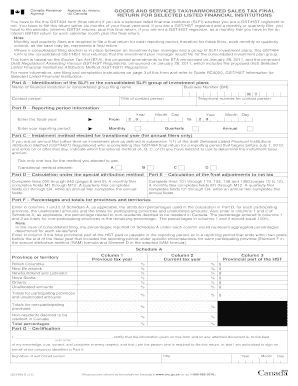

Gst34 Form

What is the GST34?

The GST34, also known as the Goods and Services Tax Return Form GST34, is a crucial document for businesses in Canada. It is used to report goods and services tax (GST) collected and paid on taxable supplies. This form is essential for ensuring compliance with tax regulations and for businesses to reclaim any GST they have paid on their purchases. Understanding the GST34 is vital for maintaining accurate financial records and fulfilling tax obligations.

How to Obtain the GST34

To obtain the GST34 form, businesses can access it through the Canada Revenue Agency (CRA) website. The form is available in a fillable PDF format, allowing users to complete it digitally. Additionally, businesses can request a paper version if they prefer to fill it out by hand. It is important to ensure that the correct version of the form is used, as there may be updates or changes in regulations that affect its content.

Steps to Complete the GST34

Completing the GST34 involves several key steps:

- Gather all relevant financial documents, including sales records and receipts for purchases.

- Calculate the total GST collected on sales and the total GST paid on purchases.

- Fill out the GST34 form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the completed form to the CRA by the specified deadline.

Legal Use of the GST34

The GST34 must be used in accordance with Canadian tax laws. This means that businesses must ensure they are reporting accurate figures and adhering to deadlines set by the CRA. Failure to comply with these regulations can result in penalties or audits. It is advisable for businesses to keep thorough records of all transactions and maintain a copy of the submitted form for their records.

Filing Deadlines / Important Dates

Filing deadlines for the GST34 vary depending on the reporting period of the business. Typically, businesses must file their GST34 quarterly or annually. It is essential to be aware of these deadlines to avoid late filing penalties. The CRA provides a schedule of due dates on their website, which businesses should consult to ensure timely submissions.

Required Documents

When completing the GST34, businesses need to prepare several documents:

- Sales invoices that detail the GST collected.

- Purchase receipts that show the GST paid.

- Any previous GST34 forms filed, if applicable.

- Records of any adjustments or corrections made to previous filings.

Form Submission Methods

The GST34 can be submitted through various methods, providing flexibility for businesses. Options include:

- Online submission through the CRA's secure portal.

- Mailing a paper copy of the completed form to the appropriate CRA office.

- In-person submission at designated CRA locations, though this option may be limited.

Quick guide on how to complete gst34

Complete Gst34 effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, edit, and eSign your documents swiftly without delays. Manage Gst34 on any device using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

The easiest way to edit and eSign Gst34 with minimal effort

- Find Gst34 and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select how you wish to deliver your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Edit and eSign Gst34 and ensure outstanding communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the gst34

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is gst34 2 and how does it relate to airSlate SignNow?

The gst34 2 is a feature within airSlate SignNow designed to streamline the document signing process. This solution allows businesses to efficiently manage their electronic signatures, ensuring compliance and security in their transactions. By incorporating gst34 2, users can enhance their workflow and boost productivity.

-

How much does airSlate SignNow cost when using gst34 2?

AirSlate SignNow offers competitive pricing tiers that include access to the gst34 2 feature. Pricing depends on the plan selected, but the cost-effectiveness of airSlate SignNow makes it an attractive option for businesses looking to integrate digital signature solutions. Contact our sales team for a detailed pricing breakdown.

-

What features does gst34 2 include with airSlate SignNow?

The gst34 2 feature includes capabilities such as customizable templates, real-time tracking of document status, and robust security measures. These tools enable users to efficiently send, sign, and store documents all in one place. AirSlate SignNow is designed to enhance user experience while ensuring compliance.

-

What benefits does using gst34 2 provide for businesses?

By utilizing gst34 2, businesses can signNowly reduce the time spent on document management tasks. The feature enhances operational efficiency by automating processes and providing users with flexibility in document handling. Additionally, this leads to quicker turnaround times for eSigning, improving overall customer satisfaction.

-

Can gst34 2 integrate with other software applications?

Yes, gst34 2 is designed to integrate seamlessly with various software applications including CRM systems, cloud storage services, and productivity tools. This integration enhances the overall functionality of airSlate SignNow, enabling a more cohesive workflow. Users can easily connect their existing systems to maximize efficiency.

-

Is the gst34 2 feature secure for sensitive documents?

Absolutely, the gst34 2 feature prioritizes security by employing top-level encryption and compliance with industry standards. This ensures that sensitive documents are protected throughout the signing process. Users can confidently send and manage their documents knowing that airSlate SignNow safeguards their data.

-

How easy is it to use the gst34 2 feature in airSlate SignNow?

The gst34 2 feature is designed with user-friendliness in mind. With an intuitive interface, users can quickly learn how to utilize its functionalities without extensive training. This makes it accessible for teams of any size to enhance their document signing workflows effortlessly.

Get more for Gst34

- Notice of changes to credit card agreement 497331610 form

- Agreement one year form

- Helmet waiver in favor of a business offering pony rides form

- Registration and medical release form for minors to participate in roofing earn while you learn program

- Performance review employment

- Sample letter support form

- Letter lien form

- Construction projects form

Find out other Gst34

- eSign Ohio High Tech Letter Of Intent Later

- eSign North Dakota High Tech Quitclaim Deed Secure

- eSign Nebraska Healthcare / Medical LLC Operating Agreement Simple

- eSign Nebraska Healthcare / Medical Limited Power Of Attorney Mobile

- eSign Rhode Island High Tech Promissory Note Template Simple

- How Do I eSign South Carolina High Tech Work Order

- eSign Texas High Tech Moving Checklist Myself

- eSign Texas High Tech Moving Checklist Secure

- Help Me With eSign New Hampshire Government Job Offer

- eSign Utah High Tech Warranty Deed Simple

- eSign Wisconsin High Tech Cease And Desist Letter Fast

- eSign New York Government Emergency Contact Form Online

- eSign North Carolina Government Notice To Quit Now

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple