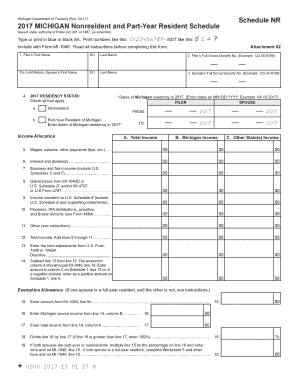

MICHIGAN Nonresident and Part Year Resident Schedule Form

What is the Michigan Nonresident and Part Year Resident Schedule

The Michigan Nonresident and Part Year Resident Schedule is a tax form designed for individuals who do not reside in Michigan for the entire tax year or who have moved in or out of the state during the year. This form helps determine the amount of Michigan income tax owed based on income earned while residing in the state. It is essential for accurately reporting income and ensuring compliance with state tax laws.

How to use the Michigan Nonresident and Part Year Resident Schedule

To effectively use the Michigan Nonresident and Part Year Resident Schedule, taxpayers should first gather all necessary financial documents, including W-2 forms, 1099s, and any other income statements. Next, complete the schedule by entering income earned during the time spent in Michigan. Ensure that all calculations are accurate to avoid discrepancies. The completed form will then be submitted along with the Michigan tax return.

Steps to complete the Michigan Nonresident and Part Year Resident Schedule

Completing the Michigan Nonresident and Part Year Resident Schedule involves several key steps:

- Gather all relevant income documentation, including forms that report income earned in Michigan.

- Determine the period of residency in Michigan during the tax year.

- Fill out the schedule by reporting income earned while a resident of Michigan.

- Calculate the tax owed based on the reported income.

- Review the completed schedule for accuracy before submission.

Filing Deadlines / Important Dates

Taxpayers must be aware of the filing deadlines for the Michigan Nonresident and Part Year Resident Schedule. Typically, the deadline aligns with the federal tax return due date, which is usually April fifteenth. If this date falls on a weekend or holiday, the deadline may be extended. It is crucial to check for any updates or changes to deadlines each tax year.

Required Documents

When preparing to complete the Michigan Nonresident and Part Year Resident Schedule, certain documents are required:

- W-2 forms from employers for income earned in Michigan.

- 1099 forms for any additional income sources.

- Records of any deductions or credits claimed.

- Proof of residency duration in Michigan, if applicable.

Legal use of the Michigan Nonresident and Part Year Resident Schedule

The Michigan Nonresident and Part Year Resident Schedule is legally binding when completed accurately and submitted on time. It must comply with Michigan tax laws to ensure that taxpayers fulfill their obligations. Using digital tools for completion can enhance security and efficiency, provided that the eSignature regulations are followed to validate the submission.

Quick guide on how to complete 2018 michigan nonresident and part year resident schedule

Effortlessly prepare 2018 michigan nonresident and part year resident schedule on any device

The management of documents online has gained popularity among organizations and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed papers, allowing you to obtain the correct format and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and eSign your documents quickly and without delays. Manage 2018 michigan nonresident and part year resident schedule on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to edit and eSign michigan non resident tax form easily

- Obtain michigan part year resident and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight essential parts of your documents or redact sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign option, which takes mere seconds and carries the same legal weight as a conventional wet ink signature.

- Review all information and then click on the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious searches for forms, or mistakes that require printing new copies. airSlate SignNow caters to your document management requirements in just a few clicks from your chosen device. Edit and eSign michigan schedule nr and guarantee outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs michigan schedule nr

-

How a Non-US residence company owner (has EIN) should fill the W-7 ITIN form out? Which option is needed to be chosen in the first part?

Depends on the nature of your business and how it is structured.If you own an LLC taxed as a passthrough entity, then you probably will check option b and submit the W7 along with your US non-resident tax return. If your LLC’s income is not subject to US tax, then you will check option a.If the business is a C Corp, then you probably don’t need an ITIN, unless you are receiving taxable compensation from the corporation and then we are back to option b.

-

I got 50.5 marks from 70 in NID 2017 DAT (Part A). How much marks do I need out of 30 (Creative Test) to Excel? And what could be the cutoff dis year?

