51a270 Form

What is the 51a270

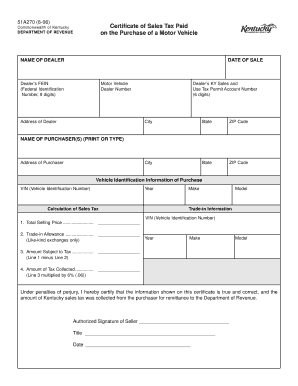

The 51a270 is a specific fillable form used in Kentucky, primarily for tax purposes. This form is essential for individuals and businesses to report certain financial information to the state revenue department. It is designed to streamline the process of submitting tax-related data, ensuring compliance with state regulations. Understanding the purpose and requirements of the 51a270 is crucial for accurate and timely filing.

How to use the 51a270

Using the 51a270 involves several straightforward steps. First, ensure you have the correct version of the form, which can be obtained from the Kentucky Department of Revenue's website or through authorized sources. Next, gather all necessary financial documents and information required to complete the form accurately. Once you have the form, fill it out carefully, ensuring all fields are completed as required. Finally, review the form for accuracy before submitting it to the appropriate state agency.

Steps to complete the 51a270

Completing the 51a270 involves a series of organized steps:

- Download the fillable 51a270 form from an official source.

- Gather all relevant financial documents, such as income statements and previous tax returns.

- Fill in your personal information, including your name, address, and Social Security number.

- Provide detailed financial information as required by the form.

- Review all entries for accuracy and completeness.

- Sign and date the form electronically if using a digital platform.

- Submit the completed form via the designated method, whether online, by mail, or in person.

Legal use of the 51a270

The legal use of the 51a270 is governed by Kentucky state tax laws. To ensure that the form is considered valid, it must be completed accurately and submitted within the specified deadlines. The form serves as a legal document that can be used in tax assessments and audits. Therefore, it is important to follow all instructions and maintain compliance with relevant regulations to avoid potential penalties.

Key elements of the 51a270

The 51a270 includes several key elements that must be addressed for proper completion:

- Personal Information: This includes the taxpayer's name, address, and identification number.

- Financial Data: Accurate reporting of income, deductions, and credits is essential.

- Signature: A valid signature, either electronic or handwritten, is required to authenticate the form.

- Submission Date: The date of submission must be clearly indicated to ensure compliance with filing deadlines.

Form Submission Methods

The 51a270 can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online Submission: Utilizing a secure digital platform for immediate processing.

- Mail: Sending a printed version of the form to the appropriate state agency address.

- In-Person: Delivering the completed form directly to a local tax office.

Quick guide on how to complete 51a270

Complete 51a270 with ease on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow equips you with all the resources needed to create, edit, and electronically sign your documents quickly and without delays. Manage 51a270 on any device using airSlate SignNow's Android or iOS applications and streamline your document-related processes today.

How to edit and electronically sign 51a270 effortlessly

- Obtain 51a270 and click Get Form to begin.

- Use the tools we offer to complete your document.

- Highlight pertinent sections of the documents or redact sensitive information using tools that airSlate SignNow specifically offers for that purpose.

- Create your signature with the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow takes care of all your document management needs with just a few clicks from any device you prefer. Edit and electronically sign 51a270 and ensure effective communication throughout the entire document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 51a270

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 51a270 feature in airSlate SignNow?

The 51a270 feature in airSlate SignNow allows users to streamline their document signing processes with efficient workflow automation. This feature enhances the user experience by making it easy to create, send, and manage documents from a single platform. By implementing 51a270, businesses can signNowly reduce turnaround times and improve their productivity.

-

How much does airSlate SignNow cost if I want to use the 51a270 capabilities?

The pricing for airSlate SignNow varies based on the plan you choose, but all tiers unlock the powerful 51a270 features. Typically, users can expect a subscription that provides great value and integrates well into existing workflows. For specific pricing information tailored to your needs, visit our pricing page or contact our sales team.

-

What are the main benefits of using the 51a270 feature in airSlate SignNow?

Utilizing the 51a270 feature in airSlate SignNow brings numerous benefits, including efficient document management and faster signing processes. This feature is designed to minimize manual work and reduce errors, allowing teams to focus on their core tasks. Additionally, it enhances compliance and security for sensitive documents.

-

Can I integrate 51a270 with other tools and platforms?

Yes, airSlate SignNow supports a wide array of integrations, enhancing the functionality of the 51a270 feature. Users can connect with popular applications such as Google Drive, Salesforce, and Zapier, ensuring seamless workflows across different tools. These integrations enable you to maximize the value of the 51a270 capabilities tailored to your business needs.

-

Is airSlate SignNow secure when using the 51a270 functionality?

Absolutely, airSlate SignNow prioritizes security and compliance, especially with the use of the 51a270 functionality. The platform uses state-of-the-art encryption and complies with major regulations, such as GDPR and HIPAA. This ensures that your documents remain secure while leveraging the efficiency of the 51a270 feature.

-

How can I get started with using 51a270 in airSlate SignNow?

Getting started with the 51a270 feature in airSlate SignNow is simple. You can sign up for a free trial, explore the intuitive interface, and take advantage of online resources and tutorials. Our customer support team is also available to assist you as you implement the 51a270 capabilities into your document signing process.

-

Does the 51a270 feature cater to businesses of all sizes?

Yes, the 51a270 feature in airSlate SignNow is designed to accommodate businesses of all sizes, from small startups to large enterprises. The flexibility and scalability of the platform allow it to adapt to various organizational needs and workflows. This makes 51a270 an ideal solution for anyone looking to enhance their document management process.

Get more for 51a270

- Www jtltraining comwp contentuploadscolour vision certificate jtl form

- Kyneton district horse and pony club inc form

- Anm cognitive decline request form

- Medical certificate for maternity benefit social w form

- Rf111 form 622920837

- Canada plan care child form

- Hong kong ird specimen ir56g form

- Ca tax return 618853393 form

Find out other 51a270

- Can I eSign Michigan Business Operations POA

- eSign Car Dealer PDF South Dakota Computer

- eSign Car Dealer PDF South Dakota Later

- eSign Rhode Island Car Dealer Moving Checklist Simple

- eSign Tennessee Car Dealer Lease Agreement Form Now

- Sign Pennsylvania Courts Quitclaim Deed Mobile

- eSign Washington Car Dealer Bill Of Lading Mobile

- eSign Wisconsin Car Dealer Resignation Letter Myself

- eSign Wisconsin Car Dealer Warranty Deed Safe

- eSign Business Operations PPT New Hampshire Safe

- Sign Rhode Island Courts Warranty Deed Online

- Sign Tennessee Courts Residential Lease Agreement Online

- How Do I eSign Arkansas Charity LLC Operating Agreement

- eSign Colorado Charity LLC Operating Agreement Fast

- eSign Connecticut Charity Living Will Later

- How Can I Sign West Virginia Courts Quitclaim Deed

- Sign Courts Form Wisconsin Easy

- Sign Wyoming Courts LLC Operating Agreement Online

- How To Sign Wyoming Courts Quitclaim Deed

- eSign Vermont Business Operations Executive Summary Template Mobile