Tax Exempt Form Va

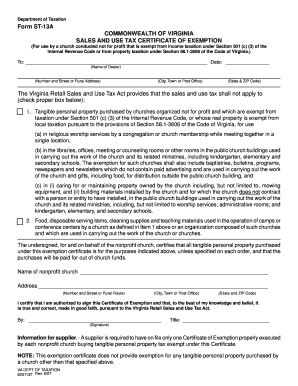

What is the Tax Exempt Form VA

The Tax Exempt Form VA is an official document used in the state of Virginia to claim exemption from sales tax. This form is essential for organizations that qualify as tax-exempt entities, such as non-profit organizations, charities, and certain government entities. By submitting this form, eligible organizations can purchase goods and services without incurring sales tax, thereby maximizing their resources for their intended purposes.

How to Obtain the Tax Exempt Form VA

To obtain the Tax Exempt Form VA, organizations can visit the Virginia Department of Taxation's official website. The form is typically available for download in a PDF format. Additionally, organizations may request a physical copy by contacting the department directly. It is important to ensure that the form is the most current version to meet all legal requirements.

Steps to Complete the Tax Exempt Form VA

Completing the Tax Exempt Form VA involves several key steps:

- Gather necessary information, including the organization's legal name, address, and federal tax identification number.

- Indicate the type of organization and the reason for the tax exemption.

- Provide details about the specific purchases that will be tax-exempt.

- Ensure that all information is accurate and complete before submission.

Once completed, the form should be signed by an authorized representative of the organization.

Legal Use of the Tax Exempt Form VA

The Tax Exempt Form VA is legally binding when used correctly. Organizations must ensure they meet the eligibility criteria for tax exemption as outlined by the Virginia Department of Taxation. Misuse of the form, such as using it for personal purchases or for ineligible items, can result in penalties. It is crucial for organizations to maintain compliance with state regulations to uphold their tax-exempt status.

Key Elements of the Tax Exempt Form VA

Key elements of the Tax Exempt Form VA include:

- Organization Information: Legal name, address, and contact details.

- Tax Identification Number: The federal tax ID number assigned to the organization.

- Exemption Reason: A clear statement of why the organization qualifies for tax-exempt status.

- Authorized Signature: The form must be signed by an individual with the authority to bind the organization.

Examples of Using the Tax Exempt Form VA

Organizations can use the Tax Exempt Form VA in various scenarios, such as:

- Purchasing office supplies for a non-profit organization.

- Acquiring materials for community service projects.

- Buying equipment for educational programs run by a tax-exempt entity.

Each of these examples illustrates how the form can help organizations allocate funds more effectively by reducing unnecessary tax expenses.

Quick guide on how to complete tax exempt form va

Effortlessly Prepare Tax Exempt Form Va on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as a perfect environmentally friendly alternative to conventional printed and signed paperwork, allowing you to find the right template and securely keep it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly and without delay. Manage Tax Exempt Form Va on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to Modify and Electronically Sign Tax Exempt Form Va with Ease

- Find Tax Exempt Form Va and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or mask sensitive information using tools provided uniquely by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information carefully and click the Done button to save your modifications.

- Select how you wish to share your form, whether via email, text message (SMS), an invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form hunting, or errors that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choosing. Edit and electronically sign Tax Exempt Form Va and ensure excellent communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tax exempt form va

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a tax exempt form va?

A tax exempt form va is a document used in Virginia to signNow that certain purchases are exempt from sales tax. This form is essential for organizations that qualify for tax exemption, such as nonprofits and government entities. By utilizing the tax exempt form va, eligible businesses can save on costs associated with taxable purchases.

-

How can I obtain a tax exempt form va?

To obtain a tax exempt form va, you can visit the Virginia Department of Taxation's official website or contact them directly. They provide downloadable versions of the form, which you can fill out and submit. Additionally, many eSignature solutions, like airSlate SignNow, simplify the process by allowing you to complete and send the tax exempt form va electronically.

-

Is there a fee for using airSlate SignNow to submit the tax exempt form va?

airSlate SignNow offers a cost-effective solution for eSigning documents, including the tax exempt form va. While there is a subscription fee for using the platform, many find the benefits outweigh the costs due to enhanced efficiency and ease of use. Current pricing plans can be reviewed on our website for more information.

-

What features does airSlate SignNow provide for processing the tax exempt form va?

airSlate SignNow provides an intuitive interface for creating, sending, and signing the tax exempt form va. Features include customizable templates, real-time tracking of documents, and secure storage options. These capabilities streamline the eSigning process, ensuring your tax exempt form va can be completed quickly and effectively.

-

Can airSlate SignNow integrate with other systems for managing the tax exempt form va?

Yes, airSlate SignNow integrates seamlessly with various business systems and applications, making it easy to manage the tax exempt form va alongside other documents. Integrations with platforms like Google Drive, Dropbox, and CRMs ensure that your workflow remains efficient. This capability allows for a hassle-free process when handling tax-exempt documentation.

-

What are the benefits of using airSlate SignNow for the tax exempt form va?

Using airSlate SignNow for the tax exempt form va offers numerous benefits, including increased turnaround time for document processing and enhanced security for sensitive information. Additionally, the platform's user-friendly design allows even those with minimal technical skills to utilize its features. Overall, it simplifies the management of your tax exempt needs.

-

Are there any templates available for the tax exempt form va in airSlate SignNow?

airSlate SignNow provides a range of templates for the tax exempt form va that can be customized to meet your specific needs. These templates help you save time and reduce errors by ensuring all necessary fields are included. Users can easily access and modify these templates within the platform.

Get more for Tax Exempt Form Va

- Simpsite form

- End user declaration letter 412843619 form

- Sample request form w 9 legacy oca

- Residents canyon lake ca city of canyon lake form

- Medical report omers total disability benefits form 147

- Form w 2gu guam wage and tax statement

- Ca dmv license renewal form pdf fill out ampamp sign online

- Transfer authorization for registered investments hsbc canada form

Find out other Tax Exempt Form Va

- Electronic signature Nebraska Finance & Tax Accounting Business Plan Template Online

- Electronic signature Utah Government Resignation Letter Online

- Electronic signature Nebraska Finance & Tax Accounting Promissory Note Template Online

- Electronic signature Utah Government Quitclaim Deed Online

- Electronic signature Utah Government POA Online

- How To Electronic signature New Jersey Education Permission Slip

- Can I Electronic signature New York Education Medical History

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed

- Electronic signature Oregon Finance & Tax Accounting Lease Agreement Online

- Electronic signature Delaware Healthcare / Medical Limited Power Of Attorney Free

- Electronic signature Finance & Tax Accounting Word South Carolina Later

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney

- Electronic signature Maine Healthcare / Medical Letter Of Intent Fast

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease