Halifax Tax Residency Letter Form

What is the Halifax Tax Residency Letter

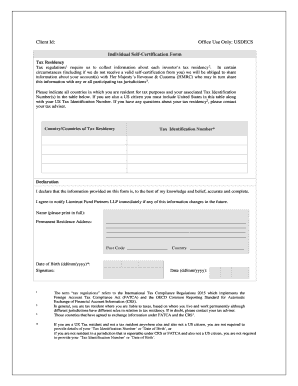

The Halifax Tax Residency Letter serves as a formal document that certifies an individual's residency status for tax purposes. It is essential for individuals who need to confirm their residency to tax authorities, especially when filing taxes or applying for tax benefits. This letter typically includes the individual's name, address, and the period of residency, providing clear evidence of where the individual is considered a tax resident.

How to obtain the Halifax Tax Residency Letter

To obtain the Halifax Tax Residency Letter, individuals must typically request it from their local tax authority or financial institution. The process may involve submitting a formal request, providing identification, and sometimes completing a specific form. It is advisable to check with the relevant authority for any specific requirements or documentation needed to facilitate the request.

Steps to complete the Halifax Tax Residency Letter

Completing the Halifax Tax Residency Letter involves several key steps:

- Gather necessary personal information, including your full name, address, and Social Security number.

- Fill out any required forms provided by the issuing authority.

- Review the information for accuracy to ensure there are no mistakes that could delay processing.

- Submit the completed form along with any required identification or supporting documents.

- Follow up with the issuing authority if you do not receive the letter within the expected timeframe.

Legal use of the Halifax Tax Residency Letter

The Halifax Tax Residency Letter is legally recognized as proof of residency for tax purposes. It can be used to validate residency claims when filing taxes, applying for tax treaties, or seeking exemptions. It is important to ensure that the letter is issued by an authorized body to maintain its legal validity.

Key elements of the Halifax Tax Residency Letter

When reviewing the Halifax Tax Residency Letter, there are several key elements to consider:

- Personal Information: The letter should include the individual's full name and address.

- Period of Residency: It must specify the time frame during which the individual has been a resident.

- Issuing Authority: The letter should be issued by a recognized tax authority or financial institution.

- Signature: An authorized signature or stamp may be required to validate the document.

Form Submission Methods

The Halifax Tax Residency Letter can typically be submitted through various methods, depending on the requirements of the receiving authority. Common submission methods include:

- Online: Many authorities allow electronic submission through their websites.

- Mail: Physical copies can be sent via postal service to the designated address.

- In-Person: Individuals may also choose to deliver the letter directly to the relevant office.

Quick guide on how to complete halifax tax residency letter

Complete Halifax Tax Residency Letter effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can obtain the required form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and eSign your documents quickly without delays. Manage Halifax Tax Residency Letter on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

The easiest way to modify and eSign Halifax Tax Residency Letter without any hassle

- Locate Halifax Tax Residency Letter and click on Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with the tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred delivery method for your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate the worries of lost or misplaced files, tedious form searches, or errors that require reprinting documents. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Halifax Tax Residency Letter to ensure excellent communication at every stage of the form creation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the halifax tax residency letter

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Halifax tax residency form, and why is it important?

The Halifax tax residency form is a crucial document that verifies your tax residency status in Halifax. It is important for individuals and businesses to ensure compliance with local tax laws and avoid potential penalties. Completing this form accurately can help streamline your tax filing process.

-

How can airSlate SignNow assist with the Halifax tax residency form?

airSlate SignNow allows you to easily eSign and send documents like the Halifax tax residency form. Our platform streamlines the signing process, making it simple and efficient for users to manage their tax forms electronically. This saves time and ensures that your documents are securely stored.

-

Is there a cost associated with using airSlate SignNow for the Halifax tax residency form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs when handling documents, including the Halifax tax residency form. Our cost-effective solutions ensure that you can manage your documentation without breaking the bank while enjoying a high level of service.

-

What features does airSlate SignNow offer for eSigning the Halifax tax residency form?

With airSlate SignNow, you can enjoy features like cloud storage, easy document sharing, and real-time tracking for the Halifax tax residency form. Our platform also provides reusable templates and an intuitive user interface, making it easy to manage your eSigning needs quickly and efficiently.

-

Can I integrate airSlate SignNow with other software for the Halifax tax residency form?

Yes, airSlate SignNow seamlessly integrates with various software applications to improve your workflow regarding the Halifax tax residency form. This allows you to connect your favorite tools and streamline your document management process, enhancing overall efficiency.

-

How does airSlate SignNow ensure the security of the Halifax tax residency form?

Security is a top priority at airSlate SignNow. We implement advanced encryption and secure cloud storage to protect your Halifax tax residency form and other sensitive documents. Additionally, our platform is compliant with industry regulations to guarantee the confidentiality of your information.

-

What benefits can I expect when using airSlate SignNow for the Halifax tax residency form?

Using airSlate SignNow for the Halifax tax residency form offers numerous benefits, including faster turnaround times and reduced paperwork. Our user-friendly platform simplifies the signing process and signNowly enhances productivity. You'll be able to focus more on your business while we handle your documentation needs.

Get more for Halifax Tax Residency Letter

- Missouri real estate contract form

- Maryland limited liability company llc operating agreement form

- Fiduciary deed form

- Nm will template form

- North dakota revocation of general durable power of attorney form

- Purchase tn form

- Pa relastate sales aggreement form

- Arkansas general notice of default for contract for deed form

Find out other Halifax Tax Residency Letter

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document