Ifta Registration Ga 2013-2026

What is the IFTA Registration GA

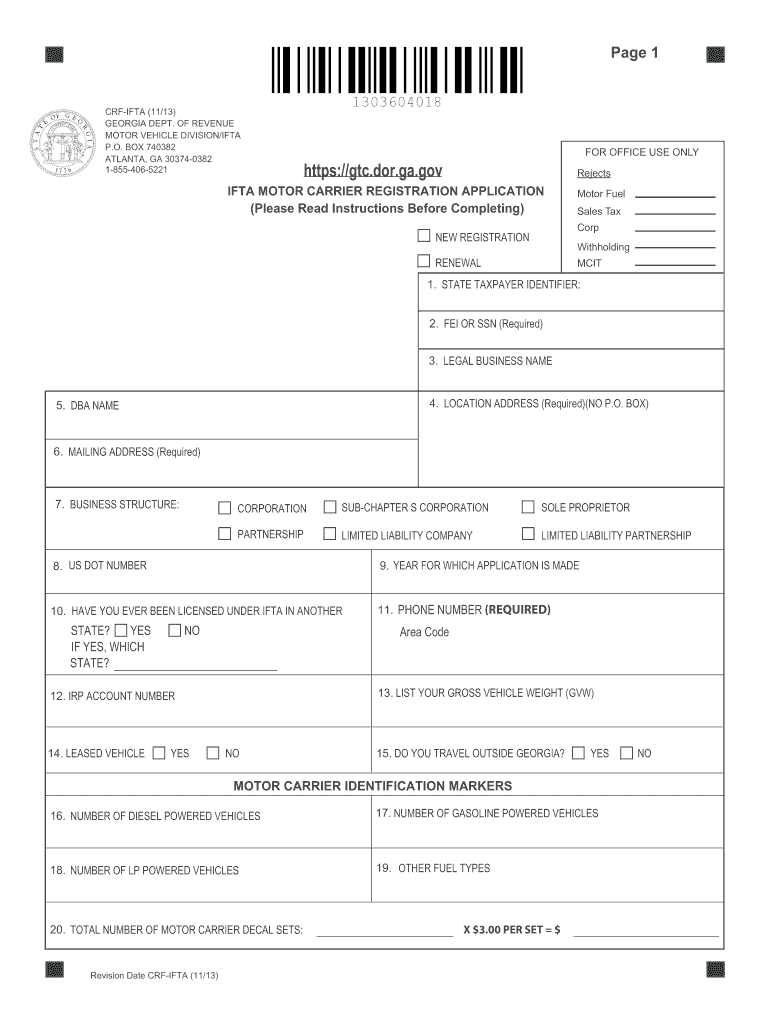

The International Fuel Tax Agreement (IFTA) registration in Georgia is a mandatory requirement for commercial motor carriers operating in multiple jurisdictions. This agreement simplifies the reporting of fuel use taxes by allowing carriers to file a single tax return for all member jurisdictions. The IFTA registration helps ensure compliance with state fuel tax regulations and streamlines the tax reporting process for trucking companies that travel across state lines.

How to Obtain the IFTA Registration GA

To obtain the IFTA registration in Georgia, carriers must complete the Georgia IFTA application. This application can be filled out online or through a paper form. Applicants need to provide essential information, such as their business name, address, and vehicle details. After submitting the application, the Georgia Department of Revenue will review it and issue an IFTA license and decals for the registered vehicles. The decals must be displayed on the vehicles to demonstrate compliance.

Steps to Complete the IFTA Registration GA

Completing the IFTA registration in Georgia involves several key steps:

- Gather necessary documents, including business identification and vehicle information.

- Fill out the Georgia IFTA application form accurately.

- Submit the application online or by mail to the Georgia Department of Revenue.

- Receive your IFTA license and decals upon approval.

- Affix the decals to your vehicles as required.

