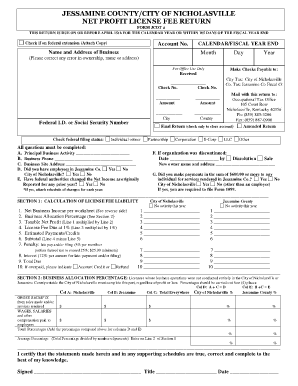

Jessamine County City of Nicholasville Net Profit License Fee Return Form

What is the Jessamine County City Of Nicholasville Net Profit License Fee Return

The Jessamine County City of Nicholasville net profit license fee return is a tax form that businesses operating within the city must complete to report their net profits. This return is essential for determining the amount of license fee owed to the city based on the business's earnings. It is a legal requirement for all businesses, including corporations, partnerships, and sole proprietorships, ensuring compliance with local tax regulations. The form captures various financial details, including gross receipts, allowable deductions, and the resulting net profit, which ultimately influences the license fee calculation.

Steps to Complete the Jessamine County City Of Nicholasville Net Profit License Fee Return

Completing the Jessamine County net profit license fee return involves several key steps:

- Gather financial records, including income statements and expense reports.

- Calculate total gross receipts for the reporting period.

- Identify and document allowable deductions, such as operating expenses.

- Determine the net profit by subtracting total deductions from gross receipts.

- Fill out the return form with the calculated figures, ensuring accuracy.

- Review the completed form for any errors or omissions.

- Submit the form by the designated deadline, either online or via mail.

Legal Use of the Jessamine County City Of Nicholasville Net Profit License Fee Return

The Jessamine County net profit license fee return serves as a legally binding document when completed accurately and submitted on time. For it to be valid, businesses must comply with all relevant tax laws and regulations. The return must include appropriate signatures and be filed within the deadlines established by the city. Failure to adhere to these legal requirements can result in penalties or fines, emphasizing the importance of proper completion and submission.

Required Documents for the Jessamine County City Of Nicholasville Net Profit License Fee Return

When preparing to file the Jessamine County net profit license fee return, certain documents are necessary to ensure accurate reporting. These documents typically include:

- Income statements detailing total revenue.

- Expense reports outlining allowable deductions.

- Previous tax returns for reference.

- Any supporting documentation for claimed deductions, such as receipts or invoices.

Having these documents ready will facilitate a smoother filing process and help maintain compliance with local tax laws.

Filing Deadlines / Important Dates

It is crucial for businesses to be aware of the filing deadlines for the Jessamine County net profit license fee return. Typically, the return is due annually, and the specific date may vary based on the business's fiscal year. Missing the deadline can lead to penalties and interest on unpaid fees. Businesses should mark their calendars and prepare their returns ahead of time to avoid last-minute issues.

Form Submission Methods

The Jessamine County City of Nicholasville net profit license fee return can be submitted through various methods to accommodate different preferences:

- Online submission via the designated city portal, which offers a streamlined process.

- Mailing a hard copy of the completed return to the appropriate city office.

- In-person submission at the local government office for direct assistance.

Choosing the right submission method can enhance the efficiency of the filing process and ensure timely compliance.

Quick guide on how to complete jessamine county city of nicholasville net profit license fee return

Complete Jessamine County City Of Nicholasville Net Profit License Fee Return seamlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow provides you with all the tools you need to create, edit, and eSign your documents swiftly and without delays. Manage Jessamine County City Of Nicholasville Net Profit License Fee Return on any device using airSlate SignNow's Android or iOS applications and streamline any document-related tasks today.

The easiest method to edit and eSign Jessamine County City Of Nicholasville Net Profit License Fee Return effortlessly

- Obtain Jessamine County City Of Nicholasville Net Profit License Fee Return and click Get Form to begin.

- Use the tools we provide to complete your document.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Create your eSignature with the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you would like to share your form, via email, text message (SMS), invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or mistakes requiring new document printouts. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you select. Edit and eSign Jessamine County City Of Nicholasville Net Profit License Fee Return and ensure superior communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the jessamine county city of nicholasville net profit license fee return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the jessamine county net profit license fee return?

The jessamine county net profit license fee return is a tax return required by businesses operating in Jessamine County, Kentucky. It helps the county assess the net profit for the purpose of calculating local business fees. Ensuring timely and accurate submission is crucial for compliance and avoiding penalties.

-

How can airSlate SignNow assist with the jessamine county net profit license fee return?

airSlate SignNow simplifies the process of preparing and submitting the jessamine county net profit license fee return. With our electronic signature capabilities, you can easily sign and send documents online, ensuring they are ready for submission. This streamlines your workflow and keeps everything organized.

-

Is there a cost associated with using airSlate SignNow for a jessamine county net profit license fee return?

Yes, while airSlate SignNow offers a cost-effective solution for document management, pricing may vary based on your business needs. We provide various subscription plans to suit different scales of use, ensuring that filing your jessamine county net profit license fee return is both affordable and efficient.

-

What features does airSlate SignNow offer to simplify the jessamine county net profit license fee return process?

airSlate SignNow comes equipped with features like document templates, automated reminders, and secure cloud storage to make the jessamine county net profit license fee return process hassle-free. These tools enhance productivity and collaboration, allowing businesses to focus on growth instead of paperwork.

-

Are there any integrations available with airSlate SignNow for managing the jessamine county net profit license fee return?

Absolutely! airSlate SignNow integrates seamlessly with popular accounting software and other tools to streamline managing your jessamine county net profit license fee return. This ensures that your financial data and documents are synchronized and accessible, making the filing process smoother.

-

How can I ensure compliance when filing the jessamine county net profit license fee return using airSlate SignNow?

Using airSlate SignNow helps ensure compliance by providing templates that align with local regulations for the jessamine county net profit license fee return. Additionally, our secure e-signature feature can help document proof of filing, minimizing the risk of late submissions.

-

What benefits can businesses expect from using airSlate SignNow for the jessamine county net profit license fee return?

Businesses can expect enhanced efficiency, reduced errors, and improved organization when using airSlate SignNow for the jessamine county net profit license fee return. Our platform enables faster processing times and ensures that all necessary signatures are gathered, simplifying the overall experience.

Get more for Jessamine County City Of Nicholasville Net Profit License Fee Return

- Unum cl 1061 form

- Bemployee warning noticeb toolscirastatetxus form

- Condominium sale prohibition covenant washington form

- Abc thought log form

- Form ct 222 underpayment of estimated tax by a corporation tax year 772083723

- Agricultural production contract template form

- Financial loan contract template form

- Finders fee contract template form

Find out other Jessamine County City Of Nicholasville Net Profit License Fee Return

- Help Me With eSignature Florida Courts Affidavit Of Heirship

- Electronic signature Alabama Banking RFP Online

- eSignature Iowa Courts Quitclaim Deed Now

- eSignature Kentucky Courts Moving Checklist Online

- eSignature Louisiana Courts Cease And Desist Letter Online

- How Can I Electronic signature Arkansas Banking Lease Termination Letter

- eSignature Maryland Courts Rental Application Now

- eSignature Michigan Courts Affidavit Of Heirship Simple

- eSignature Courts Word Mississippi Later

- eSignature Tennessee Sports Last Will And Testament Mobile

- How Can I eSignature Nevada Courts Medical History

- eSignature Nebraska Courts Lease Agreement Online

- eSignature Nebraska Courts LLC Operating Agreement Easy

- Can I eSignature New Mexico Courts Business Letter Template

- eSignature New Mexico Courts Lease Agreement Template Mobile

- eSignature Courts Word Oregon Secure

- Electronic signature Indiana Banking Contract Safe

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe