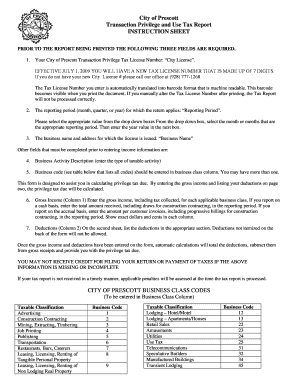

City of Prescott Tax Form

Understanding the Arizona Transaction Privilege Tax

The Arizona transaction privilege tax (TPT) is a tax imposed on businesses for the privilege of conducting business within the state. Unlike a traditional sales tax, which is levied on the consumer, the TPT is assessed on the seller. This tax applies to various business activities, including retail sales, rental of tangible personal property, and certain services. Understanding the nuances of this tax is essential for compliance and effective business operations in Arizona.

Steps to Complete the Arizona Transaction Privilege Tax Form

Completing the Arizona transaction privilege tax form involves several key steps:

- Gather necessary information, including your business details, gross income, and any exemptions.

- Access the appropriate form, which can typically be found on the Arizona Department of Revenue website.

- Fill out the form accurately, ensuring all sections are completed, including the calculation of tax owed.

- Review the form for accuracy and completeness before submission.

- Submit the form by the designated deadline, either online, by mail, or in person.

Required Documents for the Arizona Transaction Privilege Tax Form

When preparing to file the Arizona transaction privilege tax form, certain documents are essential:

- Your business license and registration information.

- Records of gross income and sales for the reporting period.

- Any documentation supporting exemptions or deductions claimed.

- Previous tax returns, if applicable, for reference.

Filing Deadlines for the Arizona Transaction Privilege Tax

It is crucial to adhere to the filing deadlines for the Arizona transaction privilege tax to avoid penalties. Generally, the tax is due on the 20th day of the month following the end of the reporting period. For example, if you are filing for the month of January, your form and payment would be due by February 20. Businesses may choose to file monthly, quarterly, or annually, depending on their gross income.

Penalties for Non-Compliance with the Arizona Transaction Privilege Tax

Failure to comply with the Arizona transaction privilege tax regulations can result in significant penalties. These may include:

- Late filing penalties, which can be a percentage of the tax owed.

- Interest on unpaid taxes, accruing from the due date until payment is made.

- Potential legal action for continued non-compliance, which can lead to further financial liabilities.

Legal Use of the Arizona Transaction Privilege Tax Form

The Arizona transaction privilege tax form must be used in accordance with state laws and regulations. This includes ensuring that the form is completed accurately and submitted on time. Businesses must also maintain proper records to support the information reported on the form, as these may be subject to audit by the Arizona Department of Revenue. Understanding the legal implications of the TPT is vital for maintaining compliance and avoiding disputes.

Quick guide on how to complete city of prescott tax form

Prepare City Of Prescott Tax Form effortlessly on any device

Digital document management has gained popularity among companies and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed paperwork, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents swiftly and without issues. Manage City Of Prescott Tax Form on any device utilizing airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The optimal way to modify and electronically sign City Of Prescott Tax Form effortlessly

- Locate City Of Prescott Tax Form and click Get Form to begin.

- Utilize the tools available to complete your document.

- Highlight important portions of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal standing as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose your preferred method of delivering your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Edit and electronically sign City Of Prescott Tax Form to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the city of prescott tax form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Arizona transaction privilege tax?

The Arizona transaction privilege tax is a tax imposed on the business activity conducted within the state. It is often considered similar to a sales tax, but it is levied on the seller's gross income rather than the consumer's purchase price. Understanding this tax is crucial for businesses operating in Arizona to ensure compliance.

-

How can airSlate SignNow help businesses manage their Arizona transaction privilege tax documentation?

airSlate SignNow streamlines the process of preparing, signing, and managing documents related to the Arizona transaction privilege tax. By digitizing these documents, businesses can reduce paperwork, minimize human error, and ensure timely submissions. This makes it easier for companies to stay organized and compliant with Arizona tax regulations.

-

What features does airSlate SignNow offer to simplify tax compliance related to the Arizona transaction privilege tax?

airSlate SignNow offers features like customizable templates, automated reminders, and secure electronic signatures to simplify tax compliance. These features help ensure that all necessary documentation related to the Arizona transaction privilege tax is completed and filed on time, reducing the risk of penalties.

-

Is there a cost associated with using airSlate SignNow for managing Arizona transaction privilege tax documents?

Yes, airSlate SignNow offers various pricing plans designed to fit different business needs. The cost may vary based on factors such as the number of users and additional features required. Investing in a solution like airSlate SignNow can ultimately save time and resources while ensuring compliance with the Arizona transaction privilege tax.

-

Can airSlate SignNow integrate with other software to assist with Arizona transaction privilege tax management?

Absolutely! airSlate SignNow integrates seamlessly with many accounting and business management software tools, making it easier to track and manage Arizona transaction privilege tax obligations. These integrations enable businesses to maintain a streamlined workflow and enhance overall efficiency.

-

What are the benefits of using airSlate SignNow for Arizona transaction privilege tax filing?

Using airSlate SignNow for Arizona transaction privilege tax filing provides businesses with an efficient, secure, and cost-effective solution. It enhances document collaboration, reduces time spent on manual processes, and helps ensure accuracy in tax-related submissions. Consequently, this allows businesses to focus more on their core operations.

-

How does airSlate SignNow ensure the security of documents related to the Arizona transaction privilege tax?

airSlate SignNow employs high-level security measures, including encryption and secure access controls, to protect documents related to the Arizona transaction privilege tax. This ensures that sensitive information is safeguarded and only accessible to authorized personnel. Businesses can confidently manage their tax documents without compromising security.

Get more for City Of Prescott Tax Form

- Macomb county michigan dba form

- 8 ball score sheets palm beach county bca pool league form

- Woman dies after being found unresponsive in pool form

- Ftngd cd position vacancy announcement form

- Application for reinstatement form

- Travel expense request form

- Form or tcc tax compliance certification 150 800 743

- Form or 40 p oregon individual income tax return

Find out other City Of Prescott Tax Form

- How Do I Sign Alaska Paid-Time-Off Policy

- Sign Virginia Drug and Alcohol Policy Easy

- How To Sign New Jersey Funeral Leave Policy

- How Can I Sign Michigan Personal Leave Policy

- Sign South Carolina Pregnancy Leave Policy Safe

- How To Sign South Carolina Time Off Policy

- How To Sign Iowa Christmas Bonus Letter

- How To Sign Nevada Christmas Bonus Letter

- Sign New Jersey Promotion Announcement Simple

- Sign Louisiana Company Bonus Letter Safe

- How To Sign Delaware Letter of Appreciation to Employee

- How To Sign Florida Letter of Appreciation to Employee

- How Do I Sign New Jersey Letter of Appreciation to Employee

- How Do I Sign Delaware Direct Deposit Enrollment Form

- How To Sign Alabama Employee Emergency Notification Form

- How To Sign Oklahoma Direct Deposit Enrollment Form

- Sign Wyoming Direct Deposit Enrollment Form Online

- Sign Nebraska Employee Suggestion Form Now

- How Can I Sign New Jersey Employee Suggestion Form

- Can I Sign New York Employee Suggestion Form