Assuming you have attempted all the questions in the creative drawing part decently, and you get atleast 50% marks (which most probably you will) then there is a pretty good chance for you to clear the Written part (with anywhere around 60–70 marks).But again, what i said is completly based on previous year’s cutoff which was 59.65 for Bachelor of Design.As There is no way to predict this year’s cutoff, just hope for the best and start preparing well for the Studio Tests.Hope this was helpful:)

-

How do SENSEX or NIFTY 50 index always increase in value over the long term while the companies forming part of the index move in and out? Is it possible that after 20 years from now, the SENSEX or NIFTY 50 value may fall to levels of today?

The answer lies in your question itself. It happens because poor performing companies are removed and strong performing companies are added thereby ensuring that the index continues to perform well. Also weightage of the companies changes as well

Related searches to 2018 michigan nonresident and part year resident schedule

Create this form in 5 minutes!

How to create an eSignature for the michigan non resident tax form

How to generate an eSignature for your 2017 Michigan Nonresident And Part Year Resident Schedule in the online mode

How to generate an electronic signature for your 2017 Michigan Nonresident And Part Year Resident Schedule in Google Chrome

How to make an electronic signature for signing the 2017 Michigan Nonresident And Part Year Resident Schedule in Gmail

How to generate an electronic signature for the 2017 Michigan Nonresident And Part Year Resident Schedule from your mobile device

How to make an eSignature for the 2017 Michigan Nonresident And Part Year Resident Schedule on iOS devices

How to make an eSignature for the 2017 Michigan Nonresident And Part Year Resident Schedule on Android

People also ask michigan schedule nr

-

What is the 2018 Michigan nonresident and part year resident schedule?

The 2018 Michigan nonresident and part year resident schedule is a tax form that individuals must complete if they lived in Michigan for part of the year or if they earned income from Michigan sources while residing in another state. This schedule helps determine the correct tax amount owed to Michigan based on your nonresident or part-year resident status.

-

How do I file my 2018 Michigan nonresident and part year resident schedule?

You can file your 2018 Michigan nonresident and part year resident schedule either by mail or electronically. If you choose to file electronically, many tax software solutions can guide you through the process to ensure accuracy and compliance, specifically for your nonresident and part-year resident status.

-

Are there any fees associated with filing the 2018 Michigan nonresident and part year resident schedule?

The fees for filing the 2018 Michigan nonresident and part year resident schedule depend on whether you are using a tax professional, tax software, or filing paper forms. While e-filing may have a minimal cost associated with tax software, it often saves you time and errors compared to self-filing on paper.

-

What documents do I need to complete the 2018 Michigan nonresident and part year resident schedule?

To complete the 2018 Michigan nonresident and part year resident schedule, you'll typically need your W-2 forms, any 1099s for income earned, and documentation of other sources of income during the year. It's essential to gather this information beforehand to ensure accurate and hassle-free filing.

-

What are the benefits of using airSlate SignNow for my 2018 Michigan nonresident and part year resident schedule?

Using airSlate SignNow to sign and send your 2018 Michigan nonresident and part year resident schedule offers convenience and speed. Our platform provides a cost-effective solution with easy-to-use features that streamline the document workflow, ensuring you keep your tax filings organized and secure.

-

Can I integrate airSlate SignNow with my tax software for filing the 2018 Michigan nonresident and part year resident schedule?

Yes, airSlate SignNow can integrate seamlessly with many popular tax software programs. This integration allows you to electronically sign and send your 2018 Michigan nonresident and part year resident schedule directly from your tax software, simplifying the overall filing process.

-

What is the deadline for filing the 2018 Michigan nonresident and part year resident schedule?

The deadline for filing the 2018 Michigan nonresident and part year resident schedule is typically April 15 of the following year. However, if you are unable to meet this deadline, you may apply for an extension, but all taxes owed must still be paid by the original deadline to avoid penalties.

Get more for 2018 michigan nonresident and part year resident schedule

- Michigan 2017 minor deviation for hours form

- Michigan affidavit of parentage record michigan form

- Application for broker license state of michigan michigan form

- Michigan application for master electrician form

- Tr 13a form

- Michigan fire alarm specialty license form

- Michigan pardon governor form

- Application for registration of pesticides in michigan michigan form

Find out other michigan non resident tax form

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF