Form 8840 Instructions

What is the Form 8840 Instructions

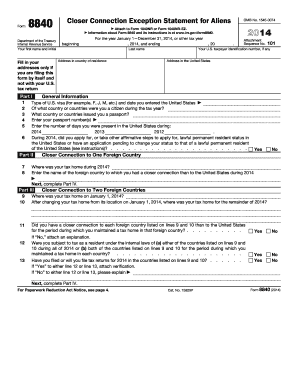

The Form 8840 instructions are essential guidelines for individuals who are seeking to claim a closer connection exception to the substantial presence test for U.S. tax purposes. This form is primarily used by non-resident aliens who wish to establish that they meet the requirements to be considered a non-resident for tax purposes, despite spending significant time in the United States. Understanding these instructions is crucial for ensuring compliance with IRS regulations and for avoiding potential tax liabilities.

Steps to complete the Form 8840 Instructions

Completing the Form 8840 involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including details about your residency status and the days spent in the U.S. Next, fill out the form by providing personal information, including your name, address, and taxpayer identification number. It's important to carefully follow the instructions for each section, ensuring that all required fields are completed. After filling out the form, review it for accuracy before submitting it to the IRS.

How to obtain the Form 8840 Instructions

The Form 8840 instructions can be easily obtained from the IRS website. They are available in PDF format, which allows for easy downloading and printing. Additionally, you can request a physical copy by contacting the IRS directly. Ensure that you have the most current version of the instructions, as tax regulations can change, affecting how the form should be completed.

Legal use of the Form 8840 Instructions

Understanding the legal use of the Form 8840 instructions is critical for compliance with U.S. tax laws. The form serves as a declaration of your status as a non-resident alien and must be filed correctly to avoid penalties. It is important to adhere to the guidelines provided in the instructions, as any errors or omissions could lead to complications with the IRS. Moreover, maintaining accurate records and documentation to support your claims is advisable.

Filing Deadlines / Important Dates

Filing deadlines for the Form 8840 are crucial for compliance. Generally, the form must be submitted by June 15 of the year following the tax year for which you are claiming the closer connection exception. However, if you are filing for an extension, be aware that the deadlines may vary. It is essential to stay informed about any changes to these dates to ensure timely submission and avoid penalties.

Form Submission Methods (Online / Mail / In-Person)

Submitting the Form 8840 can be done through various methods. While the IRS does not currently accept electronic submissions for this specific form, it can be mailed directly to the appropriate IRS address. Ensure that you use the correct mailing address based on your location and whether you are enclosing a payment. In-person submission is generally not an option for this form, so mailing is the primary method of submission.

Quick guide on how to complete form 8840 instructions

Effortlessly Complete Form 8840 Instructions on Any Device

Managing documents online has gained traction among organizations and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed papers, allowing you to locate the right form and securely archive it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents swiftly without delays. Handle Form 8840 Instructions on any platform with airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

The Easiest Way to Modify and eSign Form 8840 Instructions Seamlessly

- Locate Form 8840 Instructions and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Generate your signature using the Sign tool, which takes moments and has the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form: via email, SMS, an invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your chosen device. Edit and eSign Form 8840 Instructions and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 8840 instructions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the purpose of the form 8840 instructions pdf?

The form 8840 instructions pdf provides detailed guidance on how to accurately complete Form 8840, which is necessary for determining tax residence for foreign individuals in the U.S. By following these instructions, users can ensure compliance with tax laws and avoid potential penalties.

-

How can I access the form 8840 instructions pdf?

You can download the form 8840 instructions pdf directly from the IRS website or through other trusted financial service providers. This document is available for free, making it accessible to anyone who needs assistance with the form.

-

Are there any costs associated with using airSlate SignNow for signing the form 8840?

airSlate SignNow offers a cost-effective solution for eSigning the form 8840 instructions pdf. With flexible pricing plans, you can easily choose a tier that fits your needs, with no hidden fees for document processing or signing.

-

Can I integrate airSlate SignNow with other applications for managing the form 8840?

Yes, airSlate SignNow seamlessly integrates with various applications including cloud storage services and document management systems. This allows you to efficiently manage your form 8840 instructions pdf alongside other important documents in one platform.

-

What are the benefits of using airSlate SignNow for signing the form 8840?

Using airSlate SignNow to sign the form 8840 instructions pdf simplifies the signing process by providing a user-friendly interface and efficient workflows. It enhances security, ensuring your data is protected while also saving time with automated reminders and notifications.

-

Is it easy to complete the form 8840 using your platform?

Absolutely! airSlate SignNow offers tools that make it easy to fill out and sign the form 8840 instructions pdf. With features like text fields and guided prompts, users find the process straightforward even if they're unfamiliar with tax documents.

-

What features does airSlate SignNow provide specifically for tax documents like the form 8840?

airSlate SignNow offers a range of features tailored for tax documents, including customizable templates, audit trails, and secure cloud storage. These features ensure that your form 8840 instructions pdf is completed accurately and stored securely for future reference.

Get more for Form 8840 Instructions

- Demolition permit dem application planning ampamp building form

- Www atlantaga govgovernmentdepartmentsoffice of zoning ampamp developmentatlanta ga form

- Www atlantaga govhomeshowpublisheddocumentcity of atlanta 55 trinity avenue suite 3900 form

- Design environment and construction city of decatur ga form

- Inspection request form atlanta ga

- County of sacramento department of community development building form

- Occupancy statement peachtree mortgage services inc form

- Department of the army ep 500 1 1 u s army corps of form

Find out other Form 8840 Instructions

- Sign Georgia Education Business Plan Template Now

- Sign Louisiana Education Business Plan Template Mobile

- Sign Kansas Education Rental Lease Agreement Easy

- Sign Maine Education Residential Lease Agreement Later

- How To Sign Michigan Education LLC Operating Agreement

- Sign Mississippi Education Business Plan Template Free

- Help Me With Sign Minnesota Education Residential Lease Agreement

- Sign Nevada Education LLC Operating Agreement Now

- Sign New York Education Business Plan Template Free

- Sign Education Form North Carolina Safe

- Sign North Carolina Education Purchase Order Template Safe

- Sign North Dakota Education Promissory Note Template Now

- Help Me With Sign North Carolina Education Lease Template

- Sign Oregon Education Living Will Easy

- How To Sign Texas Education Profit And Loss Statement

- Sign Vermont Education Residential Lease Agreement Secure

- How Can I Sign Washington Education NDA

- Sign Wisconsin Education LLC Operating Agreement Computer

- Sign Alaska Finance & Tax Accounting Purchase Order Template Computer

- Sign Alaska Finance & Tax Accounting Lease Termination Letter Free