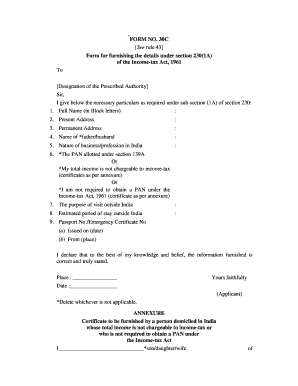

Form 30c

What is the Form 30c

The Form 30c is an important document used in the context of income tax in the United States. It serves as a declaration for certain tax-related claims, particularly those concerning deductions or exemptions. This form is essential for taxpayers who wish to provide specific information regarding their tax situation to the Internal Revenue Service (IRS). Understanding the purpose and requirements of the Form 30c is crucial for ensuring compliance with tax regulations.

How to use the Form 30c

Using the Form 30c involves several steps that ensure accurate completion and submission. First, gather all necessary documentation related to your income and deductions. Next, fill out the form with the required information, including your personal details and the specifics of your tax claims. Be sure to double-check for accuracy before submission. Once completed, the form can be submitted electronically or via mail, depending on your preference and the guidelines set by the IRS.

Steps to complete the Form 30c

Completing the Form 30c requires careful attention to detail. Follow these steps for a smooth process:

- Gather all relevant financial documents, including income statements and previous tax returns.

- Access the Form 30c online or obtain a physical copy.

- Fill in your personal information, including your name, address, and Social Security number.

- Provide details regarding your income and any deductions you are claiming.

- Review the form for any errors or omissions.

- Submit the completed form according to IRS guidelines.

Legal use of the Form 30c

The Form 30c is legally binding when completed correctly and submitted to the IRS. It must meet specific requirements to be considered valid, including accurate information and proper signatures. Compliance with federal regulations is essential, as any discrepancies can lead to penalties or audits. Utilizing a reliable eSignature solution can enhance the legal standing of the form, ensuring that it meets all necessary legal frameworks.

Filing Deadlines / Important Dates

Timely submission of the Form 30c is crucial to avoid penalties. The IRS typically sets specific deadlines for tax filings, which can vary based on the type of taxpayer and the nature of the claims being made. It is important to stay informed about these deadlines to ensure that your Form 30c is submitted on time. Mark these dates on your calendar and plan your filing accordingly to maintain compliance.

Required Documents

To complete the Form 30c accurately, certain documents are required. These typically include:

- Income statements, such as W-2s or 1099s.

- Receipts or documentation for any deductions being claimed.

- Previous tax returns for reference.

- Any additional forms that may support your claims.

Having these documents ready will facilitate a smoother filing process and help ensure that all necessary information is included.

Quick guide on how to complete form 30c

Effortlessly prepare Form 30c on any device

Managing documents online has gained popularity among companies and individuals. It offers an ideal sustainable substitute for conventional printed and signed documents, as you can easily locate the right form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and electronically sign your documents quickly and without delays. Handle Form 30c on any device using airSlate SignNow apps for Android or iOS and enhance any document-related process today.

How to modify and electronically sign Form 30c with ease

- Obtain Form 30c and select Get Form to begin.

- Utilize the features we offer to complete your document.

- Emphasize relevant sections of your documents or obscure sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method of delivering your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from a device of your choice. Modify and electronically sign Form 30c and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 30c

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the form 30c and how can airSlate SignNow help with it?

The form 30c is a specific document used for various transactions. airSlate SignNow simplifies the process of preparing and signing form 30c, ensuring that your documents are completed accurately and efficiently. With our platform, you can easily create, send, and eSign form 30c from anywhere, saving time and reducing errors.

-

What features does airSlate SignNow offer for managing form 30c?

airSlate SignNow provides essential features for managing form 30c, such as custom templates, real-time tracking, and automated reminders. These features help streamline the document signing process, ensuring that you never miss important deadlines. Additionally, the intuitive interface makes it easy for users to navigate and manage multiple form 30c documents.

-

How much does it cost to use airSlate SignNow for form 30c?

The pricing for airSlate SignNow depends on the plan you choose, but it is designed to be cost-effective for businesses of all sizes. You can send, manage, and eSign form 30c documents without incurring hefty costs. There are monthly and annual subscription options available, allowing you to choose what best fits your budget.

-

Can I integrate airSlate SignNow with other tools for managing form 30c?

Yes, airSlate SignNow offers seamless integrations with a variety of tools, making it easy to manage form 30c alongside your existing workflow. You can connect with popular applications such as Google Drive, Salesforce, and Zapier. These integrations enhance the overall management of form 30c, allowing for better document organization and accessibility.

-

What are the benefits of using airSlate SignNow for form 30c?

Using airSlate SignNow for form 30c comes with numerous benefits, such as enhanced security, improved efficiency, and reduced paper usage. You can be assured that your documents are securely stored and easily accessible anytime. Additionally, airSlate SignNow facilitates faster signing and approval processes, contributing to better productivity for your business.

-

Is airSlate SignNow compliant with regulations for signing form 30c?

Yes, airSlate SignNow is compliant with major regulations and standards for electronic signatures, ensuring that your signed form 30c is legally binding. Our platform adheres to eSignature laws like ESIGN and UETA, providing peace of mind for users. This compliance safeguards the validity and integrity of your form 30c documents.

-

Can I customize my form 30c with airSlate SignNow?

Absolutely! airSlate SignNow allows you to customize your form 30c to fit your specific needs. You can add fields, edit text, and create templates that can be reused for future transactions, making the process more efficient and tailored to your requirements.

Get more for Form 30c

- Pythagorean theorem worksheet five pack math worksheets land form

- Assurity life insurance company new business fax form

- Work portfolio examples pdf form

- Accounting 25th edition warren test bank solutions manual test form

- Contact uscity of amarillo tx amarillo gov form

- Carnival bpermitb application haltom city texas form

- Sign operating permit application form

- Building departmentcity of richmond form

Find out other Form 30c

- Electronic signature West Virginia Education Contract Safe

- Help Me With Electronic signature West Virginia Education Business Letter Template

- Electronic signature West Virginia Education Cease And Desist Letter Easy

- Electronic signature Missouri Insurance Stock Certificate Free

- Electronic signature Idaho High Tech Profit And Loss Statement Computer

- How Do I Electronic signature Nevada Insurance Executive Summary Template

- Electronic signature Wisconsin Education POA Free

- Electronic signature Wyoming Education Moving Checklist Secure

- Electronic signature North Carolina Insurance Profit And Loss Statement Secure

- Help Me With Electronic signature Oklahoma Insurance Contract

- Electronic signature Pennsylvania Insurance Letter Of Intent Later

- Electronic signature Pennsylvania Insurance Quitclaim Deed Now

- Electronic signature Maine High Tech Living Will Later

- Electronic signature Maine High Tech Quitclaim Deed Online

- Can I Electronic signature Maryland High Tech RFP

- Electronic signature Vermont Insurance Arbitration Agreement Safe

- Electronic signature Massachusetts High Tech Quitclaim Deed Fast

- Electronic signature Vermont Insurance Limited Power Of Attorney Easy

- Electronic signature Washington Insurance Last Will And Testament Later

- Electronic signature Washington Insurance Last Will And Testament Secure