Ptax 340 Tazewell Co Illinois Form

What is the Ptax 340 Tazewell Co Illinois

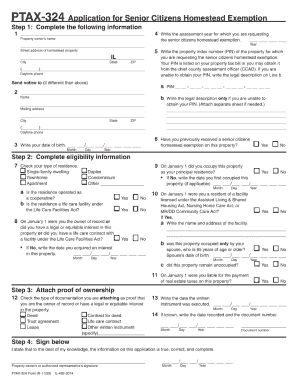

The Ptax 340 Tazewell County Illinois form is a crucial document used to apply for property tax exemptions in Tazewell County. This form specifically addresses the homestead exemption, which reduces the property tax burden for eligible homeowners. By filing this form, residents can benefit from significant savings on their property taxes, depending on their eligibility criteria. Understanding the purpose and implications of this form is essential for homeowners looking to maximize their tax benefits.

Eligibility Criteria

To qualify for the Tazewell County homestead exemption, applicants must meet specific eligibility criteria. Generally, the applicant must be the owner of the property and occupy it as their primary residence. Additionally, there may be age requirements for senior exemptions, and income limitations could apply. It is important for applicants to review these criteria carefully to ensure they meet all necessary conditions before submitting the Ptax 340 form.

Steps to Complete the Ptax 340 Tazewell Co Illinois

Completing the Ptax 340 form involves several key steps. First, gather all required information, including property details and personal identification. Next, accurately fill out the form, ensuring that all sections are completed to avoid delays. After completing the form, review it for accuracy and sign where indicated. Finally, submit the form through the appropriate method, whether online, by mail, or in person, ensuring it is sent before any deadlines.

Required Documents

When applying for the Tazewell County homestead exemption using the Ptax 340 form, several documents may be required. Commonly required documents include proof of ownership, such as a deed, and identification that verifies residency, like a driver’s license or utility bill. Depending on the specific exemption being applied for, additional documentation may be necessary, such as income statements for senior exemptions. Ensuring all required documents are included with the application can help expedite the approval process.

Form Submission Methods

The Ptax 340 Tazewell County Illinois form can be submitted through various methods. Homeowners have the option to file the form online, which is often the quickest method. Alternatively, applicants can mail the completed form to the appropriate county office or deliver it in person. Each submission method has its own advantages, and choosing the right one can depend on personal preference and urgency.

Legal Use of the Ptax 340 Tazewell Co Illinois

The Ptax 340 form is legally binding once it is completed and submitted according to the regulations set forth by Tazewell County. Compliance with local laws regarding property tax exemptions is essential for the validity of the application. Understanding the legal implications of the form ensures that applicants are aware of their rights and responsibilities as property owners seeking tax relief.

Quick guide on how to complete ptax 340 tazewell co illinois

Prepare Ptax 340 Tazewell Co Illinois seamlessly on any device

Digital document management has become increasingly favored by companies and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed paperwork, enabling you to find the correct form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without any holdups. Manage Ptax 340 Tazewell Co Illinois on any device using airSlate SignNow's Android or iOS applications and enhance any document-related procedure today.

How to modify and eSign Ptax 340 Tazewell Co Illinois effortlessly

- Find Ptax 340 Tazewell Co Illinois and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight important sections of the documents or redact sensitive information with tools provided by airSlate SignNow specifically for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Select your preferred method to send your form: via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, and errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Ptax 340 Tazewell Co Illinois and guarantee effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ptax 340 tazewell co illinois

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Tazewell County senior homestead exemption?

The Tazewell County senior homestead exemption is a program designed to provide property tax relief for seniors who meet specific eligibility criteria. This exemption can signNowly reduce the taxable value of a home, lowering property taxes for qualifying seniors. It aims to support seniors in maintaining homeownership and managing their finances.

-

Who is eligible for the Tazewell County senior homestead exemption?

Eligibility for the Tazewell County senior homestead exemption typically requires that applicants be at least 65 years old, occupy their property as a primary residence, and meet certain income guidelines. To determine eligibility, seniors may need to provide documentation that demonstrates their age and income. It's important for applicants to check the specific requirements set by Tazewell County.

-

How can I apply for the Tazewell County senior homestead exemption?

To apply for the Tazewell County senior homestead exemption, seniors should contact the local tax assessor's office or visit their official website for the application form. Completing the application involves providing necessary information, including proof of age and residency. Make sure to submit the application before the deadline to ensure you receive the exemption for the current tax year.

-

When is the application deadline for the Tazewell County senior homestead exemption?

The application deadline for the Tazewell County senior homestead exemption varies each year, but it typically falls around the end of March. Seniors should check the Tazewell County tax assessor's website to confirm the exact date for the current year. Submitting applications on time is crucial to benefit from the exemption.

-

What benefits does the Tazewell County senior homestead exemption provide?

The main benefit of the Tazewell County senior homestead exemption is the reduction in property taxes, which can lead to signNow savings for eligible seniors. This exemption helps ease financial burdens on senior homeowners, allowing them to allocate funds to other essential expenses. Additionally, this program encourages seniors to remain in their homes longer by making them more affordable.

-

Can the Tazewell County senior homestead exemption be combined with other exemptions?

Yes, the Tazewell County senior homestead exemption can often be combined with other tax exemptions or relief programs, providing additional savings. Seniors should consult with the local tax assessor or financial advisor to understand how to optimize their benefits effectively. Each exemption will have its own criteria, so confirm the compatibility with any existing exemptions.

-

What documentation is required when applying for the Tazewell County senior homestead exemption?

When applying for the Tazewell County senior homestead exemption, applicants will typically need to provide proof of age, proof of residency, and possibly proof of income. Required documents may include a driver's license or state ID, utility bills, and tax returns. Proper documentation is essential to ensure a smooth application process.

Get more for Ptax 340 Tazewell Co Illinois

Find out other Ptax 340 Tazewell Co Illinois

- Electronic signature Tennessee House rent agreement format Myself

- How To Electronic signature Florida House rental agreement

- eSignature Connecticut Retainer Agreement Template Myself

- How To Electronic signature Alaska House rental lease agreement

- eSignature Illinois Retainer Agreement Template Free

- How Do I Electronic signature Idaho Land lease agreement

- Electronic signature Illinois Land lease agreement Fast

- eSignature Minnesota Retainer Agreement Template Fast

- Electronic signature Louisiana Land lease agreement Fast

- How Do I eSignature Arizona Attorney Approval

- How Can I eSignature North Carolina Retainer Agreement Template

- Electronic signature New York Land lease agreement Secure

- eSignature Ohio Attorney Approval Now

- eSignature Pennsylvania Retainer Agreement Template Secure

- Electronic signature Texas Land lease agreement Free

- Electronic signature Kentucky Landlord lease agreement Later

- Electronic signature Wisconsin Land lease agreement Myself

- Electronic signature Maryland Landlord lease agreement Secure

- How To Electronic signature Utah Landlord lease agreement

- Electronic signature Wyoming Landlord lease agreement Safe