Bir Form

What is the Bir Form

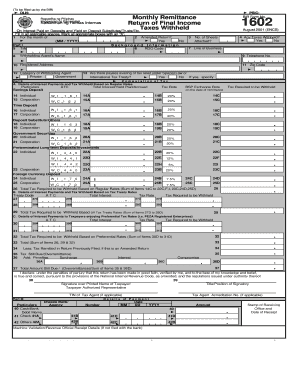

The Bir Form, specifically the 1602 bir form, is a crucial document used for various tax-related purposes in the United States. It is primarily utilized by businesses and individuals to report specific income and tax information to the Internal Revenue Service (IRS). Understanding the purpose and requirements of this form is essential for compliance with federal tax regulations.

How to use the Bir Form

Using the bir form involves several steps to ensure accurate completion and submission. First, gather all necessary information, including personal identification details and financial data relevant to the reporting period. Next, fill out the form carefully, ensuring that all entries are accurate and complete. Once filled, the form can be submitted electronically or via mail, depending on the preferences and requirements of the filing entity.

Steps to complete the Bir Form

Completing the bir form requires a systematic approach to avoid errors. Follow these steps:

- Review the form instructions thoroughly to understand the required information.

- Collect all necessary documents, such as previous tax returns and income statements.

- Fill out the form section by section, ensuring accuracy in all entries.

- Double-check the completed form for any mistakes or omissions.

- Submit the form according to the specified guidelines, either online or by mail.

Legal use of the Bir Form

The legal use of the bir form is governed by federal tax laws, which stipulate that the information provided must be truthful and accurate. Failure to comply with these regulations can lead to penalties or legal repercussions. It is essential to ensure that all data entered is correct and that the form is submitted within the designated timeframes to maintain compliance with IRS requirements.

Key elements of the Bir Form

The bir form includes several key elements that are essential for accurate reporting. These elements typically consist of:

- Taxpayer identification information, such as name and Social Security number.

- Details of income earned during the reporting period.

- Applicable deductions or credits that may reduce taxable income.

- Signature and date to validate the form.

Form Submission Methods

There are multiple methods for submitting the bir form, each with its own advantages. These methods include:

- Online Submission: Many taxpayers prefer to submit the form electronically through authorized platforms, ensuring faster processing.

- Mail Submission: Alternatively, the form can be printed and sent via postal mail to the appropriate IRS address.

- In-Person Submission: Some individuals may choose to deliver the form in person at local IRS offices, allowing for immediate confirmation of receipt.

Filing Deadlines / Important Dates

Filing deadlines for the bir form are critical to ensure compliance and avoid penalties. Typically, the form must be submitted by April 15 of the following tax year. However, specific circumstances, such as extensions, may alter these deadlines. It is advisable to keep track of important dates and ensure timely submission to avoid complications.

Quick guide on how to complete bir form

Complete Bir Form effortlessly on any device

Online document management has become increasingly favored by companies and individuals alike. It offers a superb eco-friendly substitute for traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents quickly and without delays. Manage Bir Form on any platform with airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The easiest way to edit and eSign Bir Form without hassle

- Obtain Bir Form and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of your documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the information and then click on the Done button to save your changes.

- Choose how you would like to send your form, via email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or errors that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from a device of your choice. Modify and eSign Bir Form and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the bir form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are BIR forms and why are they important?

BIR forms are essential documents used for tax reporting and compliance with the Bureau of Internal Revenue in the Philippines. These forms ensure that businesses accurately report their earnings and fulfill their tax obligations. Utilizing tools like airSlate SignNow can streamline the process of completing and eSigning these BIR forms.

-

How can airSlate SignNow help with BIR forms?

airSlate SignNow offers an intuitive platform that allows users to create, send, and eSign BIR forms easily. With its user-friendly interface, you can efficiently manage your document workflow and ensure compliance with tax regulations. This not only saves time but also minimizes the risk of errors when handling BIR forms.

-

Is airSlate SignNow suitable for businesses of all sizes regarding BIR forms?

Yes, airSlate SignNow is designed to accommodate businesses of all sizes, from startups to large enterprises, when dealing with BIR forms. Its scalable features allow you to adapt the solution as your business grows. Regardless of your organization's size, you can ensure that your BIR forms are managed effectively.

-

What pricing options are available for using airSlate SignNow for BIR forms?

airSlate SignNow offers various pricing plans to fit different business needs, starting from a free trial to more advanced features for a monthly fee. Each plan provides access to the necessary tools to handle BIR forms efficiently. This ensures that you can choose a package that suits your budget and requirements.

-

Can I integrate airSlate SignNow with other software for handling BIR forms?

Absolutely! airSlate SignNow can integrate seamlessly with various software and applications, enhancing your workflow when managing BIR forms. Popular integrations include Google Workspace, Microsoft Office, and various CRM systems, allowing you to streamline document processes further.

-

What security features does airSlate SignNow offer for BIR forms?

airSlate SignNow prioritizes the security of your data, implementing advanced security measures for BIR forms. Features such as encryption, two-factor authentication, and secure cloud storage protect your sensitive information. This ensures that your documents remain confidential and comply with data protection regulations.

-

How can airSlate SignNow improve the efficiency of processing BIR forms?

By using airSlate SignNow, you can signNowly reduce the time spent on processing BIR forms through automation and electronic signing. This speeds up the submission process and reduces manual errors, ensuring that your forms are filled out and submitted correctly on time. Enhanced efficiency leads to more accurate tax reporting.

Get more for Bir Form

- Step 6 final declaration of disclosure kinsey law offices form

- Application for absentee ballot form av r1 mobile county probate probate mobilecountyal

- Form 82

- Oha 45 24 adoption report form oregon gov

- Ontario pc party membership application form

- Avlci form

- Checklist for quarterly report on sec form 10 q center for

- Padi liability release general training atlantic edge dive center form

Find out other Bir Form

- Can I Electronic signature Maryland High Tech RFP

- Electronic signature Vermont Insurance Arbitration Agreement Safe

- Electronic signature Massachusetts High Tech Quitclaim Deed Fast

- Electronic signature Vermont Insurance Limited Power Of Attorney Easy

- Electronic signature Washington Insurance Last Will And Testament Later

- Electronic signature Washington Insurance Last Will And Testament Secure

- Electronic signature Wyoming Insurance LLC Operating Agreement Computer

- How To Electronic signature Missouri High Tech Lease Termination Letter

- Electronic signature Montana High Tech Warranty Deed Mobile

- Electronic signature Florida Lawers Cease And Desist Letter Fast

- Electronic signature Lawers Form Idaho Fast

- Electronic signature Georgia Lawers Rental Lease Agreement Online

- How Do I Electronic signature Indiana Lawers Quitclaim Deed

- How To Electronic signature Maryland Lawers Month To Month Lease

- Electronic signature North Carolina High Tech IOU Fast

- How Do I Electronic signature Michigan Lawers Warranty Deed

- Help Me With Electronic signature Minnesota Lawers Moving Checklist

- Can I Electronic signature Michigan Lawers Last Will And Testament

- Electronic signature Minnesota Lawers Lease Termination Letter Free

- Electronic signature Michigan Lawers Stock Certificate Mobile