is a Notice of Federal Tax Lien an Actual Lien 1999-2026

Understanding the Notice of Federal Tax Lien

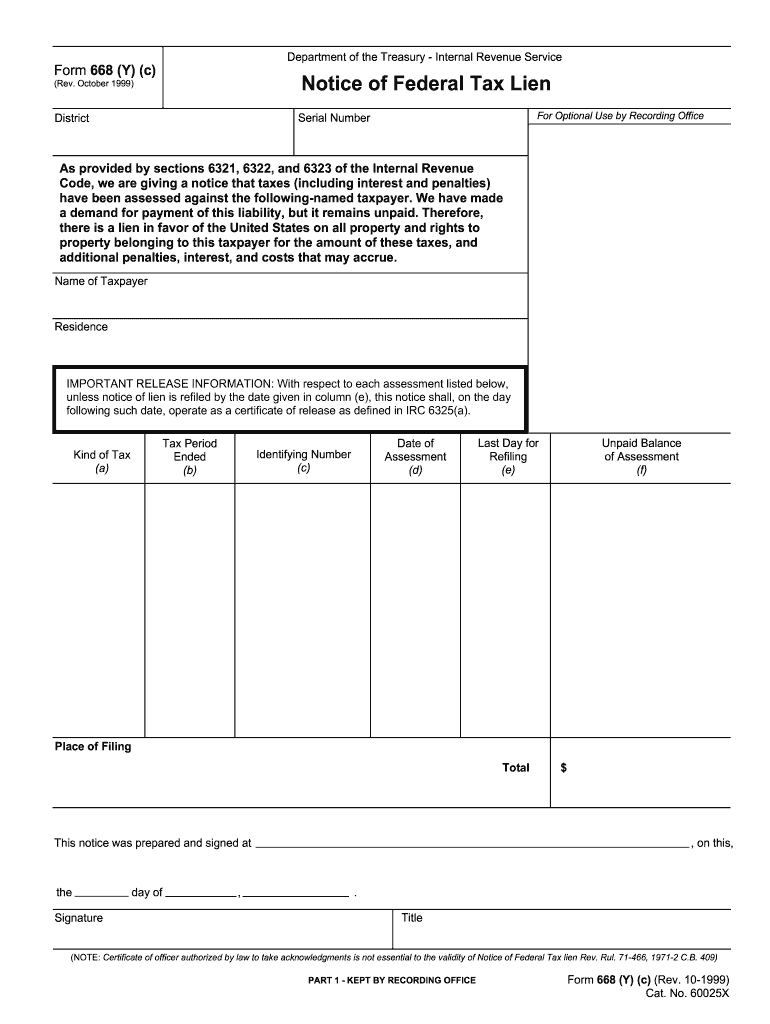

A Notice of Federal Tax Lien is a legal claim the government makes against your property when you neglect or refuse to pay a tax debt. This lien serves as a public notice that the IRS has a right to your property, which can include real estate, personal property, and financial assets. It is important to understand that this lien can affect your credit rating and your ability to sell or refinance property.

Steps to Complete Form 668 Y C

Completing Form 668 Y C involves several key steps:

- Gather necessary information, including your personal details and tax identification number.

- Ensure you have the correct version of the form, as outdated forms may not be accepted.

- Fill out all required fields accurately, paying close attention to details to avoid errors.

- Review the form for completeness before submission to ensure all necessary attachments are included.

- Choose your submission method, whether online, by mail, or in person, and follow the guidelines accordingly.

Legal Use of Form 668 Y C

Form 668 Y C is used to officially record a federal tax lien. This document must be filed with the appropriate local authorities to ensure that the lien is legally recognized. It is essential to understand the implications of filing this form, as it can affect your legal standing and financial transactions. Legal counsel may be advisable to navigate the complexities associated with tax liens.

Required Documents for Filing

When filing Form 668 Y C, you will need to provide several key documents:

- Your completed Form 668 Y C.

- Supporting documentation that verifies your identity and tax obligations.

- Any previous correspondence with the IRS regarding your tax status.

Having these documents ready will streamline the filing process and help avoid delays.

IRS Guidelines for Tax Liens

The IRS provides specific guidelines regarding tax liens, including how they are filed, what information is required, and the implications for taxpayers. It is crucial to familiarize yourself with these guidelines to ensure compliance. The IRS also outlines the process for releasing a lien once the tax debt is settled, which can help restore your credit standing.

Filing Deadlines and Important Dates

Timely filing of Form 668 Y C is essential to avoid additional penalties. It is important to be aware of key deadlines, such as:

- The date by which the form must be submitted to avoid further legal action.

- Any deadlines related to tax payment plans or appeals.

Staying informed about these dates can help you manage your tax obligations effectively.

Penalties for Non-Compliance

Failure to file Form 668 Y C or to pay the associated tax debt can result in significant penalties. These may include:

- Increased interest on the unpaid tax amount.

- Additional fines for late filing or non-filing.

- Potential legal action from the IRS, including wage garnishments or property seizures.

Understanding these penalties can motivate timely compliance and help protect your financial interests.

Quick guide on how to complete form 668 y c rev october 1999 notice of federal tax lien patriotnetwork

Explore the most efficient method to complete and endorse your Is A Notice Of Federal Tax Lien An Actual Lien

Are you still spending time preparing your official paperwork on paper instead of handling it online? airSlate SignNow provides a superior way to complete and endorse your Is A Notice Of Federal Tax Lien An Actual Lien and other forms required for public services. Our intelligent eSignature solution equips you with all the tools necessary to process documents swiftly while adhering to official standards - robust PDF editing, management, safeguarding, signing, and sharing features are readily available within a user-friendly interface.