Legal Use of the IFTA Registration GA

The IFTA registration in Georgia is legally binding and must be adhered to by all commercial carriers operating across state lines. Proper registration ensures compliance with fuel tax regulations and helps avoid penalties. Carriers must maintain accurate records of fuel purchases and mileage traveled in each jurisdiction to support their tax filings. Failure to comply with IFTA regulations can result in audits, fines, or suspension of operating privileges.

Required Documents for IFTA Registration GA

When applying for IFTA registration in Georgia, several documents are required to ensure a smooth application process:

- Completed Georgia IFTA application form.

- Proof of business registration, such as a business license.

- Vehicle identification details, including VIN numbers.

- Any previous IFTA licenses, if applicable.

Filing Deadlines / Important Dates

Understanding the filing deadlines for IFTA in Georgia is crucial for compliance. Carriers must file their IFTA tax returns quarterly. The due dates for these filings are:

- First Quarter: April 30

- Second Quarter: July 31

- Third Quarter: October 31

- Fourth Quarter: January 31

Late submissions may incur penalties, so it is essential to adhere to these deadlines.

Quick guide on how to complete georgia ifta application department of revenue

Your assistance manual on how to prepare your Ifta Registration Ga

If you’re looking to understand how to finalize and submit your Ifta Registration Ga, here are some straightforward guidelines to simplify the tax declaration process.

To start, you simply need to set up your airSlate SignNow account to revolutionize the way you manage documentation online. airSlate SignNow is an exceptionally intuitive and powerful document management solution that allows you to edit, generate, and finish your income tax forms effortlessly. With its editing tool, you can alternate between text, checkboxes, and eSignatures and go back to revise information as necessary. Optimize your tax organization with enhanced PDF editing, eSigning, and easy sharing options.

Follow the steps below to finalize your Ifta Registration Ga in just a few minutes:

- Create your account and start editing PDFs within minutes.

- Utilize our directory to locate any IRS tax form; browse different versions and schedules.

- Click Get form to access your Ifta Registration Ga in our editor.

- Complete the necessary fillable sections with your information (text, numbers, check marks).

- Use the Sign Tool to add your legally-recognized eSignature (if needed).

- Examine your document and correct any errors.

- Save your changes, print out your copy, send it to your recipient, and download it to your device.

Take advantage of this manual to electronically file your taxes with airSlate SignNow. Keep in mind that submitting in paper form can lead to filing errors and delays in refunds. Naturally, before electronically filing your taxes, verify the IRS website for the filing regulations in your state.

Create this form in 5 minutes or less

FAQs

-

What is the total number of federal applications, documents, or forms from all the departments of government that US citizens are required by law to fill out?

I am not an American. But it would depend on the person's circumstances. How much do they earn? If you earn little then you don't need to file a tax return. How do they earn it? Self employed or employed?Do they travel? You need a passport.How long do they live? - if they die after birth then it is very little. Do they live in the USA?What entitlements do they have?Do they have dialysis? This is federally funded.Are they on medicaid/medicare?.Are they in jail or been charged with a crime?Then how do you count it? Do you count forms filled in by the parents?Then there is the census the Constitution which held every ten years.

-

How can I fill out the online application form of JVM Shyamli Ranchi?

Go to Jawahar Vidiya Mandir website

-

How do I fill out an application form to open a bank account?

I want to believe that most banks nowadays have made the process of opening bank account, which used to be cumbersome, less cumbersome. All you need to do is to approach the bank, collect the form, and fill. However if you have any difficulty in filling it, you can always call on one of the banks rep to help you out.

-

What is the last date to fill out the application form of the Indian Navy?

Hello VinayThe last date for filling the form has already gone. It was March 4, 2018. Kindly wait for the next application date to come.RegardsAnkita

-

With a BITSAT score of 270, is it advisable to fill out the application form?

