1099 Information Request Form

What is the 1099 Information Request Form

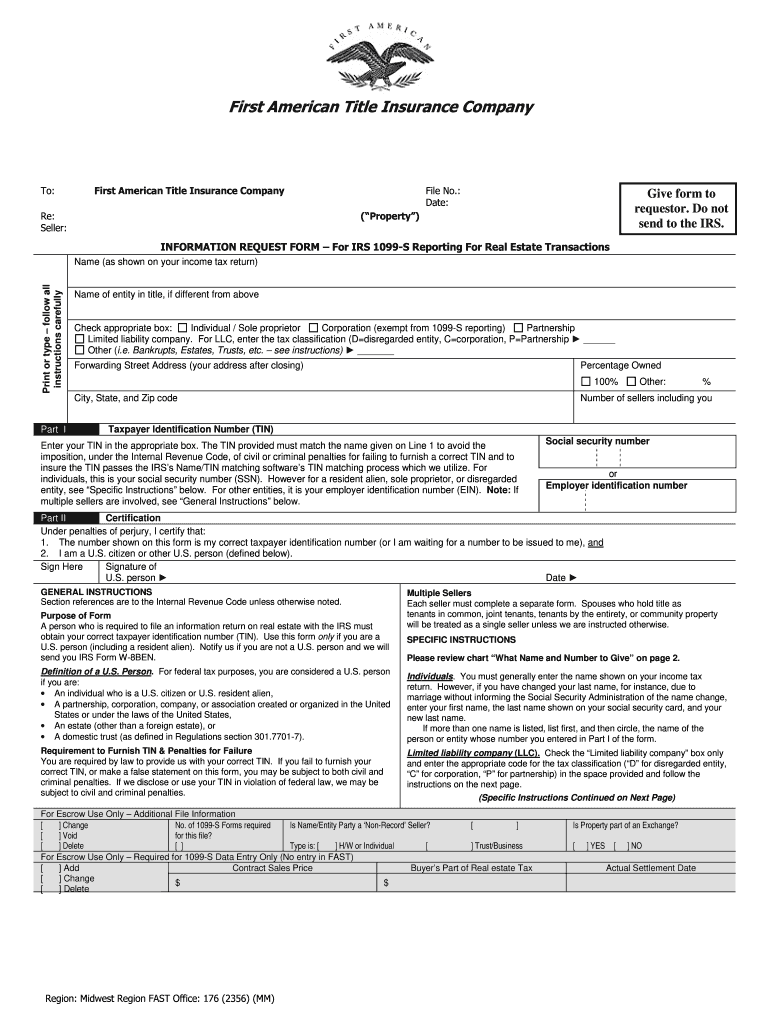

The 1099 information request form is a crucial document used in the United States for tax purposes. It allows individuals or businesses to request information regarding payments made to them or by them that may be subject to taxation. This form is particularly important for self-employed individuals, freelancers, and contractors who receive income that must be reported to the Internal Revenue Service (IRS). The information collected through this form assists in ensuring accurate reporting of income and compliance with tax obligations.

How to use the 1099 Information Request Form

Using the 1099 information request form involves several straightforward steps. First, ensure you have the correct version of the form, which can typically be obtained from the IRS website or through tax preparation software. Next, fill out the required fields, including your name, address, and taxpayer identification number. If you are requesting information from another party, include their details as well. Once completed, submit the form to the appropriate entity, such as a client or financial institution, to obtain the necessary tax information.

Steps to complete the 1099 Information Request Form

Completing the 1099 information request form requires attention to detail. Follow these steps for accurate completion:

- Obtain the latest version of the form from a reliable source.

- Fill in your personal information, including your name and address.

- Provide your taxpayer identification number, which may be your Social Security number or Employer Identification Number.

- Include the information of the party from whom you are requesting data.

- Review the form for accuracy before submitting it.

Legal use of the 1099 Information Request Form

The legal use of the 1099 information request form is essential for compliance with IRS regulations. This form serves as a formal request for information that may impact tax filings. Proper use ensures that both the requester and the provider of the information adhere to tax laws, reducing the risk of penalties or audits. It is important to keep a copy of the submitted form for your records, as it may be needed for future reference or in case of disputes.

Key elements of the 1099 Information Request Form

Several key elements are essential when completing the 1099 information request form. These include:

- Requester Information: Your name, address, and taxpayer identification number.

- Recipient Information: The name and address of the person or entity from whom you are requesting information.

