Consumer Credit Application Form PDF

What is the Consumer Credit Application Form PDF

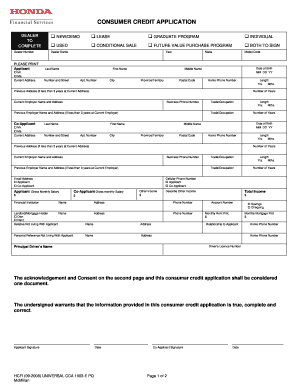

The consumer credit application form PDF is a standardized document used by individuals seeking credit from financial institutions. This form collects essential information about the applicant, including personal details, employment history, income, and credit history. By filling out this form, applicants provide lenders with the necessary data to assess their creditworthiness and determine loan eligibility. The PDF format ensures that the document maintains its structure and can be easily shared and printed, making it accessible for both applicants and lenders.

How to Use the Consumer Credit Application Form PDF

Using the consumer credit application form PDF involves several straightforward steps. First, download the form from a reliable source. Next, open the PDF using a compatible reader, such as Adobe Acrobat Reader. Fill in the required fields with accurate information, ensuring that all sections are completed to avoid delays in processing. Once the form is filled out, review it for accuracy before saving it. Many lenders allow applicants to submit the form electronically, which can expedite the application process. If required, print the completed form for submission by mail or in person.

Steps to Complete the Consumer Credit Application Form PDF

Completing the consumer credit application form PDF requires careful attention to detail. Follow these steps for a smooth process:

- Download the form from a trusted source.

- Open the PDF in a compatible viewer.

- Begin filling in your personal information, including your full name, address, and contact details.

- Provide employment information, including your employer’s name and your job title.

- Detail your income sources and amounts to give lenders a clear picture of your financial situation.

- Review your credit history, including any existing debts or loans.

- Sign and date the form, confirming that all information is accurate.

Key Elements of the Consumer Credit Application Form PDF

The consumer credit application form PDF includes several key elements that are critical for lenders. These elements typically encompass:

- Personal Information: Name, address, and contact details.

- Employment Details: Current employer, job title, and duration of employment.

- Financial Information: Income sources, monthly expenses, and outstanding debts.

- Credit History: Information regarding previous loans and credit accounts.

- Signature: A declaration of the accuracy of the provided information.

Legal Use of the Consumer Credit Application Form PDF

The consumer credit application form PDF is legally binding once it is signed by the applicant. To ensure its legality, the form must comply with federal and state regulations governing consumer credit. This includes adherence to the Equal Credit Opportunity Act (ECOA), which prohibits discrimination in lending. Additionally, lenders must securely store the completed forms to protect applicants' personal information, in accordance with privacy laws such as the Fair Credit Reporting Act (FCRA).

Eligibility Criteria

Eligibility for completing the consumer credit application form PDF typically requires applicants to meet certain criteria. These may include:

- Being at least eighteen years old.

- Having a valid Social Security number or Individual Taxpayer Identification Number.

- Providing proof of income or employment.

- Having a reasonable credit history, though some lenders may consider applicants with limited or poor credit.

Quick guide on how to complete consumer credit application form pdf

Prepare Consumer Credit Application Form Pdf effortlessly on any device

The digital management of documents has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed materials, as you can easily locate the needed form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly, eliminating delays. Manage Consumer Credit Application Form Pdf on any platform through airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The simplest way to modify and electronically sign Consumer Credit Application Form Pdf without breaking a sweat

- Find Consumer Credit Application Form Pdf and click Get Form to start.

- Utilize the tools we offer to fill out your form.

- Highlight relevant sections of the documents or censor sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or mislaid files, tedious form searches, or errors that require printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choosing. Alter and electronically sign Consumer Credit Application Form Pdf and ensure optimal communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the consumer credit application form pdf

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a consumer credit application form PDF?

A consumer credit application form PDF is a standardized document that potential borrowers fill out to request credit from lenders. This form gathers essential information about the applicant's financial status and credit history, allowing lenders to assess the risk involved. Utilizing airSlate SignNow, you can easily create and send these forms for e-signature, streamlining your application process.

-

How does airSlate SignNow help with consumer credit application forms?

airSlate SignNow provides a user-friendly platform that allows businesses to create and manage consumer credit application forms PDF efficiently. With features like customizable templates and e-signature capabilities, you can ensure that the forms are completed quickly and securely. This not only enhances your workflow but also improves customer satisfaction.

-

Is airSlate SignNow secure for handling consumer credit application forms?

Yes, airSlate SignNow employs industry-leading security measures, including encryption and secure storage, to protect your consumer credit application forms PDF. All documents are kept confidential, ensuring that sensitive financial information remains safeguarded. You can trust our platform to securely manage your credit applications.

-

What pricing options does airSlate SignNow offer for businesses?

airSlate SignNow offers flexible pricing plans designed to accommodate businesses of all sizes. Whether you're a small startup or an established enterprise, our plans include various features to help you manage consumer credit application forms PDF effectively. Visit our pricing page to explore the options that best suit your needs.

-

Can I integrate airSlate SignNow with other tools for managing consumer credit applications?

Absolutely! airSlate SignNow seamlessly integrates with a wide range of third-party applications, allowing you to manage your consumer credit application forms PDF alongside your existing tools. Whether you're using CRM systems or financial software, our integrations enhance productivity and improve your overall workflow.

-

What are the benefits of using airSlate SignNow for credit applications?

Using airSlate SignNow for consumer credit application forms PDF offers numerous benefits, including faster processing times and reduced errors. The platform allows for real-time collaboration and tracking, ensuring that all parties stay updated on the application status. This leads to enhanced efficiency and a better experience for both lenders and borrowers.

-

Can I customize consumer credit application form PDFs in airSlate SignNow?

Yes, you can easily customize your consumer credit application form PDFs using airSlate SignNow. The platform offers various templates and editing tools, enabling you to tailor the forms according to your specific requirements. This ensures that your application process aligns with your brand and meets regulatory standards.

Get more for Consumer Credit Application Form Pdf

- Attorney general louisville ky form

- Doc net profits form marion ky

- Pressure piping installation application form

- 800 pm florence government center holiday city of florence florence ky form

- Get business expo vendor application us legal forms

- Kentucky massage therapy license renewal requirements form

- Health morristown new jerseyvital statistics marriage birth ampamp death recordshealth morristown new jerseyvital statistics form

- Zoning bapplicationb residential onlypdf morristown new jersey townofmorristown form

Find out other Consumer Credit Application Form Pdf

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe