Form 2555

What is the Form 2555

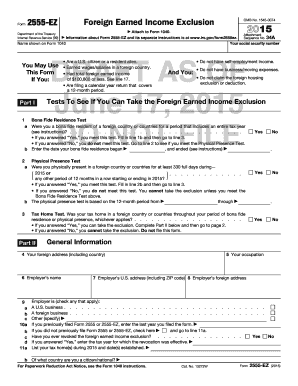

The Form 2555, also known as the Foreign Earned Income Exclusion, is a tax form used by U.S. citizens and resident aliens to exclude a portion of their foreign earnings from U.S. taxation. This form allows eligible taxpayers to claim the foreign earned income exclusion and the foreign housing exclusion or deduction, thereby reducing their taxable income. It is particularly beneficial for individuals living and working abroad, as it helps avoid double taxation on income earned outside the United States.

How to use the Form 2555

To effectively use the Form 2555, taxpayers must first determine their eligibility based on residency and income criteria. Once eligibility is established, the form must be filled out accurately, detailing the foreign earned income and any housing expenses. Taxpayers should ensure they meet the physical presence test or the bona fide residence test to qualify for the exclusions. After completing the form, it should be attached to the taxpayer's annual income tax return, typically Form 1040, when filing with the IRS.

Steps to complete the Form 2555

Completing the Form 2555 involves several key steps:

- Gather necessary documentation, including proof of foreign earned income and housing expenses.

- Determine eligibility by assessing residency status and income levels.

- Fill out the form, providing details such as the amount of foreign earned income and the location of employment.

- Complete the housing exclusion section if applicable, detailing qualified housing expenses.

- Review the form for accuracy and ensure all required signatures are included.

- Attach the completed Form 2555 to your Form 1040 when filing your tax return.

Legal use of the Form 2555

The legal use of Form 2555 is governed by IRS regulations regarding foreign earned income. To ensure compliance, taxpayers must accurately report their foreign income and adhere to the eligibility criteria outlined by the IRS. The form must be submitted in conjunction with the annual tax return, and it is essential to maintain supporting documents that validate the claims made on the form. Failure to comply with these regulations may result in penalties or the disallowance of the exclusions claimed.

Key elements of the Form 2555

Key elements of the Form 2555 include:

- Personal Information: Name, address, and Social Security number of the taxpayer.

- Foreign Earned Income: Total amount of income earned from foreign sources.

- Residency Status: Information regarding the taxpayer's residency status, including the physical presence test or bona fide residence test.

- Housing Exclusion: Details of qualified housing expenses if claiming the housing exclusion.

Filing Deadlines / Important Dates

Taxpayers must be aware of the filing deadlines associated with Form 2555. Generally, the form is due on the same date as the individual's tax return, which is typically April fifteenth. However, taxpayers living abroad may qualify for an automatic extension, allowing them to file by June fifteenth. It is crucial to remain compliant with these deadlines to avoid penalties and ensure timely processing of the tax return.

Quick guide on how to complete form 2555

Complete Form 2555 effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly substitute for traditional printed and signed documents, allowing you to find the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage Form 2555 on any platform with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and eSign Form 2555 effortlessly

- Obtain Form 2555 and select Get Form to begin.

- Use the tools we offer to complete your form.

- Mark relevant sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your autograph using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your modifications.

- Choose how you would like to submit your form, via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form navigation, or mistakes that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and eSign Form 2555 to ensure excellent communication at any point in your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 2555

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2555 EZ form and why is it important?

The 2555 EZ form is a simplified declaration for individuals living abroad, allowing them to claim the foreign earned income exclusion. Understanding the nuances of the 2555 EZ 2015 form is crucial for expats to maximize their tax benefits and ensure compliance with IRS regulations.

-

How does airSlate SignNow assist with the 2555 EZ 2015 form?

airSlate SignNow streamlines the process of filling out the 2555 EZ 2015 form through easy-to-use electronic signatures and document management. With our platform, users can effortlessly sign, send, and receive documents securely, making tax submissions more efficient.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers various pricing plans to cater to different business needs, ensuring you get value for your investment. Each plan provides access to essential features such as eSigning and document sharing, helping you efficiently manage forms like the 2555 EZ 2015.

-

What features does airSlate SignNow offer for completing the 2555 EZ 2015?

Our platform includes features such as customizable templates and automated workflows that simplify the completion of the 2555 EZ 2015 form. Additionally, users can track document statuses and send reminders, making compliance easier and stress-free.

-

Are there any integrations available with airSlate SignNow?

Yes, airSlate SignNow integrates seamlessly with various third-party applications to enhance your document management experience. This means you can easily connect your tools for accounting and compliance while efficiently handling the 2555 EZ 2015 form.

-

What are the benefits of using airSlate SignNow for tax forms like the 2555 EZ 2015?

Using airSlate SignNow not only saves time but also reduces the risk of errors when completing tax forms like the 2555 EZ 2015. Our secure platform ensures that your sensitive information is protected, while the user-friendly interface simplifies the entire signing process.

-

Is airSlate SignNow suitable for individual taxpayers or just businesses?

airSlate SignNow is designed to cater to both individual taxpayers and businesses, making it ideal for anyone needing to manage forms like the 2555 EZ 2015. Whether you're filing your personal taxes or handling documents for your company, our solution is versatile and effective.

Get more for Form 2555

- Sample demand letter to car dealership form

- Form 8 certificate of suitability

- Jgng form

- Www generalvetproducts com auattachments1388aar breeder litter registration ampamp change of ownership procedure form

- Richard bower superior court of california county of form

- Chapman valley horse riding risk warning and waiver form

- Expression of interest form template

- Hmo junior doctor assessment form important pleas

Find out other Form 2555

- Can I eSignature Nebraska Student Data Sheet

- How To eSignature Michigan Application for University

- eSignature North Carolina Weekly Class Evaluation Now

- eSignature Colorado Medical Power of Attorney Template Fast

- Help Me With eSignature Florida Medical Power of Attorney Template

- eSignature Iowa Medical Power of Attorney Template Safe

- eSignature Nevada Medical Power of Attorney Template Secure

- eSignature Arkansas Nanny Contract Template Secure

- eSignature Wyoming New Patient Registration Mobile

- eSignature Hawaii Memorandum of Agreement Template Online

- eSignature Hawaii Memorandum of Agreement Template Mobile

- eSignature New Jersey Memorandum of Agreement Template Safe

- eSignature Georgia Shareholder Agreement Template Mobile

- Help Me With eSignature Arkansas Cooperative Agreement Template

- eSignature Maryland Cooperative Agreement Template Simple

- eSignature Massachusetts Redemption Agreement Simple

- eSignature North Carolina Redemption Agreement Mobile

- eSignature Utah Equipment Rental Agreement Template Now

- Help Me With eSignature Texas Construction Contract Template

- eSignature Illinois Architectural Proposal Template Simple