My answer is based on applying for a B.E.(hons) degree from BITS.To be frank if I was in your position I would think :I know there's 0.00001% chances but still let's hope for a miracle, and let's apply.Now coming to giving a fair advice -Based on previous cutoffs its advisable not to apply unless you belive in miracles of such kind.(A pic to support my reasoning)Hope you understand.Remember I'm no expert but can surely say there's a tough chance with such score.

-

Which type of document do we need to fill out the KVPY application form or entrance form?

The students applying for KVPY Application Form need to upload the following documents:Scanned Image of Photograph and SignatureCaste Certificate for SC/ST StudentsMedical Certificate in case of PWD candidates

Create this form in 5 minutes!

How to create an eSignature for the georgia ifta application department of revenue

How to create an electronic signature for the Georgia Ifta Application Department Of Revenue in the online mode

How to create an eSignature for the Georgia Ifta Application Department Of Revenue in Chrome

How to generate an eSignature for signing the Georgia Ifta Application Department Of Revenue in Gmail

How to make an electronic signature for the Georgia Ifta Application Department Of Revenue right from your smart phone

How to generate an electronic signature for the Georgia Ifta Application Department Of Revenue on iOS

How to generate an eSignature for the Georgia Ifta Application Department Of Revenue on Android OS

People also ask

-

What is IFTA registration GA and why is it important?

IFTA registration GA, or International Fuel Tax Agreement registration in Georgia, is crucial for interstate trucking companies. It simplifies the process of reporting fuel taxes across states, ensuring compliance and reducing the risk of audits. Proper registration can save time and money for businesses operating in multiple jurisdictions.

-

How does airSlate SignNow simplify IFTA registration GA?

AirSlate SignNow streamlines the IFTA registration GA process by allowing businesses to electronically sign and submit necessary documents. This reduces paperwork and speeds up the registration process. Our user-friendly platform ensures that even those new to IFTA can navigate the requirements with ease.

-

What are the costs associated with IFTA registration GA?

The costs for IFTA registration GA can vary based on your business size and the number of vehicles registered. AirSlate SignNow offers a cost-effective solution that ensures you don’t overspend on paperwork or registration fees. Our plans are designed to fit different budgets while providing valuable features.

-

Are there any specific features of airSlate SignNow that help with IFTA registration GA?

Yes, airSlate SignNow includes features like customizable templates and real-time tracking which are essential for IFTA registration GA. These tools make it easier to gather all required documentation efficiently. Additionally, our secure eSignature functionality ensures that all your forms are signed and submitted promptly.

-

Can I track my IFTA registration GA status using airSlate SignNow?

Absolutely! AirSlate SignNow provides tracking capabilities that allow you to monitor the status of your IFTA registration GA. This ensures that you are always updated on your submission and can quickly address any issues that may arise during the registration process.

-

Does airSlate SignNow integrate with other logistics software for IFTA registration GA?

Yes, airSlate SignNow offers seamless integrations with various logistics and fleet management software that can enhance your IFTA registration GA experience. By connecting our platform with your existing tools, you can automate workflows and save valuable time. This integration ensures that all of your documents are easily accessible and manageable.

-

What benefits does airSlate SignNow provide for IFTA registration GA users?

AirSlate SignNow provides numerous benefits for IFTA registration GA users, such as increased efficiency, reduced paperwork, and enhanced compliance. Our platform makes it easy to manage all documents in one place, which minimizes the risk of errors and delays. Plus, you can save on costs associated with traditional methods of handling IFTA registration.

Get more for Ifta Registration Ga

- Notice of breach of written lease for violating specific provisions of lease with no right to cure for residential property 497431722 form

- Notice of breach of written lease for violating specific provisions of lease with no right to cure for nonresidential property 497431723 form

- Day pay rent form

- Business credit application west virginia form

- Individual credit application west virginia form

- Interrogatories to plaintiff for motor vehicle occurrence west virginia form

- Interrogatories to defendant for motor vehicle accident west virginia form

- Llc notices resolutions and other operations forms package west virginia

Find out other Ifta Registration Ga

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors