Wisconsin Form 1 Fillable

What is the Wisconsin Form 1 Fillable

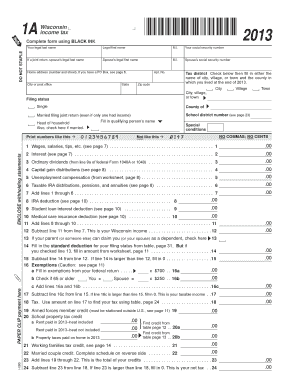

The Wisconsin Form 1 Fillable is a state tax form used by residents of Wisconsin to report their income and calculate their state tax liability. This form is specifically designed for individual taxpayers and is part of the annual tax filing process. The fillable version allows users to complete the form electronically, making it easier to enter information accurately and efficiently. It is essential for individuals to accurately report their income, deductions, and credits to ensure compliance with state tax laws.

How to use the Wisconsin Form 1 Fillable

Using the Wisconsin Form 1 Fillable involves several straightforward steps. First, access the form through a reliable source that offers it in a fillable format. Once you have the form open, you can enter your personal information, including your name, address, and Social Security number. Next, input your income details, such as wages, interest, and dividends. Be sure to follow the instructions provided on the form to ensure that you complete each section correctly. After filling out the necessary information, review the form for accuracy before saving or printing it for submission.

Steps to complete the Wisconsin Form 1 Fillable

Completing the Wisconsin Form 1 Fillable requires attention to detail. Follow these steps for a successful submission:

- Download the form from a trusted source.

- Open the form in a compatible PDF reader that supports fillable forms.

- Fill in your personal information in the designated fields.

- Report your income, including wages, self-employment income, and any other taxable income.

- Claim any applicable deductions and credits as per the instructions.

- Review all entries for accuracy and completeness.

- Save the completed form securely, and prepare it for submission.

Legal use of the Wisconsin Form 1 Fillable

The Wisconsin Form 1 Fillable is legally binding when completed and signed according to state regulations. To ensure its legal validity, it must be filled out accurately, and any required signatures must be provided. Users should be aware of the legal implications of submitting false information, which can lead to penalties or audits. Utilizing a secure platform for e-signatures can further enhance the legitimacy of the form, ensuring compliance with electronic signature laws.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the Wisconsin Form 1 Fillable is crucial for taxpayers. Typically, the deadline for filing individual income tax returns in Wisconsin is April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be aware of any extensions that may apply, as well as the importance of timely submission to avoid penalties and interest on unpaid taxes.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have several options for submitting the Wisconsin Form 1 Fillable. The most convenient method is electronic filing, which can be done through various tax preparation software or online platforms. Alternatively, taxpayers may choose to print the completed form and mail it to the appropriate state tax office. In-person submission is also an option at designated tax offices, although this may require an appointment. Each method has its own processing times and requirements, so it is essential to choose the one that best fits your needs.

Quick guide on how to complete wisconsin form 1 fillable

Effortlessly prepare Wisconsin Form 1 Fillable on any device

The management of online documents has become increasingly common among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to easily locate the right template and securely store it online. airSlate SignNow provides you with all the necessary tools to swiftly create, modify, and eSign your documents without any delays. Manage Wisconsin Form 1 Fillable on any operating system with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and eSign Wisconsin Form 1 Fillable with ease

- Obtain Wisconsin Form 1 Fillable and click on Get Form to begin.

- Utilize the tools available to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign feature, which takes only seconds and has the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your changes.

- Select how you wish to send your form – via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or disorganized documents, tedious form searching, or errors requiring the printing of new document versions. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Wisconsin Form 1 Fillable while ensuring excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the wisconsin form 1 fillable

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Wisconsin Form 1 2018 fillable?

The Wisconsin Form 1 2018 fillable is the standard individual income tax return form used by residents of Wisconsin. It allows users to report their income, deductions, and credits in a digital, easy-to-fill format. This form simplifies the tax filing process by allowing secure e-signatures and efficient electronic submissions.

-

How can I access the Wisconsin Form 1 2018 fillable using airSlate SignNow?

To access the Wisconsin Form 1 2018 fillable, simply visit the airSlate SignNow platform and search for the form in our templates section. Once you locate it, you can easily fill it out online, add your electronic signature, and submit it directly to the appropriate tax authorities. Our platform ensures that the process is efficient and secure.

-

Is airSlate SignNow affordable for filling out the Wisconsin Form 1 2018 fillable?

Yes, airSlate SignNow offers a cost-effective solution for filling out the Wisconsin Form 1 2018 fillable. With our competitive pricing plans, you can access all necessary features to complete and submit your tax form without breaking the bank. Additionally, we often offer discounts and promotions to help you save even more.

-

What features does airSlate SignNow provide for the Wisconsin Form 1 2018 fillable?

airSlate SignNow provides various features to enhance your experience with the Wisconsin Form 1 2018 fillable. These include real-time collaboration, secure e-signature capabilities, cloud storage, and automated workflows. These features ensure that you have a seamless and efficient tax-filing experience.

-

Can I save my progress on the Wisconsin Form 1 2018 fillable and complete it later?

Yes, airSlate SignNow allows you to save your progress on the Wisconsin Form 1 2018 fillable. You can return to your form at any time to complete it at your convenience. This feature is particularly useful for users who may need more time to gather the necessary information before final submission.

-

Does airSlate SignNow integrate with other software for tax filing?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and business software, making it easy to manage your financial data while filling out the Wisconsin Form 1 2018 fillable. Integrations with popular platforms ensure that you can streamline your tax filing process, keeping everything in one cohesive system.

-

Are electronic signatures valid for the Wisconsin Form 1 2018 fillable?

Yes, electronic signatures are fully valid for the Wisconsin Form 1 2018 fillable when submitted through airSlate SignNow. Our platform complies with all state regulations and ensures that your e-signatures meet the legal requirements for tax documents. This makes the process quick and efficient without compromising on legality.

Get more for Wisconsin Form 1 Fillable

- Fill ionorth carolina division of motorfill north carolina division of motor vehicles request for form

- Monitech inc form

- Initial incident response form form for initial incident response report ihs

- Form 2728 5520867

- Lawrence twp bd of trustees v canal fulton ohio form

- Request for credit for attendance at a cle activity outside ohio ccle form 1a

- Mail payment form franklin county municipal court clerk website

- Fillable online pickerington mayors court fax email print form

Find out other Wisconsin Form 1 Fillable

- Sign Maryland Plumbing Letter Of Intent Myself

- Sign Hawaii Orthodontists Claim Free

- Sign Nevada Plumbing Job Offer Easy

- Sign Nevada Plumbing Job Offer Safe

- Sign New Jersey Plumbing Resignation Letter Online

- Sign New York Plumbing Cease And Desist Letter Free

- Sign Alabama Real Estate Quitclaim Deed Free

- How Can I Sign Alabama Real Estate Affidavit Of Heirship

- Can I Sign Arizona Real Estate Confidentiality Agreement

- How Do I Sign Arizona Real Estate Memorandum Of Understanding

- Sign South Dakota Plumbing Job Offer Later

- Sign Tennessee Plumbing Business Letter Template Secure

- Sign South Dakota Plumbing Emergency Contact Form Later

- Sign South Dakota Plumbing Emergency Contact Form Myself

- Help Me With Sign South Dakota Plumbing Emergency Contact Form

- How To Sign Arkansas Real Estate Confidentiality Agreement

- Sign Arkansas Real Estate Promissory Note Template Free

- How Can I Sign Arkansas Real Estate Operating Agreement

- Sign Arkansas Real Estate Stock Certificate Myself

- Sign California Real Estate IOU Safe