Tax Exempt Form Texas

What is the Tax Exempt Form Texas

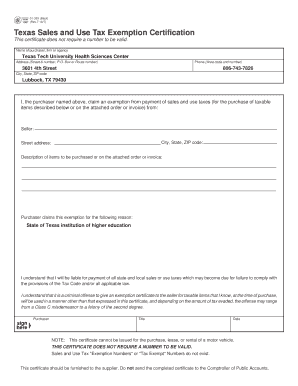

The Tax Exempt Form Texas is a document used by organizations in Texas to claim exemption from sales and use taxes. This form is essential for qualifying entities, such as non-profit organizations, religious institutions, and certain educational institutions, allowing them to make purchases without incurring sales tax. The form certifies that the organization meets specific criteria set forth by the Texas Comptroller of Public Accounts, enabling tax-exempt status for qualifying purchases.

How to use the Tax Exempt Form Texas

To use the Tax Exempt Form Texas, an eligible organization must complete the form accurately and present it to vendors during the purchase of goods or services. The vendor must retain a copy of the completed form for their records. It is crucial to ensure that the purchases made with this form are directly related to the organization's exempt purpose, as misuse can lead to penalties. Organizations should also maintain proper documentation to support their tax-exempt status.

Steps to complete the Tax Exempt Form Texas

Completing the Tax Exempt Form Texas involves several key steps:

- Obtain the form from the Texas Comptroller's website or through authorized channels.

- Fill in the organization's name, address, and Texas taxpayer identification number.

- Indicate the type of exemption being claimed, such as non-profit or religious.

- Provide a description of the items or services to be purchased tax-exempt.

- Sign and date the form to certify its accuracy.

After completing the form, present it to the vendor during the transaction.

Legal use of the Tax Exempt Form Texas

The legal use of the Tax Exempt Form Texas requires adherence to specific guidelines established by the Texas Comptroller. Organizations must ensure they qualify for tax exemption and that their purchases align with their exempt purposes. Misrepresentation or improper use of the form can result in penalties, including fines or loss of tax-exempt status. It is advisable for organizations to keep records of all transactions made using the form to demonstrate compliance during audits.

Eligibility Criteria

Eligibility for using the Tax Exempt Form Texas is generally restricted to certain types of organizations. These include:

- Non-profit organizations recognized under IRS Section 501(c)(3).

- Religious organizations.

- Educational institutions.

- Government entities.

Each organization must meet specific criteria to qualify for tax exemption and should verify their status with the Texas Comptroller before using the form.

Who Issues the Form

The Tax Exempt Form Texas is issued by the Texas Comptroller of Public Accounts. This state agency oversees tax collection and administration, including the regulation of sales and use tax exemptions. Organizations seeking to use the form should ensure they are familiar with the guidelines provided by the Comptroller to maintain compliance and understand their responsibilities regarding tax-exempt purchases.

Quick guide on how to complete tax exempt form texas

Effortlessly prepare Tax Exempt Form Texas on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed papers, as you can easily locate the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly and without delays. Manage Tax Exempt Form Texas on any platform using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to modify and eSign Tax Exempt Form Texas effortlessly

- Locate Tax Exempt Form Texas and click on Get Form to begin.

- Use the tools we provide to fill out your form.

- Highlight relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign feature, which takes just seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method for sharing your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require reprinting new copies. airSlate SignNow fulfills all your document administration needs in just a few clicks from your preferred device. Modify and electronically sign Tax Exempt Form Texas, ensuring effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tax exempt form texas

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Tax Exempt Form Texas?

A Tax Exempt Form Texas is a document used by organizations and individuals to claim exemption from state taxes. This form is essential for qualifying entities such as non-profits and government bodies to avoid unnecessary taxation on purchases.

-

How can airSlate SignNow help with the Tax Exempt Form Texas?

airSlate SignNow simplifies the process of preparing and submitting the Tax Exempt Form Texas. With our electronic signature features, you can quickly gather required signatures and securely store your documents, making compliance easy and efficient.

-

Is there a cost associated with using airSlate SignNow for the Tax Exempt Form Texas?

Yes, airSlate SignNow offers various pricing plans to suit different business needs, including options for effectively managing your Tax Exempt Form Texas. Each plan provides a range of features to streamline document signing and management, ensuring value for your investment.

-

What features does airSlate SignNow offer for managing Tax Exempt Form Texas?

Our platform provides features like customizable templates, real-time status tracking, and automated reminders, all tailored to managing the Tax Exempt Form Texas. These tools enhance document workflow efficiency and ensure that you remain organized and compliant.

-

Can I integrate airSlate SignNow with other software while managing the Tax Exempt Form Texas?

Absolutely! airSlate SignNow offers seamless integrations with various applications, such as CRM and accounting software. This functionality enhances your workflow when handling documents like the Tax Exempt Form Texas, allowing for smooth data transitions.

-

What benefits does airSlate SignNow provide for organizations dealing with the Tax Exempt Form Texas?

Using airSlate SignNow for your Tax Exempt Form Texas enables quicker processing times, reduced paperwork, and improved accuracy. Moreover, the ease of electronic signatures helps organizations save time and ensures compliance with state regulations.

-

How do I get started with airSlate SignNow for my Tax Exempt Form Texas?

Getting started with airSlate SignNow is simple! Sign up for an account, explore our templates for the Tax Exempt Form Texas, and begin customizing your documents. Our user-friendly interface makes the process quick and intuitive.

Get more for Tax Exempt Form Texas

- St johns regional medical centeroxnard cadignity health form

- Bmchp medical prior auth form rev 3 24 11 doc

- Customer service parkview health laboratory test directory form

- Doctors first p c authorization to release form

- 111 michigan avenue nw washington dc 20010 surg form

- Metropolitan life insurance company statement of health form

- Principal std claim form pdf

- 3190domestic partner affidavit page 1 of 3instruct form

Find out other Tax Exempt Form Texas

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free

- Can I eSign Montana Courts NDA

- eSign Montana Courts LLC Operating Agreement Mobile

- eSign Oklahoma Sports Rental Application Simple

- eSign Oklahoma Sports Rental Application Easy

- eSign Missouri Courts Lease Agreement Template Mobile

- Help Me With eSign Nevada Police Living Will

- eSign New York Courts Business Plan Template Later

- Can I eSign North Carolina Courts Limited Power Of Attorney

- eSign North Dakota Courts Quitclaim Deed Safe

- How To eSign Rhode Island Sports Quitclaim Deed

- Help Me With eSign Oregon Courts LLC Operating Agreement

- eSign North Dakota Police Rental Lease Agreement Now

- eSign Tennessee Courts Living Will Simple

- eSign Utah Courts Last Will And Testament Free