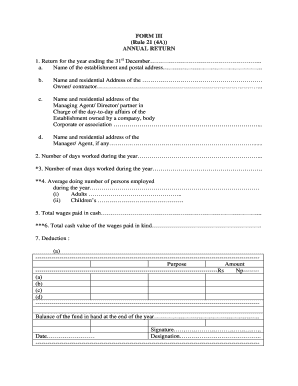

Annual Return Format

What is the annual return format?

The annual return format is a standardized document used by organizations to report their financial activities and status over the preceding year. This form is essential for maintaining compliance with federal and state regulations. It typically includes information about the organization’s income, expenses, assets, and liabilities. Accurate completion of the annual return form III rule 21 4a ensures that the organization meets its legal obligations and provides transparency to stakeholders.

Steps to complete the annual return format

Completing the annual return form III requires careful attention to detail. Here are the steps to follow:

- Gather all necessary financial documents, including income statements, balance sheets, and tax returns.

- Review the specific requirements for the annual return form III rule 21 4a to ensure compliance with applicable laws.

- Fill out the form accurately, providing all required information in the designated sections.

- Double-check all entries for accuracy and completeness before submission.

- Sign the form electronically using a secure eSignature solution to ensure it is legally binding.

Legal use of the annual return format

The annual return format is legally recognized when completed and submitted in accordance with relevant laws. To ensure its legal validity, organizations must adhere to the requirements set forth by the Electronic Signatures in Global and National Commerce Act (ESIGN) and the Uniform Electronic Transactions Act (UETA). Utilizing a reliable eSignature platform can help organizations maintain compliance and ensure that their submissions are accepted by regulatory bodies.

Filing deadlines / important dates

Filing deadlines for the annual return form III can vary based on the organization’s fiscal year and state regulations. It is crucial to be aware of these deadlines to avoid penalties. Typically, organizations must submit their annual returns within a specific timeframe after the end of their fiscal year. Keeping a calendar of important dates can help ensure timely filing and compliance with all requirements.

Required documents

When completing the annual return form III, several documents are typically required. These may include:

- Financial statements, including income and cash flow statements.

- Tax returns for the previous year.

- Records of any significant changes in ownership or structure.

- Supporting documentation for any deductions or credits claimed.

Having these documents ready will facilitate a smoother completion process and ensure that the information provided is accurate.

Form submission methods

The annual return form III can be submitted through various methods, including online, by mail, or in person. Online submission is often the most efficient and secure method, allowing for immediate processing and confirmation of receipt. Mail submissions should be sent with sufficient time to meet deadlines, while in-person submissions may be required for certain organizations or jurisdictions. Choosing the right method depends on the organization's needs and compliance requirements.

Quick guide on how to complete annual return format

Complete Annual Return Format effortlessly on any device

Managing documents online has gained popularity among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed papers, allowing you to find the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents promptly without any delays. Handle Annual Return Format across any platform with airSlate SignNow Android or iOS applications and streamline any document-related process today.

The easiest way to edit and electronically sign Annual Return Format with ease

- Find Annual Return Format and click on Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Highlight important sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to deliver your form, via email, text (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or errors necessitating the printing of new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Edit and electronically sign Annual Return Format and guarantee excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the annual return format

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the annual return form iii rule 21 4a?

The annual return form iii rule 21 4a is a specific document required for regulatory compliance. It provides essential information regarding your business’s financial status and operational details. Ensuring that this form is accurately completed can help avoid penalties and maintain good standing.

-

How can airSlate SignNow assist with the annual return form iii rule 21 4a?

airSlate SignNow simplifies the process of completing the annual return form iii rule 21 4a by allowing users to electronically sign and manage documents. Our platform enhances collaboration, making it easy to gather necessary signatures and information. This streamlined approach can save your business time and resources while ensuring compliance.

-

Is there a cost associated with using airSlate SignNow for the annual return form iii rule 21 4a?

Yes, airSlate SignNow offers various pricing plans tailored to meet different business needs. These plans include features for handling the annual return form iii rule 21 4a and other essential document management tasks. You can choose a plan based on your volume of documents and required features.

-

What features does airSlate SignNow offer for managing the annual return form iii rule 21 4a?

airSlate SignNow provides features such as customizable templates, electronic signatures, and real-time tracking for the annual return form iii rule 21 4a. These tools enhance efficiency and accuracy in document handling. You can also integrate with existing software to streamline your workflow further.

-

Are there integrations available for the annual return form iii rule 21 4a with other tools?

Absolutely! airSlate SignNow offers integrations with popular applications and CRM systems to facilitate the management of the annual return form iii rule 21 4a. These integrations allow seamless data sharing and can enhance your overall business processes, saving you time and reducing manual errors.

-

How does airSlate SignNow ensure the security of the annual return form iii rule 21 4a?

Security is a top priority for airSlate SignNow. We implement robust security measures, including data encryption and secure cloud storage, to protect your annual return form iii rule 21 4a. Our platform complies with industry standards to ensure your sensitive information remains confidential and secure.

-

Can airSlate SignNow help with compliance issues related to the annual return form iii rule 21 4a?

Yes, airSlate SignNow offers features that support compliance with the annual return form iii rule 21 4a requirements. By providing easily accessible templates and a systematic way to gather signatures, we help reduce the risk of errors that could lead to compliance issues. Our platform keeps your documentation organized and accessible for audits.

Get more for Annual Return Format

- Commercial sublease louisiana form

- Petition for divorce la cc art 102 with adult children louisiana form

- Louisiana lease 497309178 form

- Louisiana 103 form

- Louisiana property settlement 497309180 form

- Notice to lessor exercising option to purchase louisiana form

- La civil code form

- Louisiana civil code article 103 form

Find out other Annual Return Format

- Electronic signature Kansas Real Estate Residential Lease Agreement Simple

- How Can I Electronic signature North Carolina Plumbing Promissory Note Template

- Electronic signature North Dakota Plumbing Emergency Contact Form Mobile

- Electronic signature North Dakota Plumbing Emergency Contact Form Easy

- Electronic signature Rhode Island Plumbing Business Plan Template Later

- Electronic signature Louisiana Real Estate Quitclaim Deed Now

- Electronic signature Louisiana Real Estate Quitclaim Deed Secure

- How Can I Electronic signature South Dakota Plumbing Emergency Contact Form

- Electronic signature South Dakota Plumbing Emergency Contact Form Myself

- Electronic signature Maryland Real Estate LLC Operating Agreement Free

- Electronic signature Texas Plumbing Quitclaim Deed Secure

- Electronic signature Utah Plumbing Last Will And Testament Free

- Electronic signature Washington Plumbing Business Plan Template Safe

- Can I Electronic signature Vermont Plumbing Affidavit Of Heirship

- Electronic signature Michigan Real Estate LLC Operating Agreement Easy

- Electronic signature West Virginia Plumbing Memorandum Of Understanding Simple

- Electronic signature Sports PDF Alaska Fast

- Electronic signature Mississippi Real Estate Contract Online

- Can I Electronic signature Missouri Real Estate Quitclaim Deed

- Electronic signature Arkansas Sports LLC Operating Agreement Myself