Cgls 32 Form

What is the Cgls 32

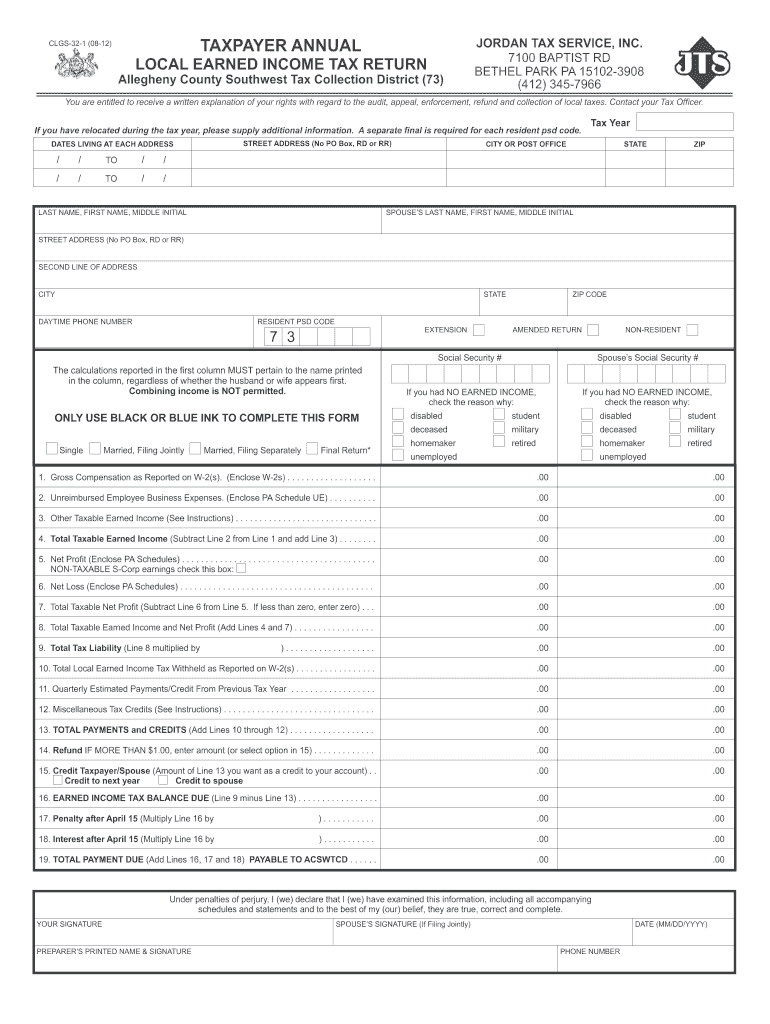

The Cgls 32 is a form used in Pennsylvania for local earned income tax purposes. It serves as a declaration for individuals to report their earned income and determine their tax obligations. This form is essential for residents and non-residents who earn income in Pennsylvania, ensuring compliance with local tax laws. Understanding the Cgls 32 is crucial for accurate tax reporting and avoiding potential penalties.

How to obtain the Cgls 32

To obtain the Cgls 32 form, individuals can visit the official Pennsylvania Department of Revenue website or contact their local tax collector's office. The form is typically available for download in a fillable PDF format, making it convenient for users to complete and submit electronically. Additionally, local tax offices may provide physical copies for those who prefer to fill out the form by hand.

Steps to complete the Cgls 32

Completing the Cgls 32 involves several key steps to ensure accurate reporting of earned income. First, gather all necessary financial documents, including W-2 forms and any other income statements. Next, fill out the personal information section, including your name, address, and Social Security number. Then, report your total earned income and any applicable deductions. Finally, review the completed form for accuracy and submit it to the appropriate local tax authority.

Legal use of the Cgls 32

The Cgls 32 is legally binding when completed accurately and submitted in compliance with local tax regulations. It is important to note that electronic signatures are accepted, provided that the eSignature meets the requirements set forth by the ESIGN Act and UETA. This ensures that the form holds legal weight and can be used for tax assessment and collection purposes.

Key elements of the Cgls 32

Key elements of the Cgls 32 include personal identification information, total earned income, and any deductions or credits applicable to the taxpayer. The form also requires a declaration of residency status, which determines the tax rate applicable to the individual. Properly completing these elements is essential for accurate tax calculation and compliance with local tax laws.

Form Submission Methods

The Cgls 32 can be submitted through various methods, including online submission via the local tax authority's website, mailing a hard copy to the designated office, or delivering it in person. Each submission method may have specific requirements, such as additional documentation or payment of taxes owed. It is advisable to verify the submission guidelines provided by the local tax authority to ensure compliance.

