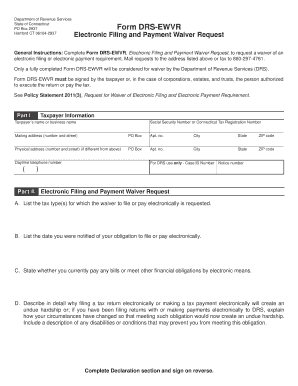

Form Drs Ewvr

What is the Form Drs Ewvr

The form drs ewvr is a specific document used in various administrative contexts, particularly in Connecticut. It serves as a formal request or declaration, often related to property or financial matters. Understanding its purpose is essential for individuals and businesses that need to comply with state regulations. This form is designed to facilitate the collection of necessary information while ensuring that all submissions are legally binding and recognized by relevant authorities.

How to use the Form Drs Ewvr

Using the form drs ewvr requires careful attention to detail. First, gather all relevant information that needs to be included, such as personal identification details and any specific data related to the request. Next, fill out the form accurately, ensuring that all sections are completed. Once filled, it is crucial to review the document for any errors before submission. Utilizing electronic tools can streamline this process, allowing for easier corrections and faster completion.

Steps to complete the Form Drs Ewvr

Completing the form drs ewvr involves several key steps:

- Gather necessary information, including identification and relevant details.

- Access the fillable drs ewvr form through a reliable platform.

- Fill in the required fields accurately, ensuring all information is correct.

- Review the completed form for accuracy and completeness.

- Submit the form electronically or print it for physical submission, depending on the requirements.

Legal use of the Form Drs Ewvr

The legal validity of the form drs ewvr is upheld when it meets specific criteria set forth by state regulations. It must be completed accurately and submitted through the appropriate channels. Adhering to eSignature laws, such as the ESIGN Act and UETA, ensures that electronically signed documents are treated as legally binding. Utilizing a trusted platform for submission can further enhance the form's legitimacy and compliance with legal standards.

State-specific rules for the Form Drs Ewvr

Each state may have unique regulations governing the use of the form drs ewvr. In Connecticut, it is essential to understand local laws and requirements that dictate how the form should be filled out and submitted. This includes any specific documentation that may need to accompany the form and deadlines for submission. Familiarizing oneself with these rules can prevent delays and ensure compliance with state laws.

Examples of using the Form Drs Ewvr

The form drs ewvr can be utilized in various scenarios, such as:

- Requesting a property tax exemption.

- Filing for financial assistance or grants.

- Submitting documentation for regulatory compliance in business operations.

Each example highlights the form's versatility and importance in facilitating essential administrative processes.

Quick guide on how to complete form drs ewvr

Execute Form Drs Ewvr effortlessly on any gadget

Digital document management has gained signNow traction with businesses and individuals alike. It offers an ideal eco-conscious alternative to conventional printed and signed materials, allowing you to locate the right form and securely preserve it online. airSlate SignNow equips you with all the necessary tools to draft, modify, and electronically sign your documents promptly without delays. Handle Form Drs Ewvr on any gadget with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest method to modify and electronically sign Form Drs Ewvr effortlessly

- Find Form Drs Ewvr and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive information using tools that airSlate SignNow specifically provides for this purpose.

- Generate your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and then click on the Done button to save your changes.

- Choose how you wish to send your form: via email, text message (SMS), invitation link, or download it to your computer.

Put aside concerns about lost or mislaid files, tedious form searching, or errors that necessitate reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your preference. Edit and electronically sign Form Drs Ewvr and guarantee excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form drs ewvr

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is 'form drs ewvr' and how does it relate to airSlate SignNow?

'form drs ewvr' is a specific document template that can be created and managed using airSlate SignNow. It allows users to efficiently fill out and eSign necessary documents, streamlining workflow and enhancing productivity.

-

How much does it cost to use airSlate SignNow for 'form drs ewvr'?

airSlate SignNow offers flexible pricing plans, making it cost-effective for businesses of all sizes to utilize 'form drs ewvr.' Pricing options vary based on features and user counts, ensuring you can choose a plan that fits your budget.

-

What features does airSlate SignNow provide for 'form drs ewvr'?

airSlate SignNow offers a variety of features for 'form drs ewvr,' including document templates, real-time tracking, and secure eSigning. These tools enable users to manage and automate their document processes efficiently.

-

Can 'form drs ewvr' be integrated with other applications?

Yes, 'form drs ewvr' can be easily integrated with many popular applications such as CRM and cloud storage services. This integration ensures that your document workflow remains seamless and enhances overall productivity.

-

What are the benefits of using airSlate SignNow for 'form drs ewvr'?

Using airSlate SignNow for 'form drs ewvr' provides businesses with faster turnaround times and improved document accuracy. The platform enhances collaboration among team members and clients, ultimately leading to more efficient workflows.

-

Is there a mobile app available for managing 'form drs ewvr'?

Yes, airSlate SignNow offers a mobile app that allows users to manage 'form drs ewvr' on-the-go. This feature ensures that you can access, fill, and eSign documents from any location, ensuring flexibility and convenience.

-

How can I get support for 'form drs ewvr' on airSlate SignNow?

If you need support for 'form drs ewvr,' airSlate SignNow provides a comprehensive help center and customer service team. You can access tutorials, FAQs, and signNow out to support for personalized assistance as needed.

Get more for Form Drs Ewvr

- Onlinebanking belizebank com form

- Warenbegleitschein herbert waldmann gmbh amp co kg form

- Plan financial budget sexy staci taurus sho sporting goods store in form

- Balancing act science spot form

- Child travelling alone legal form for ages 16 cisv

- Internet banking enrolment form brac bank

- E payment facility form 27 3 17ai takaful malaysia

- Rapid resorbable fixation implants inventory control form synthes

Find out other Form Drs Ewvr

- How Can I Sign Michigan Personal Leave Policy

- Sign South Carolina Pregnancy Leave Policy Safe

- How To Sign South Carolina Time Off Policy

- How To Sign Iowa Christmas Bonus Letter

- How To Sign Nevada Christmas Bonus Letter

- Sign New Jersey Promotion Announcement Simple

- Sign Louisiana Company Bonus Letter Safe

- How To Sign Delaware Letter of Appreciation to Employee

- How To Sign Florida Letter of Appreciation to Employee

- How Do I Sign New Jersey Letter of Appreciation to Employee

- How Do I Sign Delaware Direct Deposit Enrollment Form

- How To Sign Alabama Employee Emergency Notification Form

- How To Sign Oklahoma Direct Deposit Enrollment Form

- Sign Wyoming Direct Deposit Enrollment Form Online

- Sign Nebraska Employee Suggestion Form Now

- How Can I Sign New Jersey Employee Suggestion Form

- Can I Sign New York Employee Suggestion Form

- Sign Michigan Overtime Authorization Form Mobile

- How To Sign Alabama Payroll Deduction Authorization

- How To Sign California Payroll Deduction Authorization