Rev 420 1999-2026

What is the Rev 420

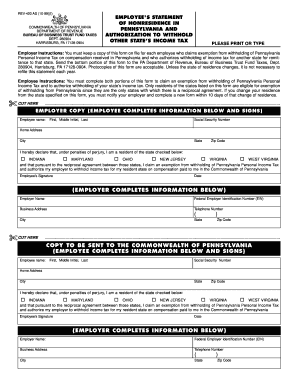

The Rev 420 form, also known as the Rev 420 authorization to withhold, is a crucial document used primarily in the context of tax withholdings in the United States. This form allows taxpayers to authorize their employers or other entities to withhold a specified amount from their income for tax purposes. It serves as a formal request to ensure that the correct amount of taxes is withheld, helping to prevent underpayment or overpayment of taxes throughout the year.

How to use the Rev 420

Using the Rev 420 form involves a few straightforward steps. First, obtain the form from a reliable source, such as the official state tax website or your employer. Next, fill out the required fields, which typically include personal information, the amount to be withheld, and any relevant tax identification numbers. Once completed, submit the form to your employer or the designated entity responsible for processing withholdings. It's essential to keep a copy for your records.

Steps to complete the Rev 420

Completing the Rev 420 form can be done efficiently by following these steps:

- Download the Rev 420 form from an official source.

- Fill in your personal details, including your name, address, and Social Security number.

- Specify the amount you wish to have withheld from your income.

- Review the form for accuracy to avoid any mistakes.

- Submit the completed form to your employer or the relevant tax authority.

Legal use of the Rev 420

The legal use of the Rev 420 form is defined by tax regulations that govern withholdings in the United States. For the form to be considered valid, it must be filled out accurately and submitted in a timely manner. Compliance with federal and state tax laws is essential, as improper use of the form can lead to penalties or issues with tax filings. The Rev 420 form also aligns with the legal requirements for electronic signatures, making it suitable for digital submission through secure platforms.

Key elements of the Rev 420

Several key elements must be included in the Rev 420 form to ensure its validity:

- Personal Information: Full name, address, and Social Security number.

- Withholding Amount: The specific dollar amount or percentage to be withheld.

- Signature: The taxpayer's signature, which may also require a date.

- Employer Information: Details of the employer or entity processing the withholding.

Examples of using the Rev 420

There are various scenarios in which the Rev 420 form may be utilized. For instance, a new employee may fill out the form to establish their withholding preferences upon starting a job. Additionally, individuals who experience a significant change in income or tax situation, such as getting married or having a child, may choose to submit a new Rev 420 to adjust their withholding amounts accordingly. These examples illustrate the form's versatility in managing tax obligations effectively.

Quick guide on how to complete rev 420

Complete Rev 420 effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, enabling you to access the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Rev 420 on any device using airSlate SignNow's Android or iOS applications and enhance any document-based process today.

Effortlessly edit and eSign Rev 420

- Find Rev 420 and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of the documents or obscure sensitive data with tools provided by airSlate SignNow specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, cumbersome form navigation, or errors that require printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from your preferred device. Modify and eSign Rev 420 and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the rev 420

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is rev 420 and how does it relate to airSlate SignNow?

Rev 420 is a powerful feature designed to enhance document signing and management within airSlate SignNow. It streamlines workflows, allowing users to send, sign, and manage documents securely and efficiently, making it an essential tool for businesses.

-

What pricing options are available for airSlate SignNow's rev 420 feature?

AirSlate SignNow offers several pricing plans that include access to rev 420, catering to different business sizes and needs. You can choose from monthly or annual subscriptions, providing flexibility to find the best fit for your organization’s budget and requirements.

-

What are the key features of the rev 420 capability in airSlate SignNow?

Rev 420 includes features like customizable templates, automated workflows, and secure eSignature options, all aimed at improving document efficiency. These robust functionalities simplify the entire signing process, making it user-friendly and effective for businesses.

-

How can rev 420 benefit my business?

Rev 420 helps businesses streamline their document processes, saving time and reducing errors. By implementing airSlate SignNow and utilizing rev 420, organizations can boost productivity and enhance collaboration among team members and clients.

-

Is rev 420 easy to integrate with other applications?

Yes, rev 420 is designed for seamless integration with various applications such as CRMs, document management systems, and productivity tools. This flexibility allows businesses to create a cohesive workflow and maximize the efficiency of their operations.

-

Can rev 420 help with compliance and security for document signing?

Certainly! Rev 420 within airSlate SignNow meets industry-standard compliance regulations and offers robust security features, such as encryption and audit trails. This ensures that your documents are signed securely while maintaining compliance with regulations.

-

Are there any limitations to using rev 420 in airSlate SignNow?

While rev 420 offers comprehensive features, users may encounter limitations based on their selected pricing plan. To access the full suite of capabilities, it is essential to review the plan details and choose the one that best suits your business needs.

Get more for Rev 420

- Yfci cacfp infant menu form 0 5 months

- Yatzy score sheet form

- As32 antrag auf rckzahlung formular forms2web electronic forms

- Introduction to linguistics schoolrack form

- Dd form 2889 quotcritical acquisition position

- Proofread contract template form

- Promotion contract template form

- Proof of concept contract template 787753981 form

Find out other Rev 420

- eSign Nevada Plumbing Business Letter Template Later

- eSign Nevada Plumbing Lease Agreement Form Myself

- eSign Plumbing PPT New Jersey Later

- eSign New York Plumbing Rental Lease Agreement Simple

- eSign North Dakota Plumbing Emergency Contact Form Mobile

- How To eSign North Dakota Plumbing Emergency Contact Form

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template

- eSign Vermont Orthodontists Rental Application Now

- Help Me With eSign Oregon Plumbing Business Plan Template

- eSign Pennsylvania Plumbing RFP Easy

- Can I eSign Pennsylvania Plumbing RFP

- eSign Pennsylvania Plumbing Work Order Free

- Can I eSign Pennsylvania Plumbing Purchase Order Template

- Help Me With eSign South Carolina Plumbing Promissory Note Template

- How To eSign South Dakota Plumbing Quitclaim Deed

- How To eSign South Dakota Plumbing Affidavit Of Heirship

- eSign South Dakota Plumbing Emergency Contact Form Myself

- eSign Texas Plumbing Resignation Letter Free

- eSign West Virginia Orthodontists Living Will Secure