Fillable W 9 Form

What is the Fillable W-9 Form

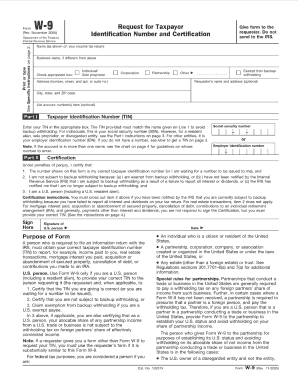

The fillable W-9 form is an official document used in the United States by individuals and businesses to provide their taxpayer identification information to others, typically for tax purposes. This form is essential for freelancers, contractors, and other self-employed individuals who need to report income to the Internal Revenue Service (IRS). The W-9 captures crucial details such as the name, business name (if applicable), address, and taxpayer identification number (TIN), which can be either a Social Security number (SSN) or an Employer Identification Number (EIN).

How to Use the Fillable W-9 Form

Using the fillable W-9 form is straightforward. Users can fill out the form digitally, ensuring that all required fields are completed accurately. After filling out the form, it can be saved and sent electronically to the requesting party. It is important to ensure that the recipient is a legitimate entity that requires this information for tax reporting purposes. Users should also keep a copy of the completed form for their records, as it may be needed for future tax filings or verification.

Steps to Complete the Fillable W-9 Form

Completing the fillable W-9 form involves several key steps:

- Download or access the fillable W-9 form online.

- Enter your name as it appears on your tax return.

- If applicable, provide your business name.

- Fill in your address, including city, state, and ZIP code.

- Enter your taxpayer identification number (either your SSN or EIN).

- Sign and date the form to certify that the information provided is accurate.

Legal Use of the Fillable W-9 Form

The fillable W-9 form is legally recognized as a valid document for tax reporting purposes. It must be completed accurately to avoid potential penalties for incorrect information. The IRS requires that this form be used when a business or individual needs to report payments made to contractors or freelancers. Ensuring compliance with IRS regulations is essential, as failure to provide a correct W-9 can lead to backup withholding on payments received.

Key Elements of the Fillable W-9 Form

Several key elements are essential for the fillable W-9 form to be complete and valid:

- Name: The legal name of the individual or business.

- Business Name: If applicable, the name under which the business operates.

- Address: Current mailing address.

- Taxpayer Identification Number: Either SSN or EIN.

- Signature: Required to certify the accuracy of the information.

- Date: The date when the form is completed.

IRS Guidelines

The IRS provides specific guidelines for the use of the fillable W-9 form. It is crucial to follow these guidelines to ensure compliance and avoid issues during tax season. The form should be submitted to the requester, not the IRS, and it should be updated whenever there are changes to your taxpayer information. Additionally, the IRS recommends that individuals and businesses verify the legitimacy of the requesting party before providing sensitive information.

Quick guide on how to complete fillable w 9 form

Complete Fillable W 9 Form effortlessly on any device

Managing documents online has gained popularity among businesses and individuals. It serves as an ideal sustainable alternative to traditional printed and signed paperwork, allowing you to find the right form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Handle Fillable W 9 Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to modify and electronically sign Fillable W 9 Form with ease

- Find Fillable W 9 Form and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Fillable W 9 Form to ensure effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the fillable w 9 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a fillable W 9 form?

A fillable W 9 form is an IRS form that individuals use to provide their taxpayer information to businesses or contractors. The form can be completed electronically, making it easy to fill out and submit without the need for printing. With airSlate SignNow, you can create and manage fillable W 9 forms efficiently.

-

How can I create a fillable W 9 form using airSlate SignNow?

Creating a fillable W 9 form with airSlate SignNow is simple. You can start by uploading a blank W 9 form and use our easy drag-and-drop interface to add fillable fields. Once done, you can send the completed form for eSignature, making the process fast and seamless.

-

Is there a cost associated with using fillable W 9 forms on airSlate SignNow?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs. You can choose a plan that allows unlimited use of fillable W 9 forms and other document types. Check our pricing page to find the best option for your organization.

-

What are the benefits of using fillable W 9 forms online?

Using fillable W 9 forms online offers convenience and efficiency. You can fill out, sign, and send documents from anywhere, eliminating the need for paper and physical signatures. Moreover, airSlate SignNow ensures your forms are secure and compliant with industry standards.

-

Can I integrate fillable W 9 forms with other applications?

Absolutely! airSlate SignNow supports numerous integrations with popular applications, enabling you to streamline your document workflows. You can easily incorporate fillable W 9 forms into your CRM or project management tools for a more cohesive business process.

-

How does airSlate SignNow ensure the security of my fillable W 9 forms?

airSlate SignNow prioritizes the security of your fillable W 9 forms by using advanced encryption technologies to protect your data. We also comply with industry regulations to ensure that your documents remain confidential and secure throughout the signing process.

-

Can I track the status of my fillable W 9 forms?

Yes, airSlate SignNow provides real-time tracking for all your fillable W 9 forms. You will receive notifications when forms are viewed and signed, allowing you to stay updated on the progress of your documents and follow up as needed.

Get more for Fillable W 9 Form

Find out other Fillable W 9 Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors