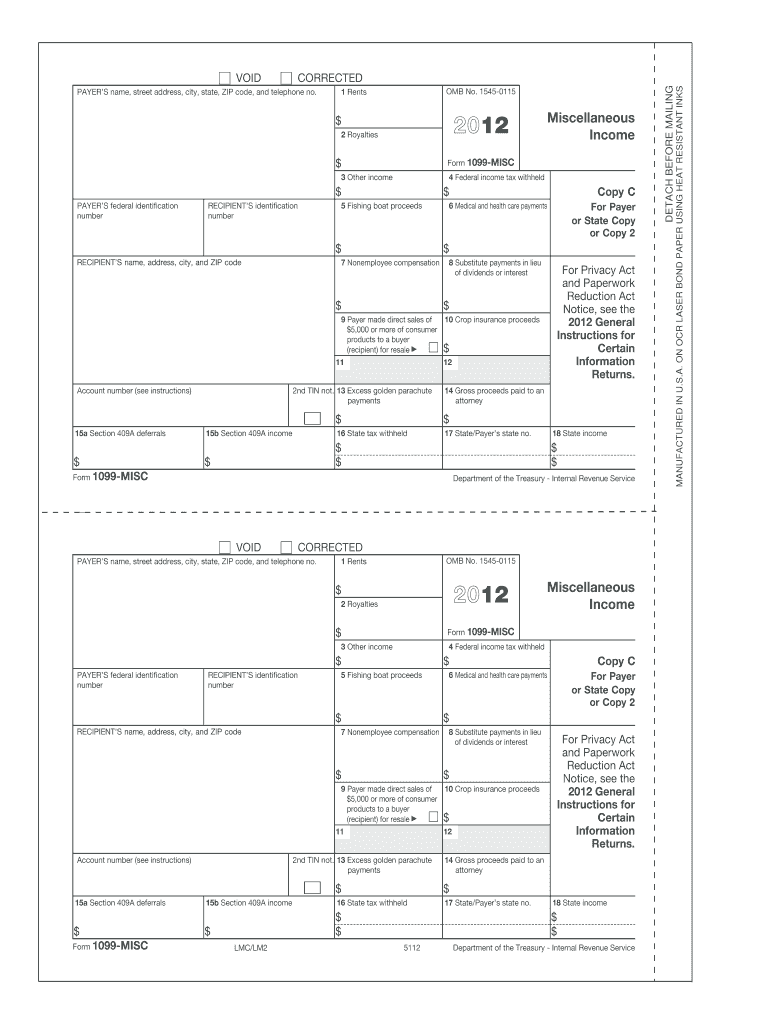

Omb No 1545 0115 Form

What is the OMB No ?

The OMB No is a form utilized by the Internal Revenue Service (IRS) in the United States. This form is primarily associated with tax-related documentation and is often required for various reporting purposes. It is essential for individuals and businesses to understand its significance and the context in which it is used, particularly in relation to tax compliance and reporting obligations.

How to Use the OMB No

Using the OMB No involves several steps that ensure proper completion and submission. First, gather all necessary information, including personal and financial details relevant to the form. Next, carefully fill out each section of the form, ensuring accuracy to avoid any issues with the IRS. After completing the form, review it for any errors before submission. It is crucial to keep a copy for your records.

Steps to Complete the OMB No

Completing the OMB No requires a systematic approach:

- Gather required documents, such as income statements and identification numbers.

- Fill out the form with accurate information in each designated field.

- Double-check all entries for correctness to prevent mistakes.

- Sign and date the form where indicated.

- Submit the form according to the instructions provided, either online or via mail.

Legal Use of the OMB No

The legal use of the OMB No is governed by IRS regulations. It is crucial that individuals and businesses comply with these regulations to ensure that the form is valid and accepted by the IRS. Failure to adhere to the legal requirements can result in penalties or issues with tax filings. Understanding the legal implications of this form is essential for maintaining compliance.

Filing Deadlines / Important Dates

Filing deadlines for the OMB No can vary depending on the specific tax year and the nature of the form's use. It is important for filers to be aware of these deadlines to avoid late submissions, which can incur penalties. Generally, tax forms are due on April fifteenth of each year, but specific circumstances may alter this date. Always check the IRS website for the most current deadlines.

Who Issues the Form

The OMB No is issued by the Internal Revenue Service (IRS), the U.S. government agency responsible for tax collection and tax law enforcement. The IRS provides guidelines and instructions for completing the form, ensuring that taxpayers have the necessary resources to fulfill their obligations accurately and efficiently.

Quick guide on how to complete omb no 1545 0115

Complete Omb No 1545 0115 effortlessly on any device

Online document management has gained popularity among organizations and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, enabling you to find the suitable form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your papers swiftly and without delays. Manage Omb No 1545 0115 on any device using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to modify and eSign Omb No 1545 0115 without any hassle

- Find Omb No 1545 0115 and then click Get Form to begin.

- Use the tools we provide to finish your document.

- Highlight important sections of your documents or redact sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your eSignature using the Sign feature, which takes seconds and holds the same legal significance as a traditional wet ink signature.

- Review the information and then click on the Done button to save your adjustments.

- Select how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Edit and eSign Omb No 1545 0115 and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the omb no 1545 0115

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is OMB 1545 0115?

OMB 1545 0115 refers to a specific IRS approval code used for electronic signatures on tax documents. Understanding this code is crucial for businesses that need to comply with federal regulations while using e-signature services like airSlate SignNow.

-

How does airSlate SignNow ensure compliance with OMB 1545 0115?

airSlate SignNow adheres to the requirements set forth by OMB 1545 0115 by providing secure electronic signatures that meet IRS standards. This ensures that your signed tax documents are valid and compliant, helping you avoid costly penalties.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers various pricing plans tailored to meet different business needs. Each plan is designed to provide exceptional value while ensuring compliance with regulations such as OMB 1545 0115, making it a cost-effective choice for e-signing solutions.

-

Can I integrate airSlate SignNow with other software?

Yes, airSlate SignNow seamlessly integrates with numerous software applications to enhance your workflow. Integrating with platforms that support OMB 1545 0115 usage ensures that all signed documents are processed efficiently and in compliance with federal guidelines.

-

What features does airSlate SignNow offer for document management?

AirSlate SignNow includes robust document management features such as easy e-signing, template creation, and real-time tracking. These functionalities not only expedite the signing process but also ensure that documents comply with regulations like OMB 1545 0115.

-

How can airSlate SignNow improve my business workflow?

By utilizing airSlate SignNow, businesses can streamline their document signing processes, reduce turnaround times, and improve overall efficiency. This efficiency is particularly important when dealing with OMB 1545 0115 compliance for tax-related documents.

-

Is airSlate SignNow user-friendly for non-technical users?

Absolutely! airSlate SignNow is designed to be intuitive and user-friendly, making it accessible for individuals without technical expertise. This ease of use applies to processes involving OMB 1545 0115 as well, allowing users to sign documents effortlessly.

Get more for Omb No 1545 0115

- Lineofcredit lineofcredit org reviews information about all domains

- Invoice template service 1tax basic xlsx form

- File motion to amend alimony form

- Edi 8292p jh jl novitasphere portal enrollment form this form is for providers in the jh jl areas to enroll for using the

- How to use your smartphone to see through walls superman form

- Identification real id enhanced drivers license and id form

- The florida commission for the transportation form

- Oversize overweight permit application city of decatur decaturil form

Find out other Omb No 1545 0115

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document