Printable Goodwill Receipt Form

What is the Printable Goodwill Receipt

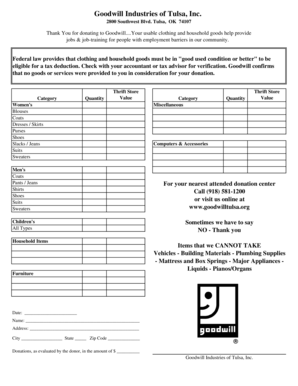

The printable goodwill receipt is a document provided by Goodwill Industries that serves as proof of donation for items given to the organization. This receipt is essential for donors, as it allows them to claim charitable contributions on their tax returns. The receipt typically includes details about the items donated, their estimated value, and the date of the donation. It is important for individuals to retain this document for their records, especially during tax season.

How to Use the Printable Goodwill Receipt

Using the printable goodwill receipt is straightforward. After making a donation to Goodwill, you should request a receipt from the organization. If you are using a printable version, ensure that you fill it out accurately with the necessary details, including your name, address, and a description of the items donated. Once completed, keep a copy for your records and submit the original with your tax filings if required. This documentation can help substantiate your charitable contributions during an audit.

Steps to Complete the Printable Goodwill Receipt

Completing the printable goodwill receipt involves several simple steps:

- Gather information about the items you are donating, including their condition and estimated value.

- Fill out your personal information, including your name and address, on the receipt.

- List the items you donated, providing a brief description and their estimated value.

- Sign and date the receipt to confirm the donation.

- Keep a copy of the completed receipt for your records.

Legal Use of the Printable Goodwill Receipt

The printable goodwill receipt is legally recognized as proof of charitable donations in the United States. To ensure its validity, it must include specific information such as the donor's name, the date of the donation, and a detailed list of the donated items. This documentation is crucial for tax purposes, as the IRS requires substantiation for charitable contributions claimed on tax returns. Donors should ensure they follow IRS guidelines to maximize their tax benefits.

IRS Guidelines

The Internal Revenue Service (IRS) provides clear guidelines regarding the use of charitable donation receipts. For donations valued at more than $250, the IRS mandates that donors obtain a written acknowledgment from the charity, which includes details about the donation. The printable goodwill receipt fulfills this requirement, but it is essential to maintain accurate records of the items donated and their values. Donors should consult IRS Publication 526 for more information on the deductibility of charitable contributions.

Examples of Using the Printable Goodwill Receipt

There are various scenarios in which the printable goodwill receipt can be utilized effectively:

- A family donates clothing and household items to Goodwill and uses the receipt to claim a deduction on their tax return.

- A business donates office furniture to Goodwill and retains the receipt to document their charitable contributions for corporate tax purposes.

- An individual donates electronics and uses the printable goodwill receipt to substantiate their contributions during an IRS audit.

Quick guide on how to complete printable goodwill receipt

Prepare Printable Goodwill Receipt effortlessly on any device

Online document management has become increasingly popular among businesses and individuals alike. It offers an excellent environmentally-friendly substitute for conventional printed and signed paperwork, allowing you to obtain the correct format and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents quickly and without delays. Manage Printable Goodwill Receipt on any platform with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to alter and electronically sign Printable Goodwill Receipt with ease

- Locate Printable Goodwill Receipt and click Get Form to begin.

- Make use of the resources we offer to complete your document.

- Mark important sections of the documents or redact sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and hit the Done button to save your modifications.

- Choose how you prefer to share your form, via email, SMS, or invite link, or download it to your computer.

Eliminate the worry of lost or misfiled documents, tedious form navigation, or mistakes that necessitate printing additional document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you prefer. Alter and electronically sign Printable Goodwill Receipt and ensure optimal communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the printable goodwill receipt

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a printable goodwill receipt?

A printable goodwill receipt is a document used to acknowledge donations made to charitable organizations, specifically those recognized by goodwill. This receipt typically includes essential details such as the donor's information, the donated items, and their estimated value. It serves as proof for tax deduction purposes, making it vital for individuals looking to maximize their charitable contributions.

-

How can I create a printable goodwill receipt with airSlate SignNow?

Creating a printable goodwill receipt with airSlate SignNow is simple and straightforward. Users can utilize our document templates to customize their receipts with the necessary information. After filling out the details, you can easily print or share the goodwill receipt electronically, ensuring a seamless donation process.

-

Is there a cost to use the printable goodwill receipt feature?

airSlate SignNow offers a cost-effective solution for creating printable goodwill receipts as part of its subscription plans. Pricing is flexible, catering to businesses of all sizes. For more specific details about our pricing structure, visit our website to explore the various options.

-

What features are included when using airSlate SignNow for printable goodwill receipts?

When using airSlate SignNow for printable goodwill receipts, users gain access to a range of features including customizable templates, automatic calculations for item values, and easy integration with cloud storage services. Additionally, you can track the status of your documents and manage all your signatures in one convenient dashboard.

-

What are the benefits of using airSlate SignNow for printable goodwill receipts?

Using airSlate SignNow for printable goodwill receipts offers several benefits, such as enhanced efficiency and streamlined documentation. The user-friendly platform allows for quick creation and sharing of receipts, ensuring you stay organized. Furthermore, eSigning capabilities save time and boost the professionalism of your donation documentation.

-

Can I integrate airSlate SignNow with other applications to manage printable goodwill receipts?

Yes, airSlate SignNow supports integrations with various applications, which can enhance your ability to manage printable goodwill receipts effectively. Whether you're using CRM systems, accounting software, or cloud storage solutions, our platform can sync data seamlessly, ensuring all your documents are up to date and organized.

-

Are printable goodwill receipts accepted for tax deductions?

Yes, printable goodwill receipts created through airSlate SignNow are generally accepted for tax deductions as long as they include all necessary details, such as the donor's name, donation date, and item description. It is important to retain these receipts for your tax records to substantiate your charitable contributions during tax season.

Get more for Printable Goodwill Receipt

Find out other Printable Goodwill Receipt

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now

- Electronic signature Colorado Plumbing LLC Operating Agreement Simple

- Electronic signature Arizona Real Estate Business Plan Template Free

- Electronic signature Washington Legal Contract Safe

- How To Electronic signature Arkansas Real Estate Contract

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney

- How Do I Electronic signature Wyoming Legal POA

- How To Electronic signature Florida Real Estate Contract

- Electronic signature Florida Real Estate NDA Secure

- Can I Electronic signature Florida Real Estate Cease And Desist Letter