St 119 Fillable Form

What is the St 119 Fillable Form

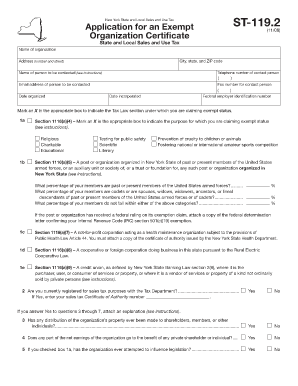

The St 119 tax exempt form, also known as the St 119 exempt organization certificate, is a crucial document used in New York State. This form allows qualifying organizations to make tax-exempt purchases. Typically, it is utilized by non-profit entities, educational institutions, and certain governmental bodies. By submitting this form, these organizations can avoid paying sales tax on purchases directly related to their exempt purposes.

How to use the St 119 Fillable Form

Using the St 119 fillable form is straightforward. First, ensure that your organization qualifies for tax-exempt status under New York State law. Next, download the fillable version of the form from a reliable source. Fill in the required fields, including the organization's name, address, and tax identification number. It is essential to provide accurate information to avoid delays in processing. Once completed, the form can be printed and signed by an authorized representative of the organization.

Steps to complete the St 119 Fillable Form

Completing the St 119 fillable form involves several key steps:

- Confirm your organization’s eligibility for tax exemption.

- Obtain the St 119 form from a trusted source.

- Fill in the organization’s name, address, and tax ID number.

- Provide details about the nature of your organization and its exempt purpose.

- Sign and date the form, ensuring it is authorized by a designated official.

- Keep a copy for your records before submitting it to vendors as needed.

Key elements of the St 119 Fillable Form

Several key elements must be included in the St 119 fillable form to ensure its validity:

- Organization Information: This includes the name, address, and tax ID number.

- Exempt Purpose: A clear statement of the organization’s purpose that qualifies it for tax exemption.

- Authorized Signature: The form must be signed by an individual authorized to act on behalf of the organization.

- Date: The date of signing should be included to validate the form.

Legal use of the St 119 Fillable Form

The St 119 tax form is legally binding when filled out correctly and used by eligible organizations. It complies with New York State tax laws that govern sales tax exemptions. Organizations must ensure that the information provided is accurate and that the form is only used for qualifying purchases. Misuse of the form can lead to penalties, including the potential for back taxes owed and fines.

Form Submission Methods (Online / Mail / In-Person)

The St 119 fillable form can be submitted in various ways, depending on the vendor's requirements. Typically, organizations present the completed form directly to the vendor at the time of purchase. Some vendors may accept electronic submissions, while others may require a printed version. It is advisable to check with each vendor regarding their preferred submission method to ensure compliance and acceptance.

Quick guide on how to complete st 119 fillable form

Complete St 119 Fillable Form effortlessly on any device

Digital document management has become increasingly popular among organizations and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to find the necessary form and securely archive it online. airSlate SignNow equips you with all the tools needed to create, edit, and eSign your documents swiftly without delays. Manage St 119 Fillable Form on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest way to edit and eSign St 119 Fillable Form without any hassle

- Find St 119 Fillable Form and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of your documents or blackout sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes only seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose your preferred method to send your form, via email, text message (SMS), or invitation link, or download it to your PC.

Say goodbye to lost or misplaced files, tedious form searching, or errors requiring the printing of new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign St 119 Fillable Form and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the st 119 fillable form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ST 119 tax exempt form, and who needs it?

The ST 119 tax exempt form is intended for organizations that qualify for tax exemptions in New York. This form allows eligible entities to purchase goods and services without paying sales tax. If your business is a nonprofit or qualifies under specific exemptions, this form is essential for you.

-

How can airSlate SignNow help me with the ST 119 tax exempt form?

airSlate SignNow simplifies the process of filling out and eSigning the ST 119 tax exempt form. With our platform, you can easily upload, edit, and securely sign the document, helping you streamline your tax exemption claims. Our intuitive interface ensures that you can complete the form quickly and efficiently.

-

Is there a cost associated with using airSlate SignNow for the ST 119 tax exempt form?

Yes, airSlate SignNow offers competitive pricing plans that cater to various business needs, including those who frequently handle the ST 119 tax exempt form. We provide a range of subscription options, ensuring cost-effectiveness while giving you access to essential features for managing tax-exempt documentation.

-

What features does airSlate SignNow offer for managing tax-exempt forms like ST 119?

airSlate SignNow includes features such as document templates, automated workflows, and secure storage to manage tax-exempt forms like ST 119. Our platform also supports in-depth tracking and reminders, ensuring you never miss a deadline related to tax exemption claims. These tools help you stay organized and compliant.

-

Can I integrate airSlate SignNow with other software to manage the ST 119 tax exempt form?

Absolutely! airSlate SignNow integrates seamlessly with popular applications such as Google Drive, Salesforce, and more. These integrations allow you to manage the ST 119 tax exempt form alongside other business workflows, enhancing productivity and ensuring all your documents are centralized.

-

What are the benefits of eSigning the ST 119 tax exempt form with airSlate SignNow?

eSigning the ST 119 tax exempt form with airSlate SignNow offers numerous benefits, including speed and convenience. With our platform, you can sign documents from anywhere on any device, speeding up the approval process. Additionally, eSignatures are legally binding, which ensures compliance and security for your tax documentation.

-

How secure is the eSigning process for the ST 119 tax exempt form?

airSlate SignNow ensures that the eSigning process for the ST 119 tax exempt form is highly secure. We utilize advanced encryption and compliance with industry standards to protect your sensitive information. Our platform includes audit trails and authentication measures to provide complete accountability for every signed document.

Get more for St 119 Fillable Form

- New york employees retirement system subsequent employment of active rs 5520 form

- Garmschv onlin form

- When to use lpor 13 in louisiana form

- Clep exam registration ticket strayer university form

- Retail keg registration form

- Opedge comwp contentuploadsoampampp jobs calendar insertion order opedge com form

- Gerrard excavating inc public data ampamp applications form

- Articles of dissolution form

Find out other St 119 Fillable Form

- Help Me With eSign Kansas Business Operations PPT

- How Can I eSign Mississippi Car Dealer Form

- Can I eSign Nebraska Car Dealer Document

- Help Me With eSign Ohio Car Dealer Document

- How To eSign Ohio Car Dealer Document

- How Do I eSign Oregon Car Dealer Document

- Can I eSign Oklahoma Car Dealer PDF

- How Can I eSign Oklahoma Car Dealer PPT

- Help Me With eSign South Carolina Car Dealer Document

- How To eSign Texas Car Dealer Document

- How Can I Sign South Carolina Courts Document

- How Do I eSign New Jersey Business Operations Word

- How Do I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- Help Me With eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Presentation

- Help Me With eSign Hawaii Charity Presentation

- How Can I eSign Hawaii Charity Presentation