Penalties for Non-Compliance

Failure to file the Cgls 32 or inaccuracies in reporting can result in penalties, including fines and interest on unpaid taxes. Local tax authorities may impose additional fees for late submissions, and persistent non-compliance can lead to more severe consequences, such as legal action or wage garnishment. It is essential for taxpayers to adhere to filing deadlines and ensure the accuracy of their submissions to avoid these penalties.

Quick guide on how to complete cgls 32

Effortlessly Prepare Cgls 32 on Any Device

Digital document management has become increasingly favored by organizations and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed paperwork, allowing you to obtain the necessary form and securely keep it online. airSlate SignNow equips you with all the resources needed to create, modify, and electronically sign your documents swiftly without any hold-ups. Manage Cgls 32 on any platform using the airSlate SignNow applications for Android or iOS and simplify any document-related task today.

How to Modify and eSign Cgls 32 with Ease

- Acquire Cgls 32 and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or redact sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to preserve your alterations.

- Choose how you would like to share your form, via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, and errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Cgls 32 to guarantee excellent communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the cgls 32

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is 'clgs 32 4' and how does it relate to airSlate SignNow?

'clgs 32 4' refers to a specific application of electronic signing standards that airSlate SignNow adheres to. By incorporating clgs 32 4, users can ensure that their electronic signatures are compliant with legal requirements, providing security and reliability in document transactions.

-

What are the pricing options available for airSlate SignNow users interested in clgs 32 4?

airSlate SignNow offers various pricing plans to suit different business needs, including options that support clgs 32 4 compliance. Pricing is based on the number of users and features required, ensuring flexibility for businesses looking to integrate electronic signatures efficiently.

-

What features of airSlate SignNow support the clgs 32 4 standard?

airSlate SignNow includes features that are compliant with clgs 32 4, such as secure digital signatures, audit trails, and easy document storage. These features ensure that the signing process remains efficient and legally defensible, enhancing overall business workflow.

-

How can businesses benefit from using airSlate SignNow with clgs 32 4 compliance?

Using airSlate SignNow with clgs 32 4 compliance offers businesses signNow advantages, including streamlined document management and improved compliance with legal standards. This leads to increased trust from clients and partners while reducing the time spent on paperwork.

-

Can airSlate SignNow integrate with other tools while maintaining clgs 32 4 compliance?

Yes, airSlate SignNow offers integration capabilities with various business tools and platforms while maintaining clgs 32 4 compliance. This flexibility allows businesses to embed eSigning into their existing workflows seamlessly, ensuring they stay compliant without disrupting operations.

-

Is it easy to learn how to use airSlate SignNow for clgs 32 4 requirements?

Absolutely! airSlate SignNow is designed with user-friendliness in mind, making it easy for users to learn how to use the platform effectively for clgs 32 4 requirements. Comprehensive tutorials and customer support are available to assist users at every step of the process.

-

What types of documents can be signed using airSlate SignNow under clgs 32 4?

airSlate SignNow allows a variety of document types to be signed under clgs 32 4, including contracts, agreements, and legal forms. This versatility makes it a great tool for businesses across different industries seeking to streamline their document signing processes.

Get more for Cgls 32

- Illinois institute of technology iit strives to provide its form

- Appeal of 3rd attempt full cost of instruction palm beach state palmbeachstate form

- American legion post 398new york ny harlem one stop form

- Cascentral authentication service buzz form

- Campus mailing addresses will not be accepted form

- Sga president and vice president applications 12 student sga tamucc form

- Requisite challenge form cabrillo

- Fillable online photo and quote release form fax

Find out other Cgls 32

- Sign Indiana Software Development Proposal Template Easy

- Sign South Dakota Working Time Control Form Now

- Sign Hawaii IT Project Proposal Template Online

- Sign Nebraska Operating Agreement Now

- Can I Sign Montana IT Project Proposal Template

- Sign Delaware Software Development Agreement Template Now

- How To Sign Delaware Software Development Agreement Template

- How Can I Sign Illinois Software Development Agreement Template

- Sign Arkansas IT Consulting Agreement Computer

- Can I Sign Arkansas IT Consulting Agreement

- Sign Iowa Agile Software Development Contract Template Free

- How To Sign Oregon IT Consulting Agreement

- Sign Arizona Web Hosting Agreement Easy

- How Can I Sign Arizona Web Hosting Agreement

- Help Me With Sign Alaska Web Hosting Agreement

- Sign Alaska Web Hosting Agreement Easy

- Sign Arkansas Web Hosting Agreement Simple

- Sign Indiana Web Hosting Agreement Online

- Sign Indiana Web Hosting Agreement Easy

- How To Sign Louisiana Web Hosting Agreement