Only a few steps are needed to finish filling out and signing your Is A Notice Of Federal Tax Lien An Actual Lien:

- Upload the editable template into the editor using the Get Form option.

- Review the information you must include in your Is A Notice Of Federal Tax Lien An Actual Lien.

- Navigate through the fields with the Next button to ensure nothing is overlooked.

- Utilize Text, Check, and Cross tools to input your details in the blanks.

- Update the content with Text boxes or Images found in the upper toolbar.

- Emphasize what is important or Redact fields that are no longer relevant.

- Press Sign to create a legally valid eSignature using your preferred method.

- Add the Date next to your signature and finalize your task with the Done button.

Store your finished Is A Notice Of Federal Tax Lien An Actual Lien in the Documents folder of your account, download it, or transfer it to your chosen cloud storage. Our service also provides adaptable form sharing options. There’s no necessity to print your templates when filing them with the relevant public office - submit them via email, fax, or by requesting a USPS “snail mail” delivery from your account. Give it a try today!

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 668 y c rev october 1999 notice of federal tax lien patriotnetwork

How to generate an eSignature for the Form 668 Y C Rev October 1999 Notice Of Federal Tax Lien Patriotnetwork in the online mode

How to generate an electronic signature for the Form 668 Y C Rev October 1999 Notice Of Federal Tax Lien Patriotnetwork in Google Chrome

How to generate an eSignature for signing the Form 668 Y C Rev October 1999 Notice Of Federal Tax Lien Patriotnetwork in Gmail

How to generate an eSignature for the Form 668 Y C Rev October 1999 Notice Of Federal Tax Lien Patriotnetwork from your smart phone

How to create an eSignature for the Form 668 Y C Rev October 1999 Notice Of Federal Tax Lien Patriotnetwork on iOS

How to generate an eSignature for the Form 668 Y C Rev October 1999 Notice Of Federal Tax Lien Patriotnetwork on Android OS

People also ask

-

What is the form 668 y c and why is it important?

The form 668 y c is a crucial IRS document used for recording tax liens against a taxpayer's property. Understanding this form is essential for individuals and businesses to manage their tax obligations effectively.

-

How can airSlate SignNow help with electronically signing the form 668 y c?

airSlate SignNow streamlines the signing process for the form 668 y c with its user-friendly electronic signature platform. You can easily send, sign, and store this important document securely online, enhancing efficiency and compliance.

-

Are there any costs associated with using airSlate SignNow for the form 668 y c?

AirSlate SignNow offers flexible pricing plans that cater to various business needs, including options for users focused on managing the form 668 y c. By choosing a plan that fits your requirements, you can efficiently handle your documentation at a competitive price.

-

What features of airSlate SignNow assist in managing the form 668 y c?

AirSlate SignNow provides key features such as document templates, real-time tracking, and reminders which are particularly beneficial for managing the form 668 y c. These tools help ensure that your documents are organized and deadlines are met effortlessly.

-

Is airSlate SignNow compliant with regulations for the form 668 y c?

Yes, airSlate SignNow complies with eSignature regulations such as the ESIGN Act, ensuring that your signed form 668 y c is legally binding and secure. This compliance helps businesses have peace of mind when managing their legal documents.

-

Can I integrate airSlate SignNow with other platforms for the form 668 y c?

Absolutely! AirSlate SignNow offers seamless integrations with various business applications, enabling you to efficiently manage the form 668 y c alongside other critical tools you use daily. This smooth connectivity allows for a more streamlined workflow.

-

What are the benefits of using airSlate SignNow for the form 668 y c?

Using airSlate SignNow to manage the form 668 y c provides numerous benefits including improved speed, accessibility, and organization. It simplifies document workflows, enhances collaboration, and reduces the risks associated with traditional paper-based processes.

Get more for Is A Notice Of Federal Tax Lien An Actual Lien

- Property manager agreement west virginia form

- Agreement for delayed or partial rent payments west virginia form

- Tenants maintenance repair request form west virginia

- Guaranty attachment to lease for guarantor or cosigner west virginia form

- Amendment to lease or rental agreement west virginia form

- Warning notice due to complaint from neighbors west virginia form

- Lease subordination agreement west virginia form

- Apartment rules and regulations west virginia form

Find out other Is A Notice Of Federal Tax Lien An Actual Lien

- Sign Hawaii Business Operations Warranty Deed Easy

- Sign Idaho Business Operations Resignation Letter Online

- Sign Illinois Business Operations Affidavit Of Heirship Later

- How Do I Sign Kansas Business Operations LLC Operating Agreement

- Sign Kansas Business Operations Emergency Contact Form Easy

- How To Sign Montana Business Operations Warranty Deed

- Sign Nevada Business Operations Emergency Contact Form Simple

- Sign New Hampshire Business Operations Month To Month Lease Later

- Can I Sign New York Business Operations Promissory Note Template

- Sign Oklahoma Business Operations Contract Safe

- Sign Oregon Business Operations LLC Operating Agreement Now

- Sign Utah Business Operations LLC Operating Agreement Computer

- Sign West Virginia Business Operations Rental Lease Agreement Now

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile

- Sign Delaware Car Dealer Limited Power Of Attorney Fast

- How To Sign Georgia Car Dealer Lease Agreement Form

- How To Sign Iowa Car Dealer Resignation Letter