Form No 9

What is the Form No 9

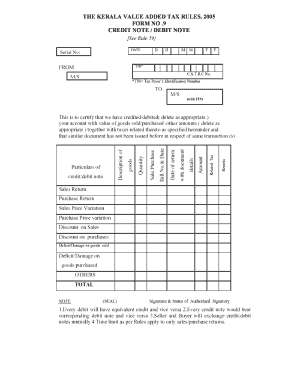

The Form No 9 is a crucial document under the tax rules established in 2005, primarily used for reporting specific financial transactions. This form is essential for businesses and individuals who need to comply with tax regulations, particularly in relation to VAT and credit notes. Understanding its purpose and requirements is vital for accurate tax reporting and compliance.

How to use the Form No 9

Using the Form No 9 involves several steps to ensure proper completion and submission. First, gather all necessary financial documents that pertain to the transactions you are reporting. Next, accurately fill out the form, ensuring that all information is complete and correct. Once completed, the form can be submitted electronically or via traditional mail, depending on your preference and the regulations in your jurisdiction.

Steps to complete the Form No 9

Completing the Form No 9 requires careful attention to detail. Here are the key steps:

- Gather relevant financial records, including invoices and receipts.

- Enter your personal or business information accurately.

- Detail the transactions being reported, ensuring all figures are accurate.

- Review the completed form for errors or omissions.

- Submit the form according to the guidelines provided by the IRS or your local tax authority.

Legal use of the Form No 9

The legal use of Form No 9 is governed by tax regulations that require accurate reporting of financial transactions. This form must be completed in compliance with established laws to ensure its validity. Failure to adhere to these rules can result in penalties or legal repercussions. Therefore, it is essential to understand the legal implications of submitting this form.

Key elements of the Form No 9

Several key elements must be included in the Form No 9 to ensure its validity. These include:

- Accurate identification of the taxpayer or business entity.

- Detailed description of the transactions being reported.

- Correct financial figures that reflect the transactions.

- Signature of the authorized person, if applicable.

Filing Deadlines / Important Dates

Filing deadlines for the Form No 9 can vary based on the type of transaction and the taxpayer's status. It is crucial to be aware of these deadlines to avoid penalties. Typically, forms must be submitted by specific dates aligned with the fiscal year or quarterly reporting periods. Keeping track of these important dates ensures compliance with tax regulations.

Form Submission Methods (Online / Mail / In-Person)

The Form No 9 can be submitted through various methods, including online submissions, mailing a physical copy, or delivering it in person to the appropriate tax authority. Online submission is often the most efficient method, allowing for quicker processing and confirmation. However, it is essential to choose the method that best suits your needs and complies with local regulations.

Quick guide on how to complete form no 9

Complete Form No 9 effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed paperwork, allowing you to access the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Handle Form No 9 on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

The easiest way to modify and eSign Form No 9 with ease

- Obtain Form No 9 and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional pen-and-ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), or invite link, or download it directly to your computer.

Forget about lost or mislaid documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Form No 9 and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form no 9

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the tax rules 2005 form no 9 requirements?

The tax rules 2005 form no 9 outlines specific compliance requirements for businesses when reporting taxes. This form is crucial as it ensures adherence to the legislation set forth in the 2005 tax rules. Understanding these requirements can help streamline your business's tax processes.

-

How does airSlate SignNow help with tax rules 2005 form no 9 compliance?

airSlate SignNow provides businesses with a fluid platform to send and eSign documents essential for compliance with tax rules 2005 form no 9. By simplifying document management, it ensures that all necessary paperwork is completed efficiently and accurately, minimizing risk.

-

What features does airSlate SignNow offer for managing tax rules 2005 form no 9 documents?

With airSlate SignNow, users can easily create, send, and track documents related to tax rules 2005 form no 9. Features like templates, reminders, and real-time tracking help maintain organization and ensure timely submissions.

-

Is there a trial available for airSlate SignNow when dealing with tax rules 2005 form no 9?

Yes, airSlate SignNow offers a free trial for potential users who want to explore its capabilities regarding tax rules 2005 form no 9. This allows businesses to assess its effectiveness and suitability for their specific documentation needs.

-

Can airSlate SignNow integrate with other software for tax rules 2005 form no 9?

Absolutely! airSlate SignNow seamlessly integrates with numerous software tools that facilitate the management of tax rules 2005 form no 9. This integration capability allows for a more streamlined workflow and improved efficiency in handling tax-related documents.

-

What are the pricing options for airSlate SignNow focused on tax rules 2005 form no 9?

airSlate SignNow offers various pricing plans to cater to different business sizes and needs, especially for managing tax rules 2005 form no 9. The transparent pricing structure allows users to choose an option that balances features and budget.

-

What benefits does using airSlate SignNow provide for the tax rules 2005 form no 9 process?

Utilizing airSlate SignNow for processes involving tax rules 2005 form no 9 signNowly enhances efficiency and accuracy. It reduces the time spent on document handling, lowers the chances of errors, and offers legal compliance through secure eSignature options.

Get more for Form No 9

- Canada life form claim

- Activities of daily living social security form

- Canada life beneficiary change form

- Apa fillable template form

- California all purpose certificate of acknowledgment 2013 form

- Payment bond form

- Standard form 25a

- Form it 196 new york resident nonresident and part year resident itemized deductions tax year

Find out other Form No 9

- eSign Pennsylvania Plumbing RFP Easy

- Can I eSign Pennsylvania Plumbing RFP

- eSign Pennsylvania Plumbing Work Order Free

- Can I eSign Pennsylvania Plumbing Purchase Order Template

- Help Me With eSign South Carolina Plumbing Promissory Note Template

- How To eSign South Dakota Plumbing Quitclaim Deed

- How To eSign South Dakota Plumbing Affidavit Of Heirship

- eSign South Dakota Plumbing Emergency Contact Form Myself

- eSign Texas Plumbing Resignation Letter Free

- eSign West Virginia Orthodontists Living Will Secure

- Help Me With eSign Texas Plumbing Business Plan Template

- Can I eSign Texas Plumbing Cease And Desist Letter

- eSign Utah Plumbing Notice To Quit Secure

- eSign Alabama Real Estate Quitclaim Deed Mobile

- eSign Alabama Real Estate Affidavit Of Heirship Simple

- eSign California Real Estate Business Plan Template Free

- How Can I eSign Arkansas Real Estate Promissory Note Template

- eSign Connecticut Real Estate LLC Operating Agreement Later

- eSign Connecticut Real Estate LLC Operating Agreement Free

- eSign Real Estate Document Florida Online