Crs 1 Long Form New Mexico

What is the CRS 1 Long Form New Mexico?

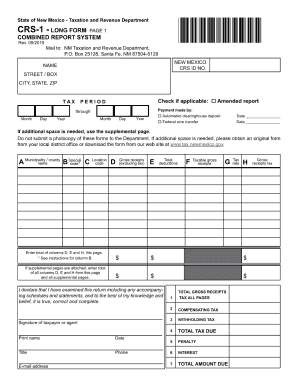

The CRS 1 Long Form is a comprehensive document used in New Mexico for reporting various tax-related information. This form consolidates multiple reporting requirements into a single submission, making it easier for businesses and individuals to comply with state regulations. It is essential for ensuring accurate reporting of gross receipts, compensating taxes, and other relevant financial data. Understanding the purpose and structure of the CRS 1 Long Form is crucial for anyone involved in business operations within the state.

How to Use the CRS 1 Long Form New Mexico

Using the CRS 1 Long Form involves several steps to ensure accurate completion and submission. First, gather all necessary financial records, including sales data and tax information. Next, fill out the form, ensuring that each section is completed with precise figures. It is important to review the instructions provided with the form, as they outline specific requirements and calculations. Once completed, the form can be submitted online, by mail, or in person, depending on your preference and the guidelines established by the New Mexico Taxation and Revenue Department.

Steps to Complete the CRS 1 Long Form New Mexico

Completing the CRS 1 Long Form requires careful attention to detail. Follow these steps for a successful submission:

- Collect all relevant financial documentation, including sales records and previous tax filings.

- Access the CRS 1 Long Form from the New Mexico Taxation and Revenue Department website or through authorized channels.

- Fill in the required sections, including gross receipts, deductions, and any applicable credits.

- Double-check all entries for accuracy and completeness to avoid errors that could lead to penalties.

- Submit the completed form according to the preferred method: online, by mail, or in person.

Legal Use of the CRS 1 Long Form New Mexico

The CRS 1 Long Form is legally recognized as a valid means of reporting tax information in New Mexico. To ensure its legal standing, it must be completed in accordance with state laws and regulations. This includes adhering to deadlines for submission and maintaining accurate records to support the information reported. Compliance with these legal requirements helps prevent issues with the New Mexico Taxation and Revenue Department and ensures that taxpayers fulfill their obligations.

Required Documents for the CRS 1 Long Form

Before filling out the CRS 1 Long Form, it is essential to gather the necessary documents that support the information being reported. Key documents include:

- Sales records detailing gross receipts.

- Invoices and receipts for deductions claimed.

- Previous tax filings that may provide context or reference.

- Any correspondence from the New Mexico Taxation and Revenue Department related to tax obligations.

Form Submission Methods

The CRS 1 Long Form can be submitted through various methods, allowing flexibility for taxpayers. Options include:

- Online submission: Utilize the New Mexico Taxation and Revenue Department's online portal for quick and efficient filing.

- Mail: Send the completed form to the designated address provided in the form instructions.

- In-person: Deliver the form directly to a local office of the New Mexico Taxation and Revenue Department.

Quick guide on how to complete crs 1 long form new mexico

Complete Crs 1 Long Form New Mexico effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly substitute for traditional printed and signed documents, allowing you to acquire the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents quickly and without delays. Manage Crs 1 Long Form New Mexico on any platform with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to modify and eSign Crs 1 Long Form New Mexico with ease

- Locate Crs 1 Long Form New Mexico and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight pertinent sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign feature, which takes seconds and carries the same legal significance as a conventional handwritten signature.

- Review the details and click on the Done button to finalize your changes.

- Choose how you want to send your form, whether by email, SMS, invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Edit and eSign Crs 1 Long Form New Mexico and ensure exceptional communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the crs 1 long form new mexico

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the CRS 1 Long Form Combined Report System Fill in Form?

The CRS 1 Long Form Combined Report System Fill in Form is a comprehensive electronic document that simplifies the reporting process for businesses. This form allows for easy filling and submission, ensuring compliance with regulatory standards. With airSlate SignNow, you can complete and eSign this form seamlessly.

-

How does airSlate SignNow enhance the CRS 1 Long Form Combined Report System Fill in Form process?

airSlate SignNow streamlines the CRS 1 Long Form Combined Report System Fill in Form by providing an intuitive interface for filling and eSigning. Users benefit from automated workflows, reducing manual errors and time spent on document management. This means you can focus on your core business operations while ensuring efficient reporting.

-

Is there a cost associated with using the CRS 1 Long Form Combined Report System Fill in Form on airSlate SignNow?

Yes, there is a pricing structure for using the CRS 1 Long Form Combined Report System Fill in Form within airSlate SignNow. Our pricing is competitive and tailored to meet the needs of businesses of all sizes. You can choose from different plans that suit your requirements, ensuring you only pay for what you need.

-

What features does airSlate SignNow offer for the CRS 1 Long Form Combined Report System Fill in Form?

AirSlate SignNow offers a variety of features for the CRS 1 Long Form Combined Report System Fill in Form including customizable templates, electronic signature capabilities, and secure cloud storage. These features ensure that your documents are easy to manage and securely stored. You can also track the status of your form in real-time.

-

Can I integrate the CRS 1 Long Form Combined Report System Fill in Form with other software applications?

Absolutely! airSlate SignNow supports various integrations for the CRS 1 Long Form Combined Report System Fill in Form, allowing you to connect with tools like CRM systems, project management software, and more. This adaptability enhances your workflow and keeps your data synchronized across applications.

-

What are the benefits of using the CRS 1 Long Form Combined Report System Fill in Form with airSlate SignNow?

Using the CRS 1 Long Form Combined Report System Fill in Form with airSlate SignNow provides numerous benefits, such as increased efficiency, better compliance tracking, and enhanced security. The platform allows for quick access and submission of forms, saving you time and ensuring accuracy. By reducing manual processes, you also minimize the risk of errors.

-

How can I ensure the security of my CRS 1 Long Form Combined Report System Fill in Form?

airSlate SignNow prioritizes security for your CRS 1 Long Form Combined Report System Fill in Form through features like encryption and secure user authentication. This ensures that only authorized personnel have access to sensitive information. Regular audits and compliance checks further enhance the reliability of our platform.

Get more for Crs 1 Long Form New Mexico

Find out other Crs 1 Long Form New Mexico

- How To Sign Wyoming Non-Profit Business Plan Template

- How To Sign Wyoming Non-Profit Credit Memo

- Sign Wisconsin Non-Profit Rental Lease Agreement Simple

- Sign Wisconsin Non-Profit Lease Agreement Template Safe

- Sign South Dakota Life Sciences Limited Power Of Attorney Mobile

- Sign Alaska Plumbing Moving Checklist Later

- Sign Arkansas Plumbing Business Plan Template Secure

- Sign Arizona Plumbing RFP Mobile

- Sign Arizona Plumbing Rental Application Secure

- Sign Colorado Plumbing Emergency Contact Form Now

- Sign Colorado Plumbing Emergency Contact Form Free

- How Can I Sign Connecticut Plumbing LLC Operating Agreement

- Sign Illinois Plumbing Business Plan Template Fast

- Sign Plumbing PPT Idaho Free

- How Do I Sign Wyoming Life Sciences Confidentiality Agreement

- Sign Iowa Plumbing Contract Safe

- Sign Iowa Plumbing Quitclaim Deed Computer

- Sign Maine Plumbing LLC Operating Agreement Secure

- How To Sign Maine Plumbing POA

- Sign Maryland Plumbing Letter Of Intent Myself