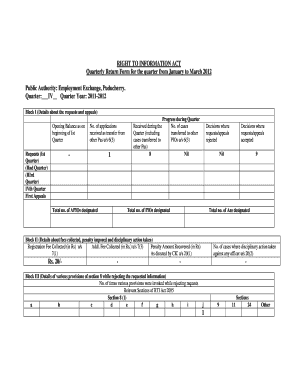

Rti Quarterly Report Format

Understanding the GST R9A Form

The GST R9A form is a crucial document for businesses operating under the Goods and Services Tax (GST) framework. It is primarily used for reporting specific financial information related to GST compliance. This form helps ensure that businesses accurately report their tax obligations, which is essential for maintaining legal compliance in the United States. Understanding the purpose and requirements of the GST R9A form is vital for any business owner or tax professional involved in GST reporting.

Steps to Complete the GST R9A Form

Completing the GST R9A form involves several important steps to ensure accuracy and compliance. Here is a structured approach:

- Gather Required Information: Collect all necessary financial records, including sales and purchase invoices, to ensure complete and accurate reporting.

- Fill Out the Form: Enter the required details in the appropriate sections of the GST R9A form. Pay attention to the specific instructions provided for each field.

- Review for Accuracy: Double-check all entries for accuracy. Mistakes can lead to compliance issues and potential penalties.

- Submit the Form: Once completed, submit the GST R9A form through the designated method, whether online or by mail, as per the guidelines.

Legal Use of the GST R9A Form

The GST R9A form serves a legal purpose within the framework of GST regulations. It is essential for businesses to understand the legal implications of this form. Submitting the GST R9A form accurately helps ensure compliance with federal tax laws. Failure to file or inaccuracies in the form can result in penalties, audits, or other legal repercussions. Therefore, businesses must treat the completion and submission of the GST R9A form with the seriousness it deserves.

Filing Deadlines for the GST R9A Form

Timely filing of the GST R9A form is crucial to avoid penalties. Businesses should be aware of the specific deadlines set by the IRS for submitting this form. Typically, the GST R9A form must be filed quarterly or annually, depending on the business's reporting requirements. It is advisable to mark these deadlines on a calendar to ensure compliance and avoid any last-minute rush that could lead to errors.

Required Documents for the GST R9A Form

To complete the GST R9A form accurately, certain documents are required. These include:

- Sales invoices that detail the GST collected.

- Purchase invoices that demonstrate the GST paid.

- Financial statements that provide an overview of the business's financial health.

- Any previous GST returns filed, if applicable.

Having these documents ready will streamline the process of filling out the GST R9A form and help ensure that all necessary information is included.

Form Submission Methods for the GST R9A

The GST R9A form can be submitted through various methods, depending on the preferences and capabilities of the business. Common submission methods include:

- Online Submission: Many businesses prefer to file electronically, which can expedite processing times and reduce the risk of errors.

- Mail Submission: For those who prefer traditional methods, mailing the completed form is also an option. Ensure that it is sent well before the deadline to account for any postal delays.

Choosing the right submission method can enhance the efficiency of the filing process and ensure compliance with GST regulations.

Quick guide on how to complete rti quarterly report format

Complete Rti Quarterly Report Format effortlessly on any device

Online document management has gained popularity among businesses and individuals. It serves as a perfect environmentally friendly alternative to traditional printed and signed documents, as you can easily locate the necessary form and securely save it online. airSlate SignNow provides all the tools required to create, edit, and eSign your documents swiftly without delays. Handle Rti Quarterly Report Format on any platform using the airSlate SignNow Android or iOS applications and enhance any document-based process today.

How to modify and eSign Rti Quarterly Report Format with ease

- Obtain Rti Quarterly Report Format and then click Get Form to begin.

- Make use of the tools we offer to fill out your document.

- Highlight relevant sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign tool, which only takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the information and then click on the Done button to save your modifications.

- Choose how you'd like to send your form, by email, SMS, or invitation link, or download it to your computer.

Forget lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign Rti Quarterly Report Format and ensure outstanding communication at any step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the rti quarterly report format

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is gst r9a and how does it relate to airSlate SignNow?

The gst r9a refers to a specific regulatory document that can be efficiently processed using airSlate SignNow. Our platform allows users to easily eSign and manage gst r9a documents, ensuring compliance and efficiency in your business operations.

-

How can airSlate SignNow help streamline the preparation of gst r9a documents?

airSlate SignNow offers customizable templates for gst r9a documents, allowing users to quickly prepare and send them for signatures. Our intuitive platform enhances collaboration, reducing the time spent on document creation and approval.

-

What are the pricing options for using airSlate SignNow for gst r9a documents?

airSlate SignNow provides competitive pricing plans that cater to various business needs, including packages designed specifically for handling gst r9a documents. Customers can choose from monthly or annual subscriptions to fit their budget and requirements.

-

Are there any integrations available for managing gst r9a with airSlate SignNow?

Yes, airSlate SignNow integrates seamlessly with various business applications like CRM and document management systems to enhance the handling of gst r9a documents. This allows for automated workflows and easy access to important information.

-

What security features does airSlate SignNow offer for gst r9a documents?

airSlate SignNow prioritizes the security of your gst r9a documents with advanced encryption and compliance with industry standards. We ensure that your documents remain safe and confidential throughout the signing process.

-

Can multiple users collaborate on gst r9a documents through airSlate SignNow?

Absolutely! airSlate SignNow enables multiple users to collaborate on gst r9a documents in real-time. This feature enhances teamwork and ensures that all stakeholders can provide input and sign off without delays.

-

How does airSlate SignNow improve the speed of processing gst r9a documents?

With airSlate SignNow, the process of obtaining signatures for gst r9a documents is signNowly expedited. The electronic signing feature removes the need for physical paperwork, allowing for faster transactions and approvals.

Get more for Rti Quarterly Report Format

- Letter to lienholder to notify of trust minnesota form

- Minnesota timber sale contract minnesota form

- Minnesota forest products timber sale contract minnesota form

- Minnesota easement form

- Minnesota easement form

- Small estate affidavit for estates not more than 75000 minnesota form

- Mn summary form

- Tenant eviction forms

Find out other Rti Quarterly Report Format

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document