Dr0104ep Form

What is the DR0104EP?

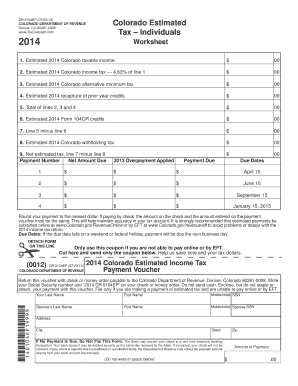

The DR0104EP is a Colorado estimated tax form used by individuals and businesses to report and pay estimated income taxes. It is particularly important for taxpayers who expect to owe tax of $1,000 or more when they file their annual tax return. The form allows taxpayers to make quarterly payments to avoid penalties and interest associated with underpayment. Understanding the purpose of the DR0104EP is essential for effective tax planning and compliance with Colorado tax laws.

How to Use the DR0104EP

Using the DR0104EP involves several straightforward steps. First, gather your income information, including wages, self-employment income, and any other sources of income. Next, calculate your expected tax liability for the year based on your total income. Once you have this figure, divide it by four to determine your quarterly estimated tax payments. Finally, complete the DR0104EP form with your calculated amounts and submit it according to the instructions provided.

Steps to Complete the DR0104EP

Completing the DR0104EP requires careful attention to detail. Follow these steps for accurate completion:

- Gather all necessary income documents, including W-2s and 1099s.

- Calculate your total expected income for the year.

- Determine your estimated tax liability using Colorado tax rates.

- Fill out the form with your personal information and calculated tax amounts.

- Review the form for accuracy before submission.

Legal Use of the DR0104EP

The DR0104EP is legally recognized as a valid method for reporting and paying estimated taxes in Colorado. Compliance with the form's requirements ensures that taxpayers meet their obligations under state law. It is crucial to file the form on time to avoid penalties. Additionally, using a reliable eSignature tool can enhance the legal standing of your submission, ensuring that it is processed efficiently and securely.

Filing Deadlines / Important Dates

Timely filing of the DR0104EP is essential to avoid penalties. The estimated tax payments are typically due on the following dates:

- April 15 for the first quarter

- June 15 for the second quarter

- September 15 for the third quarter

- January 15 of the following year for the fourth quarter

Be sure to check for any changes to these dates each tax year, as they may vary.

Required Documents

To complete the DR0104EP, you will need several key documents:

- Previous year's tax return for reference

- W-2 forms from employers

- 1099 forms for any freelance or self-employment income

- Records of any other income sources

Having these documents ready will facilitate a smoother filing process.

Quick guide on how to complete dr0104ep

Complete Dr0104ep effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can access the correct format and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Dr0104ep on any device using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

The easiest method to modify and eSign Dr0104ep effortlessly

- Find Dr0104ep and then click Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Emphasize key paragraphs of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign feature, which takes seconds and carries the same legal weight as a conventional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Choose how you would like to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign Dr0104ep and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the dr0104ep

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is dr0104ep in relation to airSlate SignNow?

dr0104ep refers to a specific feature within the airSlate SignNow platform that enhances the eSigning process. It allows users to efficiently manage their documents, ensuring seamless workflows and quick turnaround times for important agreements.

-

How does airSlate SignNow's pricing compare with other eSigning solutions?

airSlate SignNow offers competitive pricing for its services, making it an affordable choice for businesses of all sizes. With plans designed to fit various needs, you can leverage the dr0104ep capabilities without breaking the bank, ensuring you get maximum value for your investment.

-

What features does dr0104ep offer to improve document management?

The dr0104ep functionality in airSlate SignNow includes robust tracking features, seamless collaboration tools, and advanced security protocols. These enhancements ensure that you can manage your documents with confidence, facilitating easier and more secure eSigning.

-

What are the key benefits of using airSlate SignNow with dr0104ep?

Utilizing airSlate SignNow and its dr0104ep feature provides businesses with faster document turnaround times and improved operational efficiency. It empowers teams to focus on their core activities while ensuring that all eSigning processes are streamlined and error-free.

-

Can I integrate dr0104ep with other software?

Yes, airSlate SignNow supports various integrations that allow the dr0104ep feature to work harmoniously with popular business applications. This connectivity ensures that you can incorporate eSigning capabilities into your existing workflows without major disruptions.

-

Is airSlate SignNow suitable for small businesses using dr0104ep?

Absolutely! airSlate SignNow is tailored to meet the needs of small businesses, offering the dr0104ep feature as part of its versatile platform. Its user-friendly interface and cost-effective pricing make it an ideal solution for small teams looking to enhance their document management.

-

What is the onboarding process for airSlate SignNow and dr0104ep?

The onboarding process for airSlate SignNow is straightforward and user-friendly, even for first-time users. With the dr0104ep feature, new customers can access guided tutorials and customer support to facilitate a smooth transition and ensure they maximize the platform's potential.

Get more for Dr0104ep

- Hqp pff 053 100408326 form

- Centum mortgage application doc www3 telus form

- Form ss 4pr rev february espanol solicitud de numero de identificacion patronal ein

- Notice of default form

- Minor behavior tracking form koi educationcom

- D20a form 03 request for setting

- Schedule z additional information required for net metering service

- Vr 308 03 04 qxd form

Find out other Dr0104ep

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF

- How Can I Electronic signature New Mexico Finance & Tax Accounting Word