Letter of Credit Example Form

What is the sample letter of credit?

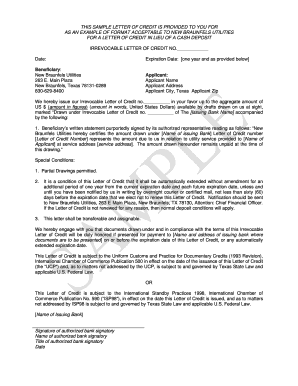

A sample letter of credit is a financial document issued by a bank or financial institution that guarantees payment to a seller on behalf of a buyer. This document serves as a promise that the bank will pay the seller a specified amount if certain conditions are met. It is often used in international trade to reduce risks associated with transactions. The letter outlines the terms and conditions under which the payment will be made, making it a crucial tool for both buyers and sellers in ensuring secure transactions.

Key elements of the sample letter of credit

Understanding the key elements of a sample letter of credit is essential for effective use. These elements typically include:

- Parties Involved: The buyer (applicant), seller (beneficiary), and the issuing bank.

- Amount: The total sum that the bank guarantees to pay the seller.

- Expiration Date: The date by which the seller must present the necessary documents to receive payment.

- Conditions: Specific requirements that must be met for the payment to be executed, such as shipping documents or invoices.

- Type: Whether the letter of credit is revocable or irrevocable, affecting the flexibility of changes to the agreement.

Steps to complete the sample letter of credit

Completing a sample letter of credit involves several important steps to ensure accuracy and compliance. Here is a simplified process:

- Gather Information: Collect all necessary details about the transaction, including the buyer's and seller's information, and the terms of sale.

- Draft the Letter: Use a template or sample letter of credit to draft the document, ensuring all key elements are included.

- Submit for Approval: Present the draft to the issuing bank for review and approval. They may require additional documentation.

- Receive the Issued Letter: Once approved, the bank will issue the letter of credit to the seller, confirming the terms.

- Monitor Compliance: Ensure that all conditions outlined in the letter are met before the expiration date to facilitate payment.

Legal use of the sample letter of credit

The legal use of a sample letter of credit is governed by various regulations and standards. In the United States, letters of credit are subject to the Uniform Commercial Code (UCC), which provides guidelines for their execution and enforcement. Additionally, the International Chamber of Commerce (ICC) sets forth the Uniform Customs and Practice for Documentary Credits (UCP), which is widely accepted in international transactions. Compliance with these legal frameworks ensures that the letter of credit is enforceable in a court of law and protects the interests of all parties involved.

How to obtain the sample letter of credit

Obtaining a sample letter of credit typically involves working with a financial institution. Here are the steps to follow:

- Identify a Bank: Choose a bank that offers letters of credit as part of their services.

- Prepare Documentation: Gather all necessary documentation related to the transaction, including contracts and identification.

- Submit Application: Complete the bank's application form for a letter of credit, providing all required information.

- Review Terms: Discuss the terms and conditions with the bank representative to ensure clarity.

- Receive the Letter: Once approved, the bank will issue the letter of credit, which you can then share with the seller.

Examples of using the sample letter of credit

Sample letters of credit can be used in various scenarios, particularly in international trade. Here are a few examples:

- Importing Goods: A U.S. company may use a letter of credit to ensure payment to a foreign supplier upon shipment of goods.

- Exporting Products: An exporter may require a letter of credit from a foreign buyer to guarantee payment before shipping products.

- Utility Payments: Businesses may use letters of credit to secure payment arrangements with utility companies, ensuring service continuity.

Quick guide on how to complete letter of credit example

Effortlessly prepare Letter Of Credit Example on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed papers, as you can easily locate the appropriate form and securely store it online. airSlate SignNow gives you all the tools necessary to create, modify, and eSign your documents rapidly without delays. Handle Letter Of Credit Example on any platform with the airSlate SignNow Android or iOS applications and enhance any document-driven process today.

