Form a Trust

What is the Form A Trust

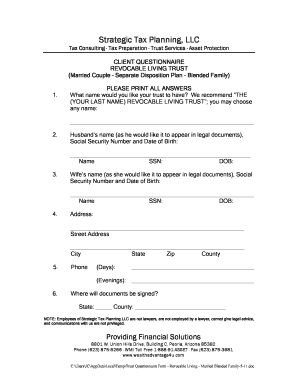

The Form A Trust is a legal document that establishes a trust, allowing an individual or entity to manage assets for the benefit of designated beneficiaries. This form is essential for those looking to create a revocable living trust, which provides flexibility in asset management and distribution during the grantor's lifetime and after their passing. The Form A Trust outlines the terms and conditions under which the trust operates, detailing the roles of the trustee and beneficiaries, as well as the specific assets included in the trust.

Key elements of the Form A Trust

Understanding the key elements of the Form A Trust is crucial for effective tax planning and asset management. Important components include:

- Grantor: The individual who creates the trust and transfers assets into it.

- Trustee: The person or entity responsible for managing the trust assets and ensuring compliance with the trust terms.

- Beneficiaries: Individuals or entities designated to receive benefits from the trust.

- Trust terms: Specific instructions regarding the management and distribution of trust assets.

- Revocation clause: A provision that allows the grantor to modify or dissolve the trust at any time.

Steps to complete the Form A Trust

Completing the Form A Trust involves several key steps to ensure its validity and effectiveness:

- Gather necessary information about assets, beneficiaries, and trustees.

- Clearly define the terms of the trust, including any specific instructions for asset management.

- Consult with a legal professional to ensure compliance with state laws and regulations.

- Complete the form accurately, providing all required information.

- Sign the document in the presence of a notary public to validate the trust.

- Distribute copies of the trust document to the trustee and beneficiaries.

IRS Guidelines

When creating a trust, it is essential to adhere to IRS guidelines to ensure proper tax treatment. Trusts can be subject to different tax rules depending on their structure. Revocable living trusts generally do not require a separate tax identification number, as the grantor's Social Security number is used for tax purposes. However, irrevocable trusts must obtain their own tax identification number and file annual tax returns. Understanding these guidelines can help prevent potential tax issues.

Required Documents

To complete the Form A Trust, several documents may be required, including:

- Proof of identity for the grantor and trustee.

- Documentation of assets to be included in the trust.

- Any existing wills or estate planning documents.

- Legal identification of beneficiaries.

Form Submission Methods

Once the Form A Trust is completed, it can be submitted in various ways, depending on state requirements:

- Online: Some states allow electronic submission through their official websites.

- Mail: The completed form can be mailed to the appropriate state office.

- In-Person: Submitting the form directly to the relevant office may be required in some jurisdictions.

Quick guide on how to complete form a trust

Finalize Form A Trust effortlessly on any gadget

Web-based document administration has become increasingly favored by organizations and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can locate the appropriate form and securely save it online. airSlate SignNow equips you with all the resources necessary to generate, alter, and electronically sign your documents promptly without setbacks. Manage Form A Trust on any gadget with airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to alter and electronically sign Form A Trust with ease

- Obtain Form A Trust and then click Get Form to initiate.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your electronic signature using the Sign feature, which takes moments and holds the same legal significance as a conventional wet ink signature.

- Review the details and then click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate worries about lost or misplaced files, monotonous form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from a device of your choice. Modify and electronically sign Form A Trust and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form a trust

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a client questionnaire for tax planning?

A client questionnaire for tax planning is a structured form designed to gather essential financial information from clients. By utilizing a client questionnaire tax planning, tax professionals can better understand their clients' unique situations, allowing for personalized strategies that optimize tax benefits.

-

How can airSlate SignNow facilitate the client questionnaire tax planning process?

airSlate SignNow streamlines the client questionnaire tax planning process by enabling businesses to easily create, send, and eSign documents. With its user-friendly interface and automated workflows, tax professionals can efficiently collect client responses, reducing paperwork and improving accuracy.

-

What features does airSlate SignNow offer for handling client questionnaires?

airSlate SignNow provides various features tailored for managing client questionnaires, including customizable templates, fillable fields, and advanced eSigning options. These capabilities enhance your client questionnaire tax planning by ensuring that all necessary information is captured accurately and securely.

-

Is there a cost associated with using airSlate SignNow for tax planning questionnaires?

Yes, while airSlate SignNow offers a range of pricing plans, it is still a cost-effective solution for managing client questionnaire tax planning. Businesses can choose a plan that fits their needs, ensuring that they have access to all necessary features without overspending.

-

Can I integrate airSlate SignNow with other tools for my tax planning needs?

Absolutely! airSlate SignNow offers integration capabilities with various third-party applications, enhancing your client questionnaire tax planning workflow. These integrations allow for seamless data transfer and can improve overall efficiency in managing your tax planning processes.

-

What are the benefits of using airSlate SignNow for client questionnaires?

Using airSlate SignNow for client questionnaires provides numerous benefits, including time-saving automation, enhanced document security, and improved client communication. By integrating these features into your client questionnaire tax planning, you can ultimately provide a better experience for both you and your clients.

-

How secure is airSlate SignNow for handling sensitive tax information from client questionnaires?

airSlate SignNow prioritizes the security of sensitive information through advanced encryption and compliance with industry standards. By using airSlate SignNow for your client questionnaire tax planning, you can trust that your clients' data is protected throughout the entire documentation process.

Get more for Form A Trust

Find out other Form A Trust

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document