Va Tax Form 200

What is the Va Tax Form 200

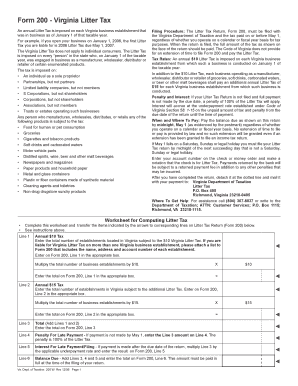

The Va Tax Form 200 is a tax document used by individuals and businesses in Virginia to report their income and calculate their state tax obligations. This form is essential for ensuring compliance with state tax laws and for determining the amount of tax owed or refundable. It includes various sections that require detailed financial information, such as income, deductions, and credits applicable to the taxpayer's situation.

How to use the Va Tax Form 200

Using the Va Tax Form 200 involves several steps. First, gather all necessary financial documents, including W-2s, 1099s, and any other income statements. Next, accurately fill out each section of the form, ensuring that all calculations are correct. After completing the form, review it for any errors before submission. It is also advisable to keep a copy for your records.

Steps to complete the Va Tax Form 200

Completing the Va Tax Form 200 requires careful attention to detail. Follow these steps:

- Collect all relevant income documentation.

- Fill in personal information, including name, address, and Social Security number.

- Report all sources of income in the designated sections.

- Apply any deductions and credits that you qualify for.

- Calculate your total tax liability or refund.

- Sign and date the form before submission.

Legal use of the Va Tax Form 200

The Va Tax Form 200 is legally binding when completed and submitted according to Virginia state tax regulations. It is crucial to ensure that all information provided is accurate and truthful. Misrepresentation or errors can lead to penalties, including fines or additional taxes owed. Utilizing a reliable eSignature solution can enhance the legal validity of your submission.

Filing Deadlines / Important Dates

Filing deadlines for the Va Tax Form 200 are typically set by the Virginia Department of Taxation. Generally, the deadline for filing is May 1 of the year following the tax year. If May 1 falls on a weekend or holiday, the deadline may be extended. It is important to stay informed about any changes to these dates to avoid late filing penalties.

Form Submission Methods

The Va Tax Form 200 can be submitted through various methods to accommodate different preferences:

- Online: Many taxpayers choose to file electronically through authorized e-filing services.

- Mail: The form can be printed and mailed to the appropriate state tax office.

- In-Person: Taxpayers may also submit the form in person at designated tax offices.

Who Issues the Form

The Va Tax Form 200 is issued by the Virginia Department of Taxation. This state agency is responsible for administering tax laws and ensuring compliance among taxpayers. It is advisable to refer to their official website or contact them directly for the most current version of the form and any related guidance.

Quick guide on how to complete va tax form 200

Complete Va Tax Form 200 effortlessly on any gadget

Digital document management has become increasingly prevalent among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents swiftly without delays. Handle Va Tax Form 200 on any gadget using the airSlate SignNow applications for Android or iOS and simplify any document-oriented process today.

The easiest way to alter and eSign Va Tax Form 200 without effort

- Find Va Tax Form 200 and click Get Form to begin.

- Utilize the tools we provide to finish your form.

- Emphasize important sections of the documents or obscure sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the information and click on the Done button to save your changes.

- Select how you wish to share your form, via email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced documents, tiresome form searching, or errors that necessitate reprinting new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and eSign Va Tax Form 200 and guarantee outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the va tax form 200

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Va Tax Form 200?

The Va Tax Form 200 is a crucial document used for personal income tax reporting in Virginia. It allows individuals to report their income and calculate their state tax obligations efficiently. Using airSlate SignNow can streamline the process of filling, signing, and submitting the Va Tax Form 200.

-

How can I fill out the Va Tax Form 200 using airSlate SignNow?

With airSlate SignNow, you can easily fill out the Va Tax Form 200 by uploading the document and using our user-friendly editing tools. You can add text, signatures, and any necessary information seamlessly. This simplifies the electronic submission process for your Virginia state taxes.

-

What are the costs associated with using airSlate SignNow for the Va Tax Form 200?

The pricing of airSlate SignNow is competitive and offers various plans to suit different business needs. Costs depend on the number of users and features required, but you can often save money compared to traditional paper-based filing for documents like the Va Tax Form 200. Explore our pricing page for detailed information.

-

Does airSlate SignNow provide templates for the Va Tax Form 200?

Yes, airSlate SignNow offers templates specifically designed for the Va Tax Form 200. Utilizing these templates can save you time and ensure that all necessary fields are included. This feature is especially beneficial for businesses that need to frequently process this tax form.

-

Can I integrate airSlate SignNow with other software for filing the Va Tax Form 200?

Absolutely! airSlate SignNow integrates seamlessly with a variety of software solutions, enhancing the efficiency of filing the Va Tax Form 200. Whether you use accounting software or CRMs, our integrations ensure a smooth workflow for managing your tax documents.

-

What are the benefits of using airSlate SignNow for the Va Tax Form 200?

Using airSlate SignNow for the Va Tax Form 200 provides several benefits, such as improved efficiency, reduced paperwork, and faster turnaround times. Our eSigning feature also allows you to gather signatures easily, ensuring timely compliance with state tax regulations. Furthermore, it provides secure storage for your documents.

-

Is airSlate SignNow secure for submitting the Va Tax Form 200?

Yes, airSlate SignNow prioritizes security and compliance, making it a safe choice for submitting your Va Tax Form 200. We adhere to industry standards to protect your sensitive information, with encryption and secure access controls. You can trust that your tax documents are handled with care.

Get more for Va Tax Form 200

- Form 6059b customs declaration portuguese fillable

- 8669592864 24378305 form

- Oklahoma last will and testament for other persons form

- Tfsa application mawer investment management form

- Ymca charlotte membership form

- Retail sales income amp expense worksheet year form

- Cse 1160a request to close child support case form

- Snow plowing contracts printable form

Find out other Va Tax Form 200

- eSign Indiana Car Dealer Separation Agreement Simple

- eSign Iowa Car Dealer Agreement Free

- eSign Iowa Car Dealer Limited Power Of Attorney Free

- eSign Iowa Car Dealer Limited Power Of Attorney Fast

- eSign Iowa Car Dealer Limited Power Of Attorney Safe

- How Can I eSign Iowa Car Dealer Limited Power Of Attorney

- How To eSign Illinois Business Operations Stock Certificate

- Can I eSign Louisiana Car Dealer Quitclaim Deed

- eSign Michigan Car Dealer Operating Agreement Mobile

- Can I eSign Mississippi Car Dealer Resignation Letter

- eSign Missouri Car Dealer Lease Termination Letter Fast

- Help Me With eSign Kentucky Business Operations Quitclaim Deed

- eSign Nevada Car Dealer Warranty Deed Myself

- How To eSign New Hampshire Car Dealer Purchase Order Template

- eSign New Jersey Car Dealer Arbitration Agreement Myself

- eSign North Carolina Car Dealer Arbitration Agreement Now

- eSign Ohio Car Dealer Business Plan Template Online

- eSign Ohio Car Dealer Bill Of Lading Free

- How To eSign North Dakota Car Dealer Residential Lease Agreement

- How Do I eSign Ohio Car Dealer Last Will And Testament