Repossession Authorization Form

What is the repossession authorization form

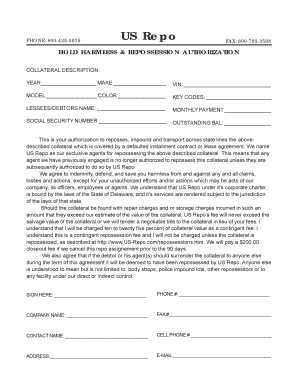

The repossession authorization form is a legal document that grants permission to a lender or repossession agent to reclaim a vehicle or property from the borrower. This form is essential in situations where a borrower has defaulted on their loan obligations, allowing the lender to take necessary actions to recover their asset. The document typically includes details such as the borrower's information, the asset being repossessed, and the lender's authority to act on behalf of the borrower in this matter.

How to use the repossession authorization form

Using the repossession authorization form involves a few straightforward steps. First, the borrower must complete the form by providing accurate personal information and details about the asset. Once filled out, the borrower should sign the document to validate it. After signing, the form should be submitted to the lender or repossession agent, who will then use it to proceed with the repossession process. It is important to keep a copy of the completed form for personal records.

Steps to complete the repossession authorization form

Completing the repossession authorization form requires careful attention to detail. Here are the steps to follow:

- Begin by entering your full name and contact information.

- Provide the details of the asset, including make, model, and VIN (Vehicle Identification Number).

- Clearly state the reason for repossession, typically due to loan default.

- Sign and date the form to confirm your authorization.

- Submit the form to the appropriate lender or repossession agent.

Legal use of the repossession authorization form

The repossession authorization form is legally binding when completed correctly. For it to be considered valid, it must meet specific legal requirements, such as being signed by the borrower and containing all necessary information. Compliance with state laws regarding repossession is crucial, as these laws may vary. It is advisable to consult legal counsel or a knowledgeable professional to ensure that the form adheres to all relevant regulations.

Key elements of the repossession authorization form

Several key elements are essential for the repossession authorization form to be effective. These include:

- Borrower's Information: Full name, address, and contact details.

- Asset Description: Detailed information about the vehicle or property, including identification numbers.

- Reason for Repossession: A clear statement outlining why the repossession is necessary.

- Signature: The borrower's signature, which validates the authorization.

- Date: The date the form is completed and signed.

State-specific rules for the repossession authorization form

Each state in the U.S. may have specific regulations governing the repossession process and the use of the repossession authorization form. These rules can dictate how the form must be completed, what information is required, and the rights of both the borrower and lender. It is important for borrowers to familiarize themselves with their state's laws to ensure compliance and protect their rights during the repossession process.

Quick guide on how to complete repossession authorization form

Prepare Repossession Authorization Form effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an excellent eco-friendly alternative to conventional printed and signed documents, as you can locate the appropriate form and securely archive it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents quickly and efficiently. Manage Repossession Authorization Form on any platform with airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to alter and eSign Repossession Authorization Form with ease

- Locate Repossession Authorization Form and click Get Form to initiate the process.

- Utilize the tools we provide to complete your form.

- Select important sections of the documents or conceal sensitive information with tools that airSlate SignNow specifically offers for that task.

- Create your signature with the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, cumbersome form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Repossession Authorization Form and guarantee excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the repossession authorization form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a repossession authorization form?

A repossession authorization form is a legal document that grants permission to a repossession agent to reclaim a vehicle or property. This form typically includes the owner's details, the asset information, and authorization statements. Utilizing this form ensures compliance with relevant laws and can help streamline the repossession process.

-

How can I create a repossession authorization form using airSlate SignNow?

Creating a repossession authorization form with airSlate SignNow is simple and efficient. You can start by selecting a template or designing your custom form using our intuitive drag-and-drop editor. Once your form is ready, you can easily send it for electronic signatures, ensuring quick and secure approvals.

-

What features does airSlate SignNow offer for managing repossession authorization forms?

airSlate SignNow offers a variety of features tailored for managing repossession authorization forms effectively. These include customizable templates, automated workflows, secure eSigning, and real-time tracking of document status. These tools help ensure that your authorization processes are both efficient and compliant.

-

Is airSlate SignNow cost-effective for small businesses needing repossession authorization forms?

Yes, airSlate SignNow provides a cost-effective solution for small businesses requiring repossession authorization forms. Our pricing plans cater to various budgets while offering essential features that enhance document management. With the savings on time and resources, your business can efficiently implement repossession authorization processes without breaking the bank.

-

Does airSlate SignNow integrate with other tools for managing repossession authorization forms?

Absolutely! airSlate SignNow seamlessly integrates with popular business tools and software, allowing you to manage repossession authorization forms alongside other essential tasks. These integrations can enhance your workflow efficiency, ensuring that all aspects of document management and customer communication are streamlined.

-

What are the benefits of using airSlate SignNow for repossession authorization forms?

Using airSlate SignNow for repossession authorization forms offers numerous benefits, including increased efficiency, legal compliance, and enhanced security. The easy-to-use platform allows for quick creation and sending of forms, and eSignatures ensure that you can promptly obtain necessary approvals, reducing delays in the repossession process.

-

How secure is airSlate SignNow when handling repossession authorization forms?

airSlate SignNow prioritizes security in handling repossession authorization forms. Our platform uses robust encryption protocols to ensure that all documents are securely transmitted and stored. Additionally, we comply with industry standards and regulations, providing peace of mind that your sensitive information is protected.

Get more for Repossession Authorization Form

Find out other Repossession Authorization Form

- eSign Kentucky Healthcare / Medical Living Will Secure

- eSign Maine Government LLC Operating Agreement Fast

- eSign Kentucky Healthcare / Medical Last Will And Testament Free

- eSign Maine Healthcare / Medical LLC Operating Agreement Now

- eSign Louisiana High Tech LLC Operating Agreement Safe

- eSign Massachusetts Government Quitclaim Deed Fast

- How Do I eSign Massachusetts Government Arbitration Agreement

- eSign Maryland High Tech Claim Fast

- eSign Maine High Tech Affidavit Of Heirship Now

- eSign Michigan Government LLC Operating Agreement Online

- eSign Minnesota High Tech Rental Lease Agreement Myself

- eSign Minnesota High Tech Rental Lease Agreement Free

- eSign Michigan Healthcare / Medical Permission Slip Now

- eSign Montana High Tech Lease Agreement Online

- eSign Mississippi Government LLC Operating Agreement Easy

- eSign Ohio High Tech Letter Of Intent Later

- eSign North Dakota High Tech Quitclaim Deed Secure

- eSign Nebraska Healthcare / Medical LLC Operating Agreement Simple

- eSign Nebraska Healthcare / Medical Limited Power Of Attorney Mobile

- eSign Rhode Island High Tech Promissory Note Template Simple