How to adjust and eSign Letter Of Credit Example with ease

- Locate Letter Of Credit Example and click Get Form to begin.

- Use the tools we offer to fill out your document.

- Highlight important sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your modifications.

- Select how you would like to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worries of lost or misfiled documents, tedious form searches, or errors that require printing new copies. airSlate SignNow caters to your document management needs in just a few clicks from your preferred device. Edit and eSign Letter Of Credit Example to ensure effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the letter of credit example

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a sample letter of credit PDF?

A sample letter of credit PDF is a downloadable document that outlines the standard format and terms of a letter of credit. It serves as a helpful reference for businesses looking to understand how to structure their own letters of credit. By providing this sample, airSlate SignNow makes it easier for companies to comply with financial regulations.

-

How can I create a sample letter of credit PDF using airSlate SignNow?

To create a sample letter of credit PDF with airSlate SignNow, simply use our user-friendly document editor to customize your letter. You can insert necessary details, adjust the format, and save it as a PDF for easy sharing and eSigning. Our platform streamlines the entire process, allowing users to create professional documents efficiently.

-

Are there any costs associated with downloading a sample letter of credit PDF?

No, downloading a sample letter of credit PDF from airSlate SignNow is completely free. We believe in empowering businesses by providing valuable resources at no cost. However, if you wish to use our advanced eSignature features, a subscription may be required.

-

What features does airSlate SignNow offer for managing letters of credit?

AirSlate SignNow provides a variety of features for managing letters of credit, including electronic signatures, document templates, and tracking options. Users can also collaborate in real-time, ensuring that all parties can sign and review the letter swiftly. This enhances efficiency and reduces the turnaround time signNowly.

-

Can I integrate airSlate SignNow with other software when managing letters of credit?

Yes, airSlate SignNow offers seamless integrations with various third-party applications, including CRM systems and cloud storage services. This allows you to easily manage your letters of credit alongside your other business operations and maintain organized documentation. Our open API further enhances these integration capabilities.

-

What are the benefits of using airSlate SignNow for letters of credit?

Using airSlate SignNow for letters of credit ensures that your documents are legally binding and securely managed. You benefit from enhanced workflow efficiency, reduced paper usage, and the ability to eSign documents anytime, anywhere. With our platform, you simplify compliance and improve communication among stakeholders.

-

Is it easy to share a sample letter of credit PDF with others?

Absolutely! AirSlate SignNow allows you to easily share your sample letter of credit PDF with colleagues, clients, or partners via email or direct links. You can also control access permissions, ensuring that only authorized individuals can view or edit the document. This feature fosters collaboration while maintaining document integrity.

Get more for Letter Of Credit Example

Find out other Letter Of Credit Example

- Electronic signature Oregon Police Living Will Now

- Electronic signature Pennsylvania Police Executive Summary Template Free

- Electronic signature Pennsylvania Police Forbearance Agreement Fast

- How Do I Electronic signature Pennsylvania Police Forbearance Agreement

- How Can I Electronic signature Pennsylvania Police Forbearance Agreement

- Electronic signature Washington Real Estate Purchase Order Template Mobile

- Electronic signature West Virginia Real Estate Last Will And Testament Online

- Electronic signature Texas Police Lease Termination Letter Safe

- How To Electronic signature Texas Police Stock Certificate

- How Can I Electronic signature Wyoming Real Estate Quitclaim Deed

- Electronic signature Virginia Police Quitclaim Deed Secure

- How Can I Electronic signature West Virginia Police Letter Of Intent

- How Do I Electronic signature Washington Police Promissory Note Template

- Electronic signature Wisconsin Police Permission Slip Free

- Electronic signature Minnesota Sports Limited Power Of Attorney Fast

- Electronic signature Alabama Courts Quitclaim Deed Safe

- How To Electronic signature Alabama Courts Stock Certificate

- Can I Electronic signature Arkansas Courts Operating Agreement

- How Do I Electronic signature Georgia Courts Agreement

- Electronic signature Georgia Courts Rental Application Fast