations Promissory Note Template Fast

- How Do I Electronic signature Arkansas Car Dealer Claim

- Electronic signature Colorado Car Dealer Arbitration Agreement Mobile

- Electronic signature California Car Dealer Rental Lease Agreement Fast

- Electronic signature Connecticut Car Dealer Lease Agreement Now

- Electronic signature Connecticut Car Dealer Warranty Deed Computer

- Electronic signature New Mexico Banking Job Offer Online

- How Can I Electronic signature Delaware Car Dealer Purchase Order Template