- Purpose of Request: A brief explanation of why the information is needed.

- Signature: Your signature certifying the accuracy of the information provided.

Filing Deadlines / Important Dates

Filing deadlines for the 1099 information request form can vary based on the specific circumstances. Generally, it is advisable to submit the request as early as possible to ensure timely receipt of the information needed for tax reporting. The IRS typically requires that all 1099 forms be filed by January thirty-first of the following year, but it is essential to check for any updates or changes in deadlines each tax season.

Quick guide on how to complete 1099 information request form

Complete 1099 Information Request Form seamlessly on any device

Managing documents online has gained traction among businesses and individuals. It serves as an excellent eco-friendly alternative to conventional printed and signed paperwork, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage 1099 Information Request Form on any platform with the airSlate SignNow Android or iOS applications and streamline any document-related task today.

The easiest way to modify and eSign 1099 Information Request Form effortlessly

- Locate 1099 Information Request Form and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight pertinent sections of your documents or obscure sensitive data with tools provided by airSlate SignNow specifically for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal authority as a traditional handwritten signature.

- Review all the details and click the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Put an end to lost or misplaced documents, tiresome form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs with just a few clicks from your chosen device. Edit and eSign 1099 Information Request Form and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 1099 information request form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 1099 s information request form?

The 1099 s information request form is a document used by businesses to request tax information from independent contractors. This form ensures that companies can accurately report income for tax purposes. Using airSlate SignNow, you can easily manage and eSign this form, streamlining your documentation process.

-

How can airSlate SignNow help with the 1099 s information request form?

airSlate SignNow provides an easy-to-use platform for creating, sending, and eSigning the 1099 s information request form. Our solution simplifies the process, ensuring that you can collect the necessary information quickly and securely. With automated workflows, you can keep track of document status and reminders.

-

Is there a cost associated with using the 1099 s information request form on airSlate SignNow?

Yes, airSlate SignNow offers flexible pricing plans that include access to features for managing the 1099 s information request form. Depending on your needs, you can choose a plan that suits your budget and usage requirements. We also provide a free trial so you can explore our solution before committing.

-

What features does airSlate SignNow offer for the 1099 s information request form?

airSlate SignNow includes features such as eSignature capabilities, document templates, and secure cloud storage for your 1099 s information request form. You can also customize the form to meet your specific needs, ensuring all required fields are included. Additionally, our platform integrates with various software to enhance your workflow.

-

Can I integrate airSlate SignNow with other applications for managing the 1099 s information request form?

Yes, airSlate SignNow offers a variety of integrations with popular applications like Google Drive, Salesforce, and Dropbox. These integrations allow you to streamline the process of managing your 1099 s information request form by automating data transfer and document retrieval. This ensures your clients and contractors can access forms easily.

-

What are the benefits of using airSlate SignNow for the 1099 s information request form?

Using airSlate SignNow for the 1099 s information request form offers numerous benefits, including improved efficiency, enhanced accuracy, and faster turnaround times. Our platform helps reduce errors associated with manual processing and increases compliance by keeping your documents securely organized. Additionally, eSigning speeds up the approval process.

-

How secure is the 1099 s information request form when using airSlate SignNow?

Security is a top priority at airSlate SignNow. When you use the 1099 s information request form, all data is encrypted and stored securely in compliance with industry standards. Our platform provides audit trails and authentication processes to ensure that only authorized individuals can access and sign your documents.

Get more for 1099 Information Request Form

- Fillable online iowa department of revenue statement of rent paid form

- Va form 21p 601

- Chastity contract template form

- Deliverables track contract template form

- Pay contract template form

- Pay back money contract template form

- Patient safety contract template form

- Pay for performance contract template

Find out other 1099 Information Request Form

- How Do I eSign Hawaii Non-Profit PDF

- How To eSign Hawaii Non-Profit Word

- How Do I eSign Hawaii Non-Profit Presentation

- How Do I eSign Maryland Non-Profit Word

- Help Me With eSign New Jersey Legal PDF

- How To eSign New York Legal Form

- How Can I eSign North Carolina Non-Profit Document

- How To eSign Vermont Non-Profit Presentation

- How Do I eSign Hawaii Orthodontists PDF

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form

- How To eSign Hawaii Plumbing Word

- Help Me With eSign Hawaii Plumbing Document

- How To eSign Hawaii Plumbing Presentation

- How To eSign Maryland Plumbing Document

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT